IMO 2020 is coming

US East Coast distillate fundamentals tighten ahead of winter and bunker regulation changes

1 minute read

Genscape is now part of Wood Mackenzie. As we combine their commodity intelligence and proprietary short-term data sets with Wood Mackenzie’s world-class long-term analysis, we will be able to offer you unparalleled depth and breadth of insight across the entire natural resources world.

In the first of a three-part series, Suzanne Danforth, Director, Downstream Oil, and Amanda Fairfax, Downstream Oil Market Analyst, examine the implications of IMO 2020 — past, present, and future — with an initial look at the state of the US distillate supply/demand balance.

As the weather turns colder in North America, the refined products market focuses on distillate products. The fall season typically brings diesel demand, seasonal refinery maintenance, and expectations for how winter heating demand will shape the distillate supply/demand balance.

This year, the upcoming implementation of the International Maritime Organization (IMO) 2020 bunker fuel regulations adds another factor to the mix. On January 1, the current maximum fuel oil sulphur limit of 3.5 weight percent (wt%) will fall to 0.5 wt%.

Middle to heavy distillates — from consumer-grade ultra-low sulfur diesel (ULSD) to refinery feedstock low sulfur vacuum gas oil (LVGO) — are expected to be utilized as a replacement fuel for 3.5% bunker fuel or used in bunker fuel blends to lower sulfur content.

How will the new regulations affect the US distillate supply/demand balance? We look at October 2019 to see how short-term market trends have impacted fundamentals and what that could mean for 2020.

US East Coast inventories fell on refinery shutdown, fall maintenance and rising demand in October

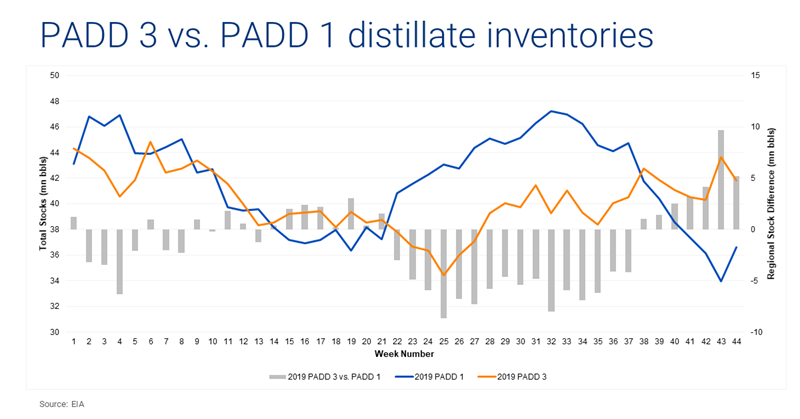

- US East Coast distillate inventories fell to a record low 33.95mn bbls

- Conversely, EIA US Gulf Coast distillate stocks rose to 43.6mn bbls, the highest seasonal levels since 2012 for the region

- PADD 3 stocks fell 2.8mn bbls to 41.8mn bbls and PADD 1 inventories rose to 36.6mn bbls, led by inventory gains in the US southeast

- Weekly EIA distillate stocks for PADD 1B continued to fall to 16.6mn bbls

This disparity between the two regions is unusual and related to several factors:

- Distillate demand growth in PADD 1

- Reduced export levels out of PADD 3

- PADD 1 fall refinery maintenance

- The shutdown of Philadelphia Energy Solutions’ (PES) 335,000 bpd Philadelphia refinery this summer following a fire

The Colonial Line 2 Pipeline carries distillate fuels from the US Gulf Coast to destinations throughout the US East Coast region and is now full. The flow of distillates via pipeline into PADD 1B — the market hub for the Northeastern US — is at a maximum level. Additional supplies may need to come via waterborne deliveries to balance the market if demand shocks occur.

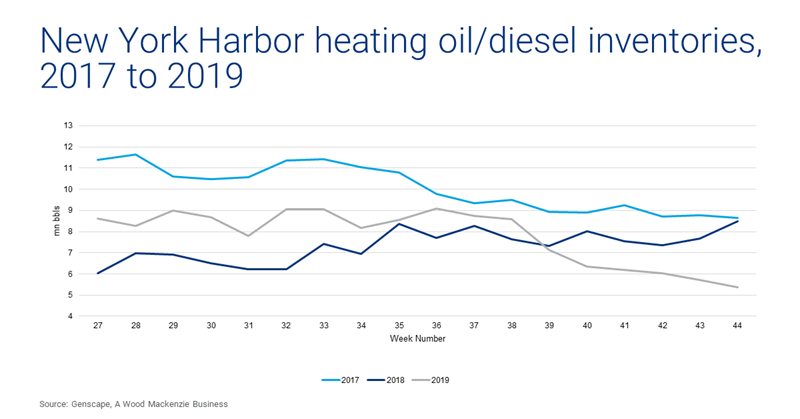

New York Harbor (NYH) heating oil/diesel inventories fell to record seasonal lows

NYH heating oil and diesel stocks fell to 5.37mn bbls at the end of October. Inventories were below the 2017 level when Hurricane Harvey affected US Gulf Coast refinery utilization and flows of refined products. NYC heating oil/diesel storage capacity utilization dropped to just 29.2%.

