Has EOG's Louisiana Austin Chalk project sparked a movement?

Early well results signify a potential breakthrough in the play

1 minute read

While horizontally-drilled hydrocarbon-rich Austin Chalk acreage has yielded some success in Texas, its eastern geographies have been historically unsung. The formation's subsurface characteristics have often resulted in strong production volumes at the start, but with extremely steep decline rates. Horizontally stimulated chalk wells in Louisiana are quite new, but will they work?

A strategic shift in the Louisiana Austin Chalk

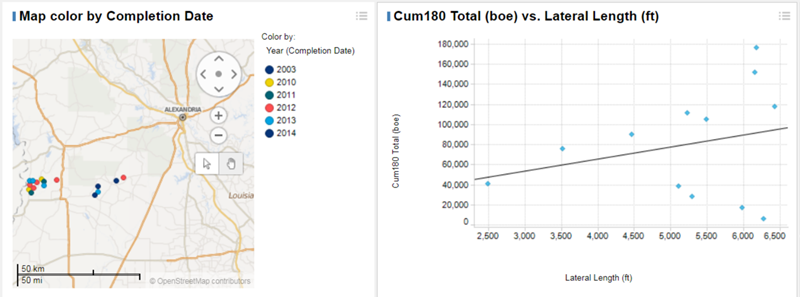

EOG is trying, drilling the Eagles Ranch 14H – the first modern completion in this portion of the Austin Chalk. Early results suggest it could be a breakthrough for Louisiana acreage. Other companies – notably ConocoPhillips – have followed suit. Many are adopting EOG's strategy of targeting unfractured, rather than naturally fractured, areas of the formation. This is confined to a somewhat small area, so land rush investors need to beware.

Source: Wood Mackenzie North America Well Analysis Tool

EOG's prior chalk success in Karnes County, Texas, has likely fed its desire to explore the Louisiana section. While natural fracturing has generated impressive initial production rates in Texas, the Louisiana landscape is more complex. Economic wells will require a complex interplay of natural fractures and matrix production in just the right balance. The rock is challenging, so completions will need to be aggressive and costs will be high.

New wells, new benchmarks

The Eagles Ranch 14H will likely be a benchmark for subsequent tests this year. At US$12.3 million, including one-time expenses for scientific testing, EOG's play-opener suggests future non-exploratory well costs between US$9 to $10 million. Initial production came in at 80,000 barrels in 110 days, but decline rates have been steep – 48%, 23% and 21% across the first three months, respectively. This aligned with the very tight nature of the reservoir.

With the average EUR of unstimulated horizontals in the Louisiana Austin Chalk coming in at 119,000 barrels, we model the Eagles Ranch 14H to have already produced two-thirds of prior mean volumes. But recent fractured horizontal wells in Texas have seen EURs five times higher than offset, unstimulated wells. As such, the Louisiana allure is clear.

What's next?

We expect 2018 to be a pivotal year in the ongoing evolution of Austin Chalk exploration, particularly in Louisiana. It will be somewhat slow-moving though, but if WTI prices stay above US$60 per barrel, exploration activity will no doubt continue to build.