Get Ed Crooks' Energy Pulse in your inbox every week

Tariffs begin to redirect global energy trade flows

The full impact of the new tariffs has not yet worked through world markets, but US energy exports to China have been falling

10 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Iran conflict a test of US energy supply response

-

Opinion

Are VPPs really a viable solution for easing strain on the grid?

-

Opinion

Data centers are adding an extra 220 gigawatts of electricity demand in the US. How can the grid cope?

-

Opinion

How are energy supply chains changing as electricity demand surges?

-

Opinion

Supply chain constraints limit the growth of gas-fired generation in the US

-

Opinion

A solution to the problem of paying for data centre power?

The period between the outbreak of World War II in September 1939 and Germany’s invasion of France in 1940 became known in Britain as the “phoney war”, because of the lack of large-scale engagements. The trade war that was declared by the US last month currently has a similar sense of unreality.

The full impacts of the Trump administration’s tariff strategy have not yet been felt. American consumers have not seen shortages or price increases as the full rates of most of the tariffs announced on 2 April have not yet come into effect. The administration is working on trade deals with about 90 other countries, which will mean the lower rates can be maintained.

But for energy, some perceptible impacts are already visible. Wood Mackenzie data on energy production, movement and sales give a sense of how the world is changing.

The impacts of the tariffs on US consumers and businesses seem likely to show up over the next couple of months. Gene Seroka, executive director of the Port of Los Angeles, told Bloomberg Television last week that he expected import volumes coming through the port this week to be about a third lower than normal. He added that retailers still had about five to seven weeks of inventory on hand, “and then we start to see shortages”.

Ryan Petersen of Flexport, a freight forwarding company, told the Wall Street Journal that if the tariffs remained in place, there would be an “extinction level, wiping-out-the-dinosaurs kind of event” for many American small businesses, because of the damage done to supply chains.

US officials are seeking to negotiate new trade deals before the deadline for increased tariffs to take effect on 8 July. No deals have yet been announced, but countries including Japan and South Korea have indicated that they want to reach an agreement before the deadline.

Maroš Šefčovič, the European trade commissioner, said in an interview with the Financial Times last week that the EU was making progress towards a deal, with LNG purchases playing a key role.

The commissioner’s comments highlighted the opportunity for US oil and gas producers in the current trade tensions. Increased LNG purchases cannot close all other countries’ trade surpluses with the US, but they can make a significant contribution towards reducing them. Investments in US LNG facilities, and contracts to buy their output, could help facilitate wider trade deals with the Trump administration.

Those diplomatic factors could help a US LNG industry that is already in a strong position. Woodside Energy last week announced it had taken a final investment decision (FID) for the first three trains at its Louisiana LNG project, at a cost of US$17.5 billion. That was clearly a commercial rather than a political decision, but other decisions in the future may have some diplomatic significance attached to them. We expect other US LNG projects to take FID this year.

However, other aspects of the situation have not been so favourable for US energy.

The Wood Mackenzie view

China’s blanket retaliatory 125% tariff on imports from the US is already having an impact on US exports of oil and gas. Data from Wood Mackenzie’s VesselTracker service show that loadings of crude from the US Gulf coast heading for China have slumped in the past couple of months, from about 148,000 barrels a day in February to about 68,000 b/d in April.

Over the same period, flows of ethane, propane and butane from the US to China dropped from 551,000 b/d to 343,000 b/d. Trade has shrunk less for ethane than for propane and butane. US ethane is a critical feedstock for China’s chemicals industry, and Reuters reported last week that the 125% tariff was being waived.

US oil and NGLs that had been previously flowing to China have been finding other markets, particularly in Southeast Asia. But China is such an important market for US ethane that finding alternatives would have been difficult.

Wood Mackenzie analysts have also been looking at another key part of the Trump administration’s plan for reconfiguring international trade flows: a new structure for port fees, announced last month.

The new fee structure imposes higher charges on vessels that are Chinese-owned, operated or built. The goal is to curb China’s maritime influence and “…address China’s unreasonable acts, policies, and practices”.