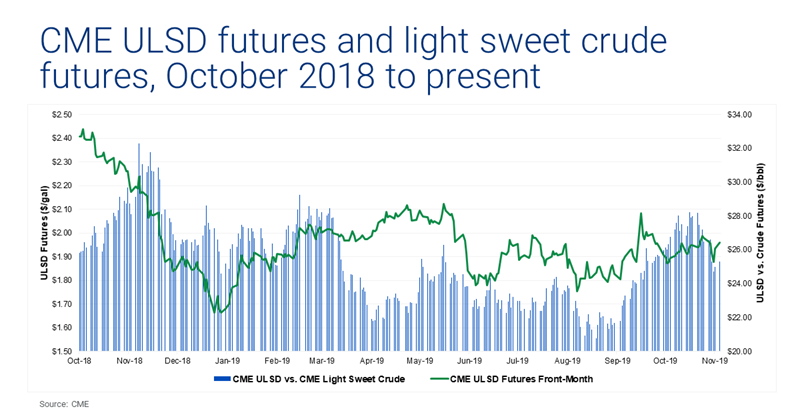

Prices for CME front-month NYH ULSD rose as high as US$1.9863/gal, up nearly US$0.10/gal from the beginning of October. This may signal that the market anticipates lower stock levels and an increase in global distillate demand in 2020. Spreads between ULSD futures and front-month CME Light Sweet Crude (WTI) futures stayed buoyant over the last year, even in the summer when diesel demand is typically lighter than other periods of the year.

December 2019 CME ULSD futures widened to as much as a US$0.0564/gal premium to the March 2020 contract month. This backwardation is typically seen in the winter. However, the spread widened ahead of IMO 2020 implementation and expectations for increased diesel demand for both winter heating and bunker fuel blending. This structure usually indicates a tightly supplied market, where prompter prices command a premium to forward prices.

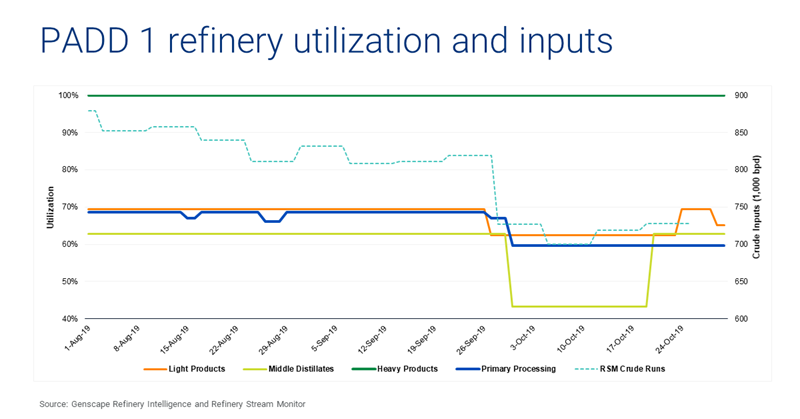

US East Coast refinery maintenance brought utilization rates to two-year lows

PADD 1 primary processing utilization dipped to a seasonal low of 59.7%, and middle distillates utilization fell to 43.4%. Our Refinery Stream Monitor calculated crude runs in the East Coast at a seasonal low of 700,000 bpd.

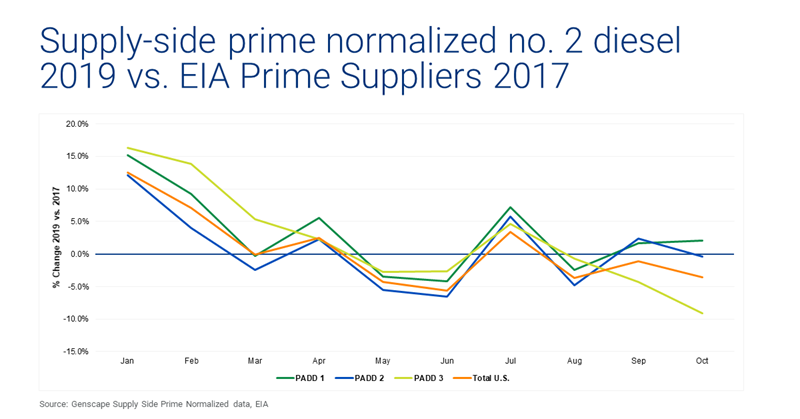

The total US diesel demand for October was 3.6% below 2017 levels

- PADD 1: distillate demand remained buoyant for 2019 versus previous years

- PADD 2: fall distillate demand contracted amid a weaker crop harvest season

- PADD 3: declining rig counts and demand for diesel to transport drilling equipment, materials, and produced crude

Looking ahead to January

Forecasts for winter temperatures in the coming months are varied. The 2020 Farmers’ Almanac is calling for colder-than-normal temperatures in the Northeastern US (PADD 1A and PADD 1B), along with above-normal precipitation.

In contrast, the National Oceanic and Atmospheric Association (NOAA) is predicting warmer-than-average temperatures for most of the US but warns that some areas may experience a colder-than-average winter. NOAA expects above-average precipitation in the northern tier of the US, which, combined with swings in the Arctic Oscillation, could lead to large variability in temperature and precipitation.

The challenges in predicting winter heating demand for distillate, coupled with the uncertainty of how IMO 2020 will affect distillate supply/demand balances and product flows, highlight the importance of our near-real-time fundamental data. Any changes in supply and demand trends could have a significant effect on price. In addition, the crude oil supply market is changing. The availability of heavy crudes is decreasing and demand for lighter crudes is increasing. These fundamental changes compound the complexity of refinery future margins.

In the coming weeks, we will be publishing part two of our IMO 2020 series, with a look at the current state of distillate fundamentals in Europe, followed by part three — a look ahead to potential crude market and refinery run impacts in an IMO 2020 world. Subscribe to our mailing list to be the first to know.