Breakthrough oil finds in the North Sea and Baltic Sea

What do the discovery of Norway’s ‘missing’ oil barrels and a 200 million barrel find in Polish waters mean for the European upstream sector?

1 minute read

Lewis Lawrence

Senior Research Analyst, Europe Upstream

Lewis Lawrence

Senior Research Analyst, Europe Upstream

Latest articles by Lewis

-

Opinion

Breakthrough oil finds in the North Sea and Baltic Sea

-

Opinion

Deepwater Black Sea: a new contender in the global gas landscape

-

Opinion

Video | Lens Upstream: Piecing together Cyprus' gas export deals with Egypt

Daniel Rogers

Senior Oil and Gas Analyst

Daniel Rogers

Senior Oil and Gas Analyst

Daniel Rogers is a senior analyst at Wood Mackenzie

Latest articles by Daniel

-

Opinion

Breakthrough oil finds in the North Sea and Baltic Sea

-

Opinion

NEO Energy and Sval Energi sale rumours - what could the portfolios offer a buyer?

Two breakthrough oil finds have dominated upstream news in Europe in recent months: Aker BP’s discovery in the Omega Alfa area east of the legacy Frigg gas field in the Norwegian North Sea; and a significant discovery in the Baltic Sea off Poland. So, what do these finds mean for the European upstream sector?

The facts

- A novel exploration approach targeting previously undeveloped, laterally extensive, thin oil columns has uncovered over 100 million barrels of oil equivalent (boe) adjacent to abandoned gas fields near the UK border of the Norwegian North Sea.

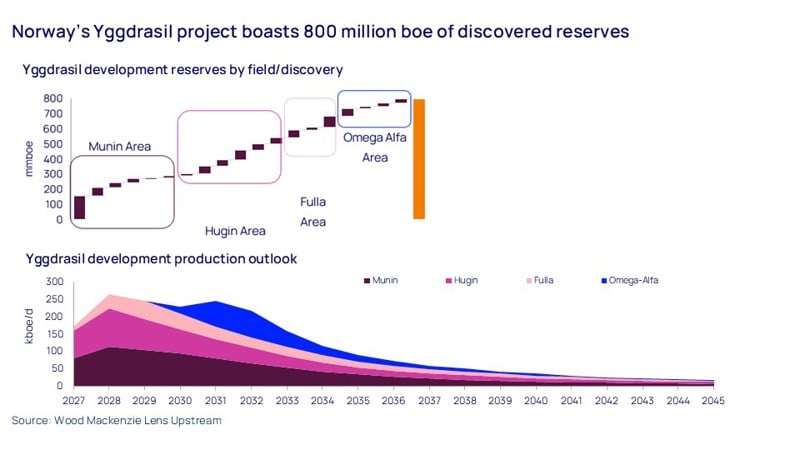

- At 10,666 metres measured depth, Aker BP’s Omega Alfa exploration well campaign broke records with the longest ever Norwegian well; it succeeded in four of the five targets tested in a single multi-lateral wellbore, and boosts resources for Norway’s under-development Yggdrasil project to 800 million boe.

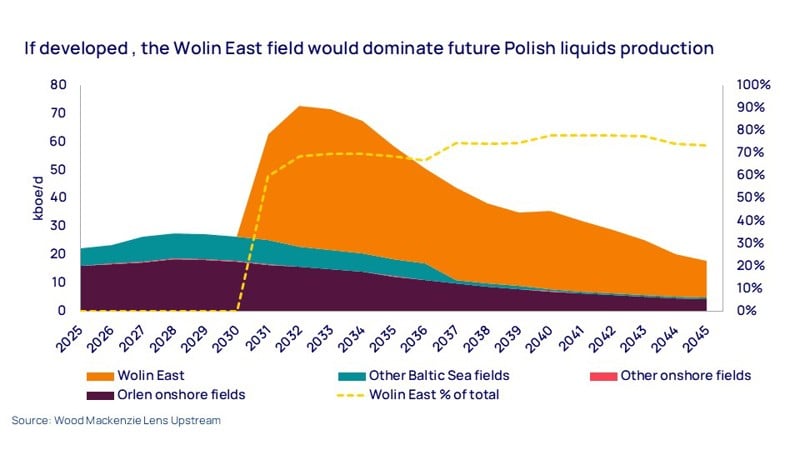

- Elsewhere, the discovery by small Canada-based firm Central European Petroleum (CEP) of 200 million barrels of oil in the Wolin area of the Baltic Sea off Poland represents the country’s largest ever find. Wolin East could also hold significant upside if EOR methods are implemented.

Our view

The discovery of Norway’s ‘missing’ oil barrels was notable as much for the novel approach used as for the not inconsiderable volumes that will be added to the Yggdrasil development. Meanwhile, we expect the announcement of Poland’s largest discovery to date could generate stronger interest in the wider Baltic region.

More oil could be discovered in the Omega Alfa Area using the same approach: The Frigg gas field was one of the largest in Europe in its time, but production stopped in 2004, leaving the oil leg untouched due to technological constraints. Aker BP expect there to be around 250 million barrels of oil in the area in total.

The Wolin find could stimulate wider Baltic Sea interest: CEP’s breakthrough represents the largest discovery in northern Europe including the North Sea, since the Wisting discovery in the West Barents in 2013. The scale of the find could generate greater interest in the Baltic region as a whole.

Orlen would be the obvious partner for CEP in exploiting the Wolin discovery: We estimate capital requirements for the development to reach plateau production at around US$2 billion in 2025 real terms. As a small player, CEP is planning to farm down its 100% stake after drilling a second test well in 2026; we believe the field would be instantly attractive to Polish state-backed Orlen, which outlined intentions to grow and maintain its domestic output in its latest group strategy.

Looking ahead

Aker BP will fast-track its Omega Alfa Area discoveries in the North Sea as part of its wider Yggdrasil development and continue to push exploration boundaries in Norway. Once appraised, the Wolin development is likely to feature an offshore processing facility built on an artificial island; liquids could then be shipped to Orlen’s refinery in Gdansk, 290 kilometres to the east.

Fill in the form at the top of the page to receive more upstream insights like this in your inbox.