Brazil 2019 exploration bid rounds: mitigating sky-high bonuses

Is the hefty upfront price tag manageable for Round 16 bidders?

1 minute read

After three highly competitive exploration bid rounds in 2018, momentum is building for Brazil's three-round licensing bonanza that starts later this year. While the PSC Round 6 planned for November still looks to be on track, the remaining rounds are less certain. Originally planned for October, the Transfer of Rights Surplus round could be deferred, which would also push Round 16 to 2020.

In coming months, we'll preview the three rounds. First, we'll tackle Concession Round 16 that tentatively takes place 10 October. Stay tuned for more analysis on the discovered resource opportunity (DRO) in the Transfer of Rights Surplus round, as well as the final bid round on 7 November, PSC Round 6.

Competitive concession terms

Not all oil plays are created equal. The best plays yield large discoveries in high-quality reservoirs with low-cost exploitation opportunities. Aside from growing signature bonuses, Brazil's pre-salt fields in the Santos basin provide two out of three. We've referred to the 'Goldilocks' depth of the basin's reservoirs. They're not too expensive to drill, but deep enough for oil to flow to the surface freely. Single wells in the reservoirs are capable of producing as much as 50 kbd in a day.

Quickly evaluate new exploration opportunities with PetroView®

Learn moreStill, there are challenges. Today's production lags 1 million b/d behind our forecast from 2010. Petrobras' role is often unmanageable as the NOC takes on the development of multiple fields as the sole operator and major equity partner. Furthermore, large amounts of non-flexible associated gas will be produced in the pre-salt projects. The region urgently needs investment in offshore pipelines and onshore processing facilities to develop the gas.

Brazil's government is acutely aware of its oil riches, and bidders are signing higher and higher bonuses to purchase a piece of the action. Minimum bonuses for Round 16 blocks are set at US$820 million – nearly equating to Equinor's total spending in recent rounds for blocks in the Campos and Santos basins. Round 16's average minimum signature bonus for frontier acreage exceeds Argentina's offshore concession round held in April.

Round 16 acreage offerings

The Round 16 concession regime offers 36 blocks across five basins. Twelve blocks in three of the five basins are frontier acreage with high exploration risk, and are paired with reduced royalty rates and work commitments. The incentives may still fail to compensate for the environmental risks in the Camamu-Almada blocks. Oil potential is unknown in the Jacuipe basin, and little geological data exists in the undrilled Pernambuco-Paraiba basin.

The remaining 24 blocks are situated in the Santos and Campos basins, which account for the biggest share of the 38,000 km2 offered. The prolific Santos basin, where half of the acreage sits, gives the Brazilian government the most hope for a big cash reward.

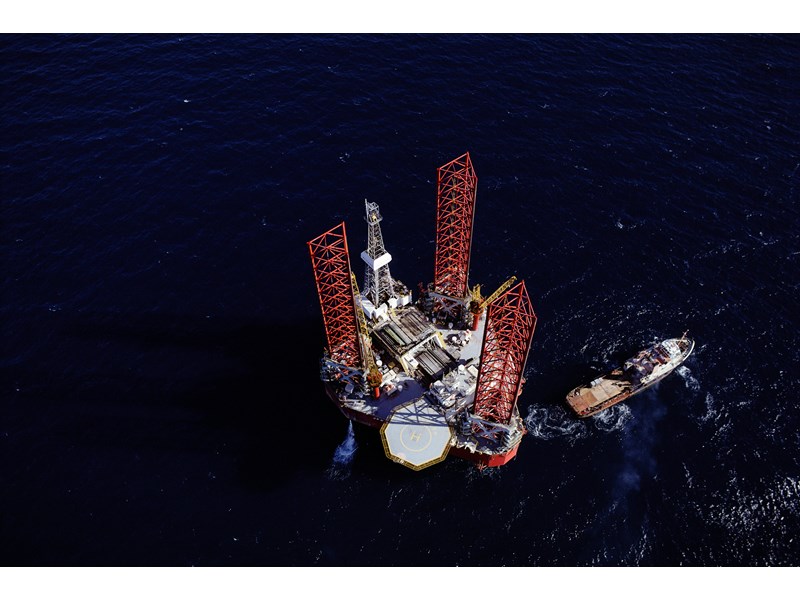

Brazil bid rounds 6 and 16 illustrated by Wood Mackenzie's PetroView®

Pre-salt exposure comes at a price

While Round 16 offers fewer blocks than Round 15, the total minimum signature bonuses are set higher. In the last offshore block auction, average winning bids were five times the minimum bonus.

To demonstrate the potential of the 11 blocks offered in the Santos basin, the average minimum bonuses in those blocks are set three times higher than the Round 15 average. Frontier acreage, which makes up 30% of all blocks on offer, have an average US$600,000 minimum signature bonus.

While the up-front price tag is high in Round 16, the bid round offers the best opportunity to contract pre-salt acreage under better terms. Stay tuned for comparative analysis of the economics of Round 16 opportunities against the PSC Round 6 in a forthcoming editorial.

Who's competing for acreage?

Recent Brazilian exploration rounds were dominated by majors, NOCs and ambitious large-cap companies. We expect Chevron to be less aggressive this year, as it focuses on expansion in the Permian. In prior auctions, ExxonMobil and Equinor have gravitated toward concession rounds, while BP and Shell go for PSC acreage.

Asian NOCs, such as CNOOC and Petronas, are expected to be present in the auctions. We foresee more aggressive bids from CNPC after its recent streak of losing bid rounds. Repsol, Enauta and Total are likely to place conservative bids if they compete, and would likely only win in the face of no competition. Of course, Brazil's own NOC Petrobras is active in the process.

Wintershall DEA has more appetite for acreage, especially in partnerships with companies experienced in deepwater. After winning equatorial margin blocks in Round 15, it teamed up with Chevron and Repsol in the prolific Santos and Campos basins.

Stay tuned

Part two in our pre-salt series will dive into the four massive DRO opportunities for auction tentatively planned for 28 October. We'll look at how key Wood Mackenzie data tools can guide the make or break decision to pursue attractive pre-salt acreage. Fill in the form on this page to receive upcoming pre-salt analysis.