Oil Supply Model

Understand how the oil price and supply outlook will evolve over time.

Face dynamic markets with certainty

Wood Mackenzie’s supply demand model builds a global oil price and supply outlook based on market fundamentals. This powerful tool enables customers to quantify how events and trends impact the global oil market, empowering them to make informed investment decisions and craft successful commercial strategies.

|

|

|

|

|

Designed to help you

Rapid market analysis

Run the model through to 2050 in 2½ minutes.

Advanced data exploration

Multiple charting options with the ability to filter down to the asset and product level

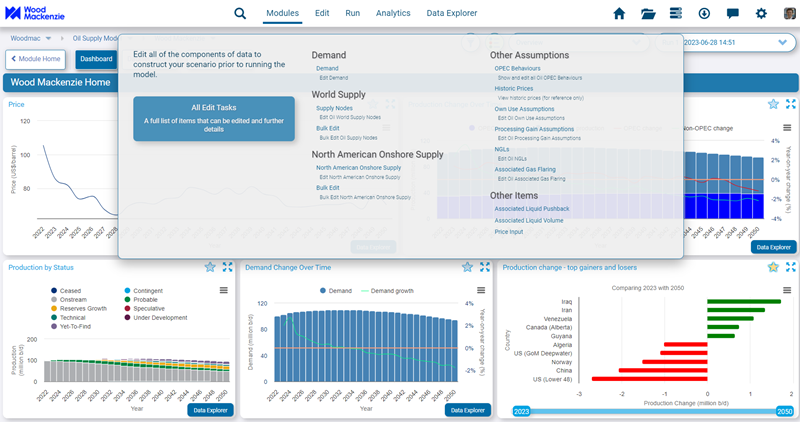

Quickly and easily edit assumptions

Adjust a host of assumptions for individual assets from production and costs to API and start date

Dynamic solver

Use demand or oil price as an input. Supply outlook automatically adjusting as inputs change

Collaborate with peers

Quickly create new datasets which can be private or shared with your team

Incorporate into your workflow

View data in Wood Mackenzie’s analytics platform, export to Excel, or use on your own platform