Dynamics shaping the European natural gas market

What does Wood Mackenzie’s new unique Supply & Demand modelling reveal about trading opportunities over the next 18 months?

4 minute read

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

Opinion

European gas: 6 Q&As on prices, supply, and regulatory impact

-

The Edge

A wild week for gas markets

-

Featured

Gas & LNG: region-by-region predictions for 2026

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Gastech 2025: when will the music stop for US LNG?

-

Opinion

Asia’s LNG affordability challenge amid surging supply

David Lewis

Senior Research Analyst, Gas & LNG

David Lewis

Senior Research Analyst, Gas & LNG

David Lewis breaks down Europe’s gas market volatility with deep insight into supply, demand and trading dynamics.

Latest articles by David

-

Opinion

What defined gas trading in 2025: five moments that mattered

-

Opinion

European natural gas: your top seven questions answered

-

Opinion

European natural gas winter outlook 2025

-

Opinion

Dynamics shaping the European natural gas market

Eric McGuire

Director of Natural Gas and LNG Analytics

Eric McGuire

Director of Natural Gas and LNG Analytics

Eric is a Director of Research, overseeing Wood Mackenzie’s North America S&D team.

Latest articles by Eric

-

Opinion

European natural gas: your top seven questions answered

-

Opinion

European natural gas winter outlook 2025

-

Opinion

The fundamentals behind summer’s strong gas injections

-

Opinion

North American oil & gas commodity data: how does WoodMac compare to EIA?

-

Opinion

Dynamics shaping the European natural gas market

-

Opinion

North America natural gas summer market outlook – 2025

Anticipating evolving dynamics in the European natural gas market requires an understanding of a complex range of factors. As global gas markets become more interlinked and geopolitics interfere with supply and demand, that task is only becoming more difficult for traders.

In a recent webinar we drew on data from our new proprietary European Supply & Demand solution to explore the fundamentals and risks likely to affect demand, supply, storage and pricing over the next 18 months. Fill out the form at the top of the page to access the webinar presentation – or read on for a quick overview.

Current state of the market

Weather patterns and geopolitical risks have been the key drivers of European gas prices in recent months. A cold winter pushed prices close to US$17/mmbtu in January, but they quickly fell amid renewed peace talks between Russia and Ukraine and the announcement of sweeping U.S. tariffs. Prices then fluctuated sharply following the outbreak of conflict between Israel and Iran. With some of these risks now easing, traders are shifting their focus back to market fundamentals, with storage levels remaining well below the seasonal average as summer begins.

Structural decline in demand

Even once climate factors have been accounted for, our modelling shows a structural decline in both residential & commercial and industrial gas demand in Europe. In residential & commercial this is mainly due to efficiency improvements through the increased use of heat pumps, reducing gas demand for heating.

In industry, we expect demand this year to be as much as 20% lower than before the Ukraine-Russia conflict. However, up to 10% of industrial demand could return in the short term, depending on fuel switching in the refining sector or increased ammonia production, which are the two main drivers of industrial gas demand in Europe.

Changes in the power market

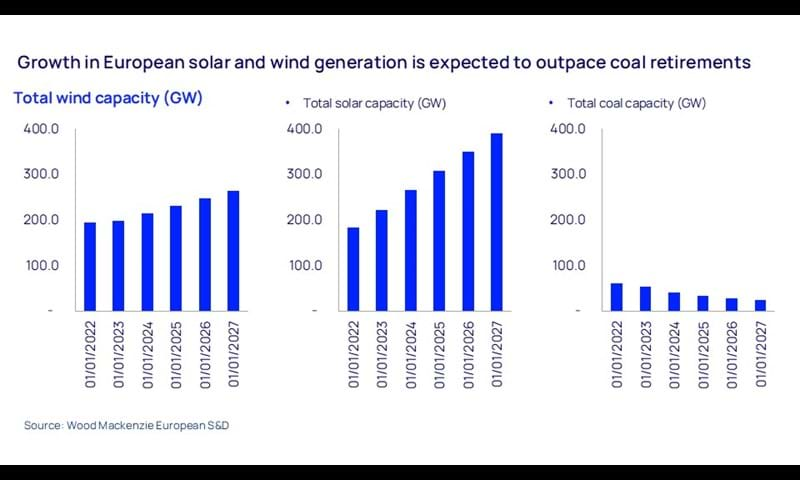

Aside from the impact of tariffs, structural changes are driving dynamics for gas use in European power generation. With the growth in solar expected to outpace coal retirements by 2027 (see charts below), renewables penetration is reducing overall thermal generation, which made up just 20% of the power mix in May 2025.