The fees are not expected to have a large immediate impact on oil and LNG trade flows but add an additional element of uncertainty and could become more significant over time.

For LNG, there are almost 100 vessels under construction in Chinese yards. By 2031, about 12% of the worldwide operational LNG carrier fleet will be Chinese-built, up from 7% today.

The rules exempt ships that arrive at US ports empty. Because LNG tankers typically arrive empty to load up at US plants, even vessels built or operated by Chinese companies will mostly avoid the fees.

However, the Office of the US Trade Representative has added another provision, determining that a set portion of all US LNG exports must be transported on US-built tankers, starting at 1% in 2028 and rising to 15% by 2047.

Building large-scale LNG tankers in the US will be challenging, especially in the near term, says Fraser Carson, Wood Mackenzie’s principal analyst for global LNG. The US built several in the 1970s and 1980s but currently lacks any large-scale LNG shipbuilding capacity.

That lack of experience, plus the costs added by tariffs, means that building LNG tankers in the US could take significantly longer, and cost significantly more, than in South Korea or China.

The position is similar for oil. Chinese-built tankers have carried about 17% of the total oil cargo shipped to or from the US, according to VesselTracker. Tankers that are both Chinese-built and Chinese-owned accounted for just 4%.

Kendrick Ng, a Wood Mackenzie senior research analyst, said he did not expect significant disruptions to the oil tanker market as a result of the new fees. The number of Chinese-owned and Chinese-built tankers using US ports is relatively low, and shipowners should be able to reshuffle their fleets so they are not liable for the additional fees.

However, the situation remains volatile and uncertain, and the new fees could potentially become an obstacle to energy trade in the future.

OPEC+ members announce further production growth

Oil prices have fallen sharply since President Donald Trump’s 2 April announcement of sharp increases in tariffs, as fears about the outlook for the world economy have grown. Another factor has been the decision by the OPEC+ group of countries to step up the pace of its production increases.

On Saturday, the eight OPEC+ members that have made voluntary production cuts, including Saudi Arabia, Russia and Iraq, announced that they would increase their output by 411,000 b/d in June. That is the same increase that they agreed for May.

The move had been predicted by Wood Mackenzie analysts but, even so, moved oil markets in early trading. Brent crude was down about US$1 a barrel at roughly US$60 a barrel on Monday morning in the US.

The OPEC+ production increase follows reports of tensions within the group, particularly over output from Kazakhstan. Yerlan Akkenzhenov, the country’s energy minister, told Reuters last month that Kazakhstan would “act only in accordance with national interests” when setting oil production levels. Kazakhstan later said it was working with OPEC+ to resolve the issues. Iraq has also come under pressure to adhere to its target.

Blackout in the Iberian Peninsula

The investigation into the grid failure that left Spain and Portugal without power for many hours last week is continuing. The root cause is still unknown, but some of the key features of the event have become clear.

At the time that the outage began, grid supply was dominated by solar, with a low contribution from conventional thermal generation. Just after 12:30pm local time, a large drop in volume – described as resembling a loss of power generation – was observed, followed a few moments later by a second, similar event. Seconds after this, interconnector flows with France were interrupted and, in the face of growing instability, a system-wide shut down began.

Peter Osbaldstone, Wood Mackenzie’s research director for Europe power, said the event had laid bare some of the issues raised by the EU’s transition to low-carbon electricity, and particularly by solar and wind power. In Iberia’s case, these challenges have been strengthened by the peninsula’s limited connectivity with the wider European network.

Europe has been very successful in adding new renewable generation, which is expected to supply more than 50% of the region’s power this year. But technologies to achieve grid flexibility have not scaled up to the same degree. Battery storage has begun to grow rapidly, but an expansion of cross-border interconnection has lagged behind.

“The sector’s transition is not limited to reducing emissions. It requires fundamental changes in technology and the characteristics of supply, demand and system function,” he said.

In brief

The US government has agreed a natural resources deal with Ukraine, setting up a joint investment fund intended to accelerate the reconstruction of the war-torn country. The deal appears to be on more equal terms than earlier versions of the agreement, which would have committed Ukraine to paying the US large amounts in reimbursement for past military support.

