Earlier this year, ExxonMobil rocked the Permian with its bold plan to boost production to 1 million boe/d by 2024.

Exxon is clearly on target with a development approach unlike anything we’ve seen before in a shale basin. The supermajor is running an unprecedented 60 rigs in the Permian, up three-fold from just 20 rigs a year and a half ago. And it’s just getting started. The company’s goals are focused on maximising NPV and executing a project that’s larger and one that moves faster than its peers.

Exxon Permian cube development strategy

To reach its ambitious 1 million boe/d goal, Exxon is utilizing cube development in the thick Wolfcamp strata and leveraging huge economies of scale. Will it work? We think so, because we see it in the early data. Decline curves look strong, leading us to believe that Exxon has made big strides in the downspacing code.

Exxon’s first large-scale cube development project in Eddy County, New Mexico, is a good proxy for plans to come. We used our Wood Mackenzie Lens® data and analytics to analyse the approach from every possible angle.

Here are 4 reasons we’re bullish about Exxon’s growth development strategy that’s being piloted in a key, early cube just northwest of Poker Lake in Eddy County.

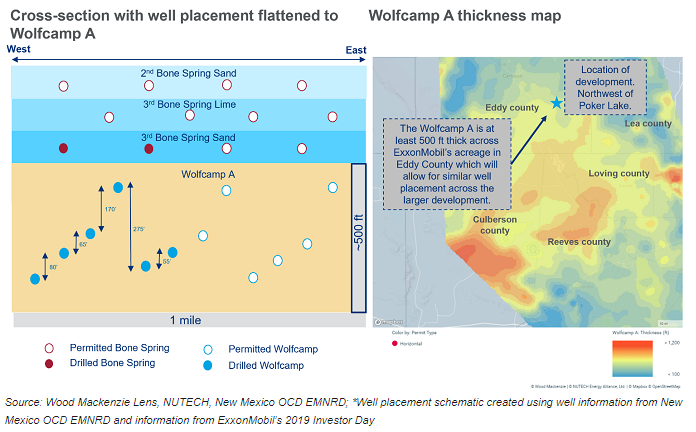

1. Thick Wolfcamp strata make wine-racking possible

Wine-racking, or vertically staggering, wells allows for more wells to be placed in a single bench. It’s only possible in the thickest stratigraphy. Exxon has this in the Wolfcamp A, where the primary zone is between 500 and 600 feet thick. It’s planning to pack 12 wells per section in just the A zone in this area, with horizontal spacing of only 440 feet.

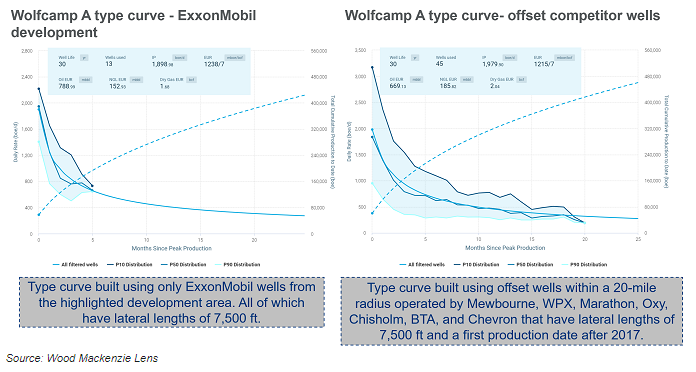

2. Tight spacing isn’t impacting well size

Aggressive spacing begs questions around well performance and size. Early indications from five months of Exxon’s production data in the Wolfcamp and Bone Spring are performing in line with offset competitor wells. In other words, early ‘child’ wells are producing like other companies’ older ‘parent’ producers.

Caveats of just five months of production data aside, our decline curve analysis also suggests that Exxon is drilling up to twice as many wells in the Wolfcamp A as its competitors. How are they doing it? We believe limited entry completions, unique lift strategies, and new proppant technologies could be playing a role. Exxon has long messaged it would tackle tight oil with a newfound technology focus that builds further on what the Independents have already accomplished.

3. Exxon is achieving high IPs, even in shallow zones

Wells in the 3rd Bone Spring formation are typically deprioritised. But Exxon is drilling it in its early pads and the Bone Spring wells come online with impressive initial production (IP) rates. They do drop off much more quickly than wells in the Wolfcamp, but the cumulative volumes produced are nothing to shy away from.

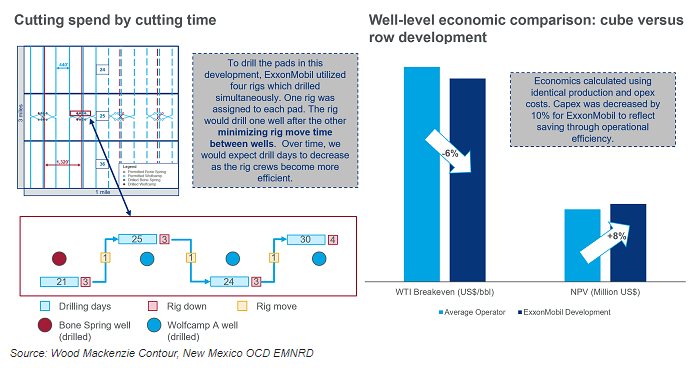

4. Operational efficiency is driving cost savings

Earlier this year, we published a report outlining critical goals needed for Exxon to reach its Permian targets: drill cheaper wells with larger EURs than it did in 2017 and 2018.

We used our digital data powerhouse, Lens, to perform the Exxon analysis in this report. Fill in the form on this page to demo our new technology.