Analysis from Monika O'Shea, Power Market Analyst, ERCOT, with contributions from Riti Goel, Lead Analyst, ERCOT, Rebecca Miller, Research Manager, ERCOT/CAISO

As analysts on Wood Mackenzie’s Market Intelligence team, we have access to monitored generation and transmission data both within ERCOT and across North America. We are in the business of forecasting short-term market conditions and have spent the past several days supporting power producers, electricity providers, and energy traders take action in response to the recent crisis in Texas.

We wish to provide a summary of the events we watched take place earlier this week that resulted in extended blackouts across the state that left millions of people without power and has raised questions around the future of emergency preparedness, market structure, and regulation within the energy sector.

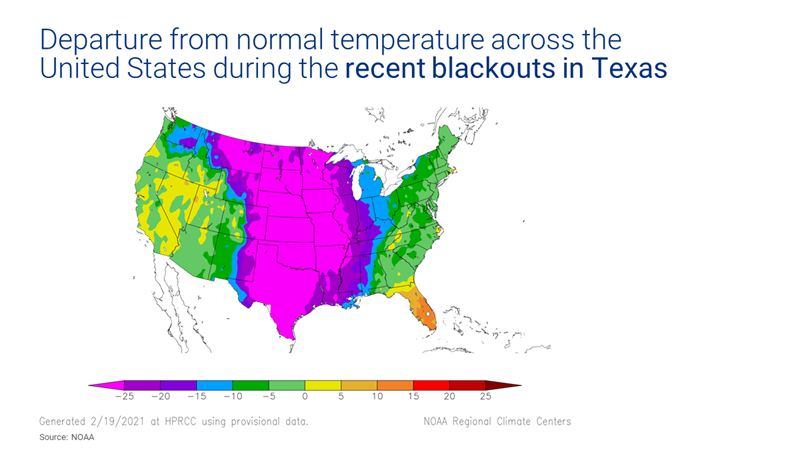

Historically, power demand peaks around 55 GW during the month of February in ERCOT, with overnight temperatures ranging in the low 30s and 40s at the start of the month and rising up to 60s and 70s by end of the month. However, a rare polar vortex dropped overnight temperatures to 50 F degrees below average in Texas this week, resulting in a >74 GW load peak forecast for February 15 and 16 during this 1-in-100 year weather event.

Figure 1: Departure from normal temperature across the United States during the recent blackouts in Texas

Demand for electricity regularly peaks above 70 GW during warm Texas summers – conditions that are strong, but manageable without a need for rolling blackouts. However, Monday’s winter storm swept in a myriad of complications that would not exist in summer.

Where did things go wrong on Monday?

First and foremost was the failure of thermal generation to perform to ERCOT’s expectations. Summer’s promise of high air conditioning usage drives thermal units to perform necessary maintenance at any other time of year in order to avoid missing out on summer’s optimal price events. Late February marks the ramp into the “shoulder season” when spring temperatures reduce demand for electricity. In the week leading up to the blackouts, approximately 14 GW of coal and gas-fired generation was already reported offline for maintenance, in line with trends from the past six years. During summer heatwaves, outage totals trend closer to ~5 GW of the state’s total >70 GW thermal capacity.