Under the final deal, any future US military assistance to Ukraine will be counted as a capital contribution to the fund. Ukraine has also agreed to contribute 50% of the revenues from the exploitation of new minerals, oil and gas projects.

Yulia Svyrydenko, Ukraine’s economy minister, said the fund would invest in minerals and oil and gas projects, in extraction, infrastructure and processing. The specific projects will be jointly determined by Ukraine and the US.

ExxonMobil, Chevron and Shell reported lower earnings for the first quarter. ExxonMobil reported a 15% fall in earnings per share (EPS). Darren Woods, chief executive, delivered a reassuring message to investors, saying: “In this uncertain market, our shareholders can be confident in knowing that we're built for this.”

Chevron reported a 26% drop in EPS, adjusted to exclude one-off items. Chief executive Mike Wirth similarly emphasised the company’s resilience in changing market conditions. He said Chevron was positioned to deliver industry-leading free cash flow growth by 2026.

Shell reported a 23% fall in adjusted EPS. Sinead Gorman, Shell’s chief financial officer, warned of “significant macro uncertainties” in the outlook. She added: “At times like this, the importance of a strong balance sheet and a robust financial framework are critical”.

Other views

The case for high-impact exploration through the downturn – Simon Flowers and Simran Bandal

Gas prices set the stage for a shifting summer market – Daniel Myers and Eugene Kim

What is the impact of US tariffs on oil and refining? – Alan Gelder and Ann-Louise Hittle

What to know about the signed US-Ukraine minerals deal – Gracelin Baskaran and Meredith Schwartz

The climate paradox: why we need to reset action on climate change – Lindy Fursman

Democrats have been at war with oil barons for far too long – Arnab Datta

Quote of the week

“Reform control the Mayoralty and County Council in Lincolnshire with myself as local MP. If you are thinking of investing in solar farms, battery storage systems, or trying to build pylons, think again. We will fight you every step of the way. We will win.”

Richard Tice, the Reform Party MP for Boston and Skegness, posted on the social network X that his party would use its success in the recent UK local elections to block investment in low-carbon infrastructure. He said he would be writing to companies considering developing projects in Lincolnshire to warn them that “you’re going to waste your money” because Reform would use “every available legal measure” to stop them.

Chart of the week

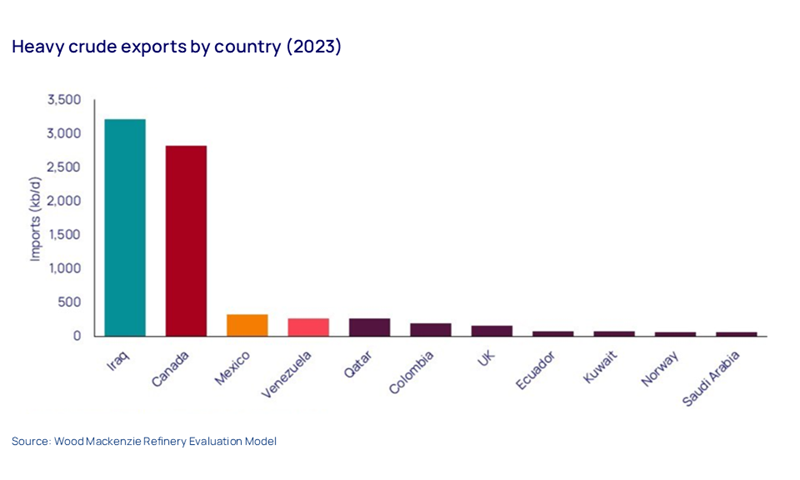

This comes from a recent note by Wood Mackenzie’s Kian Akhavan, looking at the future of Canada’s energy infrastructure. It shows the world’s largest exporters of heavy oil, with Canada and Iraq way out ahead of the rest. With no tariffs, crude from Canada is advantaged against crude from Iraq for refineries on the US Gulf coast. If the US goes ahead with its threatened tariffs on Canadian oil and gas, it would have to be priced to remain competitive against Iraqi barrels.

For more on the implications for the energy system in North America, take a look at the full note.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.