Lower 48 cost outlook: what is the market telling us about 2020?

1 minute read

With a chorus of capital discipline ringing throughout the past year, Lower 48 E&Ps have worked to improve asset economics and generate free cash flow. A 25% drop in rig count over 2019 and double-digit price deflation among oilfield services have left suppliers bidding competitively for low-cost jobs while operators continue to cut back. But will this deflationary period last?

Cost deflation throughout the Lower 48

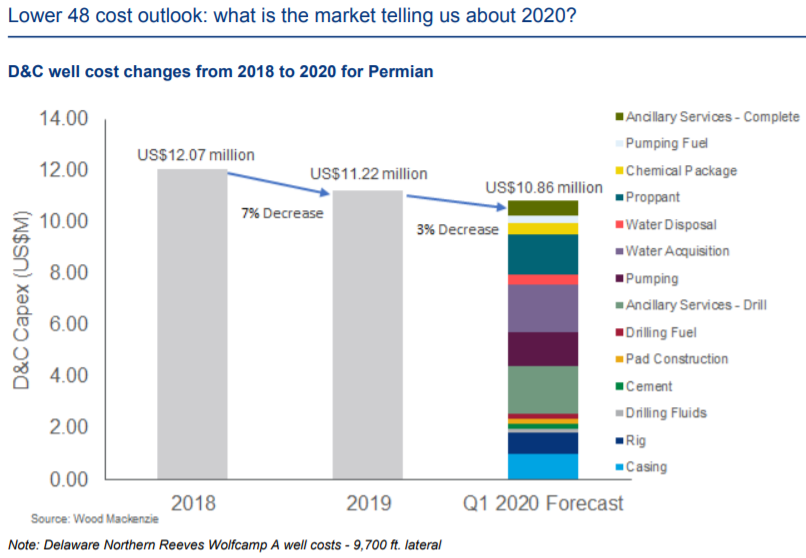

Across all basins, rig day rates and the cost of pressure pumping and casing fell significantly over the past year. Compared to early 2019, Lower 48 rig day rates are down 15%, averaging US$22,000 per day, while average pressure pumping costs are down 13% (with an exception in the Rockies), and casing and tubulars are down 12%. Combined with operational improvements, cost savings to E&Ps are even greater, sometimes resulting in well costs as much as US$1 million lower than in 2018.

Regional cost differences

Sand and water costs vary most by region, and the Permian is a perfect illustration. As a result of water infrastructure buildout, water-related costs in the basin fell 15% in Q4 2019, with disposal and transport notably dropping 20%. Permian in-basin sand is a whopping 60% cheaper than sand in the Rockies, which continues to have some of the highest costs in the Lower 48. Low sand costs will last until excess supply is removed from the market—a benefit to E&Ps in the region but unsustainable for service companies in the long run.

The rig count freefall of 2019 should see a reversal in 2020, but the uptick in activity isn’t expected to be great enough to tighten the market, meaning potential cost resilience for drilling, sand, pipe, and water.

What could force costs higher?

Service costs eventually need to increase for suppliers to maintain viability, offer quality efficient services, and invest in research and development. Equipment is aging and beginning to wear out. New equipment is not getting built except for a few new electric fleets. There’s also been virtually no new O&M spending. Some companies are bidding work at a level that just covers their variable costs.

If activity increases further into 2020, it could tighten the market significantly and raise costs for components like pressure pumping as much as 20% once supply-and-demand dynamics rebalance. While higher costs could erode capital efficiency, cost modeling is a complex undertaking. Wood Mackenzie Well Evaluator enables us to look at well design, time, and unit costs together on a granular level, creating more accurate well cost estimates unique to specific vintage, geography, geology, and well design.

For instance, pressure pumping in the Permian could increase D&C costs by $250,000/day if rates jump by 20% (hiking pumping up to 15% of total well cost). This scenario would make E&Ps’ messages to investors trickier against ongoing demands for capital discipline, but is also necessary to improve the health of OFS companies.

This year promises to be a dynamic one, with costs as risk of increasing and tight oil curves flatter than ever. To learn more about what we expect in the Lower 48 in 2020, pre-register for our cost outlook by filling out the form on this page.