Hot rocks: geothermal momentum continues to build

A healthy project pipeline, strong policy support, plentiful funding and a surge in drilling signal ongoing market growth

3 minute read

Annick Adjei

Senior Research Analyst, Subsurface (New Energies)

Annick Adjei

Senior Research Analyst, Subsurface (New Energies)

Annick is instrumental in advancing Wood Mackenzie’s geothermal solution.

Latest articles by Annick

-

Opinion

Hot rocks: geothermal momentum continues to build

-

Opinion

Rock solid: geothermal’s upward trajectory

-

Opinion

Geothermal: the next North American goldrush?

-

The Edge

The coming geothermal age

-

Opinion

Heating up: 2024 showcased the promise of geothermal energy

-

Featured

Subsurface 2025 outlook

Kate Adie

Research Analyst, Subsurface

Kate Adie

Research Analyst, Subsurface

Kate is a key contributor to our global research on established and developing geoenergy technologies.

Latest articles by Kate

-

The Edge

Can natural hydrogen deliver its potential?

-

Opinion

Hot rocks: geothermal momentum continues to build

-

Opinion

Rock solid: geothermal’s upward trajectory

-

The Edge

The coming geothermal age

-

Opinion

Heating up: 2024 showcased the promise of geothermal energy

-

Featured

Subsurface 2025 outlook

Zoé Sulmont

Research Analyst, Energy Transition

Zoé Sulmont

Research Analyst, Energy Transition

Latest articles by Zoé

-

Featured

Nuclear 2026 outlook

-

Opinion

Energy evolution: navigating the path to a sustainable future

-

Opinion

Hot rocks: geothermal momentum continues to build

-

Opinion

Rock solid: geothermal’s upward trajectory

-

The Edge

The coming geothermal age

-

Opinion

Heating up: 2024 showcased the promise of geothermal energy

Rosanele Romero

Senior Research Analyst, Subsurface

While using geothermal energy to generate electricity is far from new (the first commercial plant opened over a century ago), next-generation technologies are creating a real buzz of excitement around this proven renewable power source.

In our recent Q2 2025 Geothermal Market Update, we presented a detailed overview of the latest geothermal developments, along with a deep dive into the evolving market landscape for two established markets (the US and Germany) and two growth markets (Brazil and China). Complete the form at the top of the page to download an extract from the report, or read on for a brief insight into three key factors driving geothermal market growth in 2025.