The high proportion of renewables in the power mix causes short-term volatility in gas demand, as the deployment of solar and wind generation varies considerably with conditions. Spring 2025 saw very high levels of renewable generation, pushing down gas demand to the bottom of the five-year range. We expect this trend to continue, with record levels of solar generation through August, followed by similarly high wind generation in September, October and November.

Gas demand is only likely to trend back towards the five-year average once winter fully sets in, when a loss of coal generation will also have an impact. Ongoing coal retirements have weakened coal-to-gas switching in Europe, but it remains a key lever for gas variability and price formation.

Pipeline supply

Norway now provides 40% of imports into northwest Europe. We expect a recovery to robust levels of Norwegian supply over the summer, following unplanned maintenance in the spring that had a sizeable impact on gas deliveries into continental Europe. Planned maintenance will see a notable reduction in September, before a recovery in the remaining months of the year.

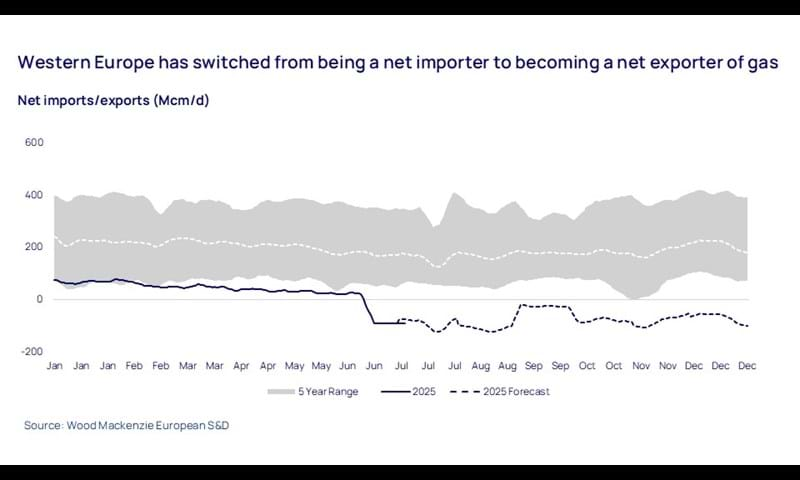

A key factor to note is that with the loss of Russian pipeline supply, Eastern Europe (i.e., everywhere to the east of Germany and Italy) is no longer exporting significant quantities of gas piped through its territory, but has instead become a net importer. At the same time, Western Europe is set to become a net exporter of gas (see chart below).

Growth in LNG supply

The key question is, where is all this additional supply for Eastern Europe going to come from? The short answer is LNG.

Our approach to European LNG supply is different from other models in that we don’t seek to balance the market. This is because LNG has become a globally tradeable commodity that can feasibly be delivered to markets all over the world. We therefore take LNG demand and pricing around the world as a key input.

Currently, weak Asian LNG prices mean Europe is the most profitable destination for most Atlantic facing cargoes, which make up the majority of flexible cargoes globally. Based on the current forward curves for TTF and Asian spot LNG prices, we therefore expect Europe to see extremely elevated levels of LNG through 2026 – particularly as major new projects will be coming online and increasing the volumes coming to market.

To find out the implications for gas storage levels over the next eighteen months, download the webinar presentation via the form at the top of the page. This explores the outlook for the European gas market to 2027 in rigorous detail and includes a full range of supporting charts and data.

The methodology behind our European natural gas summer market outlook

Watch below

Eric McGuire, Director of Natural Gas & LNG, introduces our latest European Supply & Demand product, which forms the foundation of our analysis in this outlook. Following this, David Lewis, Senior Research Analyst for European Gas & LNG, presents key insights into Europe’s current storage scenarios, shaped by the data and forecasts from our new product.

If you would like to find out more about our European Supply & Demand service, visit our Natural Gas Supply & Demand suite, or register your interest to receive updates on the product, along with exclusive insights into it’s core features, benefits, and how it can support your goals.