Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Oil and gas exploration spending to recover from historic lows, average $22B per annum through 2027

Deepwater areas of Africa and Eastern Mediterranean to provide most growth opportunities

2 minute read

Exploration spend (excluding appraisal) will recover from historic lows to average US$22 billion per annum in real terms over the next five years, according to a new report from Wood Mackenzie.

Tailwinds from attractive exploration economics, the need for energy security and the emergence of new frontiers will incentivize oil and gas companies, led by NOCs and Majors, to increase exploration spending through 2027, according to “Exploration quietly recovering” a new report from Wood Mackenzie.

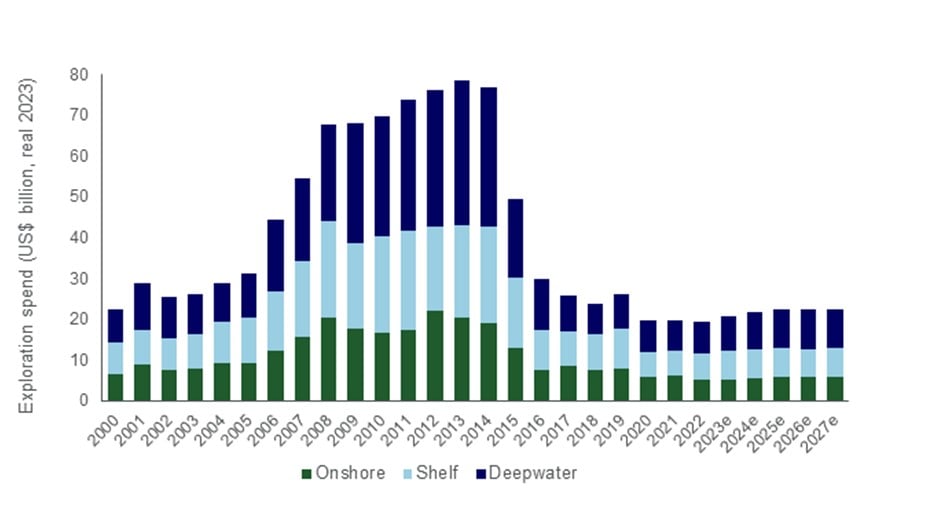

“Explorers will become bolder in the coming years,” said Julie Wilson, Director of global exploration research at Wood Mackenzie. “While this rebound might surprise some, it must be seen in context. Exploration went through a boom during 2006-2014 and spend peaked at US$79 billion (in 2023 terms). But in the prior six years, the average was US$27 billion per year in 2023 terms. While spending will increase, it won’t return to anywhere close to past highs and there will likely be a ceiling on the increase. There is a lack of high-quality prospects that would satisfy today’s economic and ESG metrics and a continued focus on capital discipline will keep a lid on overspending.”

Exploration spend 2000-2027

Source: Wood Mackenzie. Spend is in real 2023 terms

The growth will begin in 2023, with spending projected to increase 6.8% over 2022 totals (in real terms). A major driver for this increased activity is the robust business case. According to Wood Mackenzie, full-cycle returns from exploration have been consistently above 10% since 2018 and exceeded 20% in 2022.

“These positive results have increased confidence in exploration,” said Wilson. “Improved results are down to many factors. Portfolio high-grading coupled with greater discipline in spending and prospect choice mean only the best prospects are drilled and waste is minimized. Efficiency gains also serve to enhance the returns from both development and exploration.”

Deepwater drives growth in new regions

In the long term, deepwater and ultra-deepwater will provide the most growth opportunities for exploration. The Atlantic Margin of Africa and the Eastern Mediterranean regions will experience the greatest growth and there will be spend in some unspecified new frontiers.

“There are areas where leads and prospects are being worked up with recent seismic data, for example Uruguay, southern Argentina and deepwater Malaysia,” added Wilson. “Future spend in ‘success case’ areas is additional exploration following success, whether that's in a frontier like Namibia or Greece, or a more established province like Egypt's Nile Delta.”

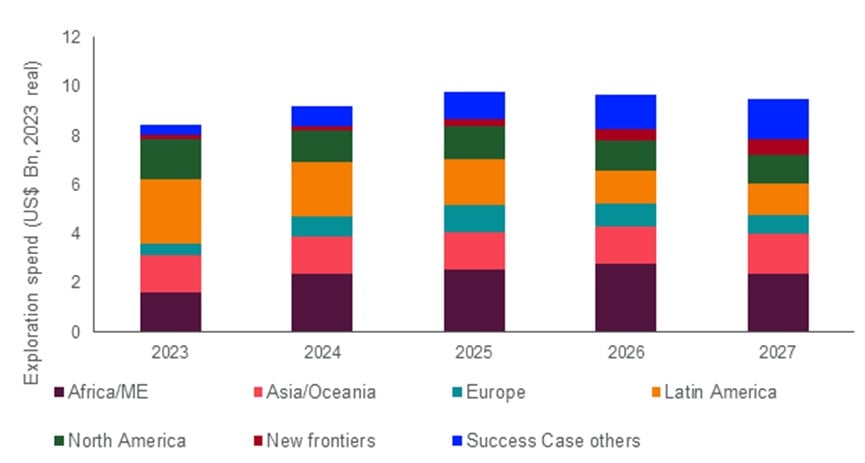

Deepwater future exploration spend estimate by region