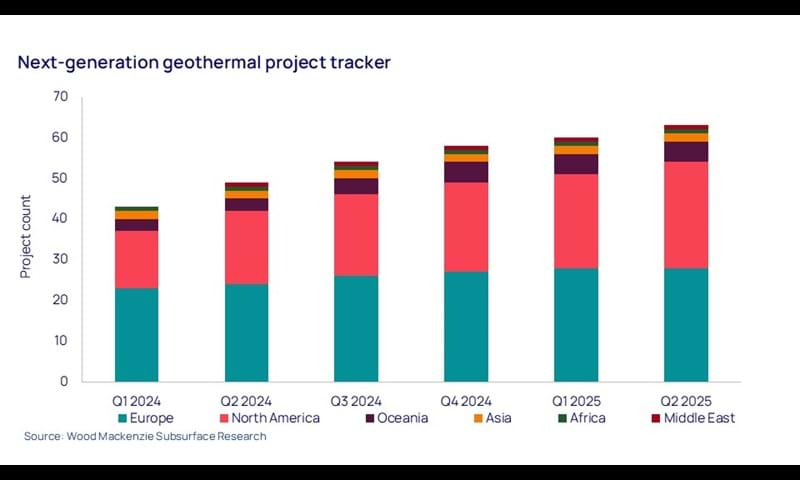

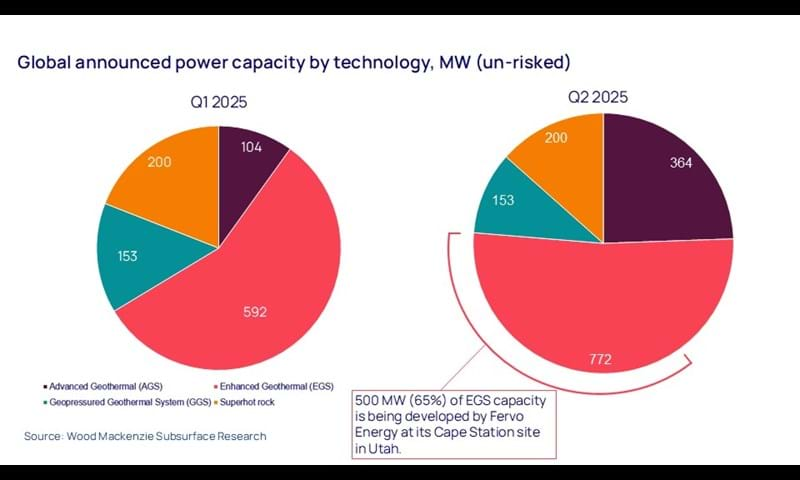

1. North American announcements give the project pipeline a boost

While the number of next-generation geothermal project announcements plateaued in other regions, North America continued to increase its global share – acting as a key driver of pipeline expansion. A total of 260 megawatts (MW) of new Advanced Geothermal Systems (AGS) power capacity was announced in the US in Q2 2025, raising un-risked AGS capacity to 20% of the overall US project pipeline (up from just 2% in the same period last year). Data centre partnerships continue to boost and strengthen the next-gen project pipeline, given their rapid growth and need for clean and reliable sources of significant amounts of electricity.

AGS comprises a closed-loop system that circulates fluid through the subsurface while avoiding direct contact with rock or groundwater. Unlike conventional geothermal, it can be used almost anywhere. Other next-gen technologies include enhanced geothermal systems (EGS), whereby fluid is injected into hot rocks to increase permeability; Geopressured Geothermal Systems (GGS), which extract energy from high-pressure, high-temperature reservoirs of water containing dissolved methane; and superhot rock, which involves harnessing geothermal energy from extremely hot, dry rocks found deep underground.

2. Policy momentum and funding is accelerating

The US Government’s backing for direct lithium extraction (DLE) project ATLiS, with its co-located geothermal project, accounted for most public funding of geothermal in North America in Q1 – and a significant proportion of global funding. Taking AtLiS out of the equation, total public funding for geothermal globally increased by 57% between Q1 and Q2 2025, to hit US$400 million – helped by strategic reforms, incentives and international alliances. The focus was on core geothermal projects covering conventional and next-generation technologies.

Investor confidence also remains strong, with next-generation startups including Fervo, XGS, Eavor and Green Therma raising a total of US$319 million in Q2. That sum represents 14% of all money invested in next-gen geothermal since 2019, and brings the total amount secured between 2019 and 2025 to a healthy US$2.2 billion.

3. Drilling announcements surged in Q2 2025

Geothermal drilling activity reached 88 wells in Q2 2025, a significant increase on the 47 wells in Q1. Europe saw less exploration but more development drilling, while Asia Pacific gained momentum through new exploration and development announcements. Meanwhile, North America experienced a period of consolidation, with drilling activity slowing as next-gen startups focused on developing technologies and advancing projects towards execution.

Notably, the Middle East also saw new activity thanks to Strataphy’s completion of test drilling for 25 shallow (250 metre) geothermal wells in northwest Saudi Arabia. The heating and cooling project is just one manifestation of growing interest in geothermal in the region; French multinational EDF recently signed a geothermal exploration agreement with the Abu Dhabi National Energy Company (TAQA), while the King Abdullah University of Science and Technology in Thuwai, Saudi Arabia, is running a research project to identify geothermal resources throughout the country.

In Germany, Vulcan Energy kicked off drilling of the fifth well for its co-located Lionheart lithium extraction and geothermal heating project – with another 24 to come. The project aims to produce lithium for the electric mobility transition with a net-zero carbon footprint. According to Vulcan, total additional energy capacity from the project will amount to 33 MW of power generation along with 30 MW of heating.

Don’t forget to fill in the form to download the extract from the report, which contains a series of charts and data illustrating these points in more detail, as well as breakdown of global licencing activity.