Ethane to Polyethylene: Advantage North America

Even after growing by 3 million tons since 2012, the North American ethylene industry has 10 firm cracker projects currently underway – adding another 10 million tons by 2020. Where will all the extra polyethylene go? Surely it won’t stay in the North American markets, and it seems that this expansion is just the beginning.

1 minute read

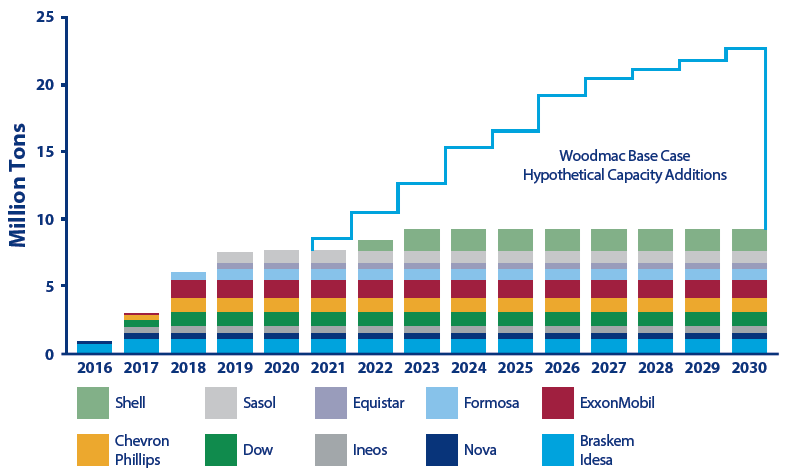

Our forecast for the longer-term price difference between crude oil/naphtha and natural gas/ethane will sustain – then enhance – the industry's global competitiveness. Between 2020 and 2030, we could see North American capacity grow by at least as much again, with our base case resulting in 2030 levels twice that of 2012 – in excess of 60 million tons of ethylene. This advantaged capacity development will bring with it approximately 20 million tons of additional polyethylene production compared with current levels.

North American: Firm and Base Case Forecast Polyethylene Capacity Expansion to 2030

Source: Wood Mackenzie Chemicals

Where will all this product go? Not in the domestic markets; this is an export story.

With our proprietary polyethylene data, our study answers these key questions and more:

- Exactly how competitive is this material on a delivered cash cost basis?

- How will this outlook change under differing oil and gas price scenarios?

- How will this outlook change under differing political/trade scenarios?

- Will the oil/gas price relationship in the 2020s trigger another wave of investment?

The ethane to polyethylene study includes:

- Executive summary of key findings

- Report incorporating oil/feedstock price scenarios, supply/demand variance, forecast trade matrices and conclusions

- Supporting Microsoft Excel tools and data on supply/demand balances, costs, competitor information and forecasts, with aligned upstream feedstock, ethylene and polyethylene price sets