Q&A on the nickel market

How real are potential effects from an electric vehicle revolution?

1 minute read

Watch Andrew Mitchell, Research Director, EMEARC Nickel Costs, discusses the state of the nickel market, and how the anticipated electric vehicle (EV) boom could affect supply-demand dynamics.

Highlights from the video transcript:

Q. In coming years, many have predicted that the nickel market will grow alongside the battery market, a result of what some are calling the ‘energy revolution. In regards to nickel’s performance in 2017, are these predictions holding true?

There is no question that there will be a significant growth in the electric vehicle market, and therefore, the use of nickel in batteries to power these vehicles. However, nickel usage in batteries is presently only a very small proportion of demand.

Stainless steel is, and will remain, the dominant demand area for nickel and presently accounts for around 70% of nickel consumption on a first use basis, whereas nickel in batteries is only 2 to 3%. So for 2017, the only impact an “energy revolution” is having is giving hope and bullish perceptions to a market that has been in the doldrums for several years.

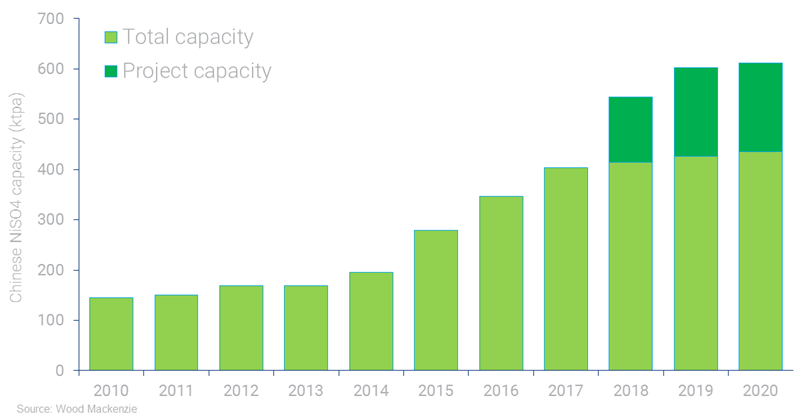

Q. BHP Billiton is all set to go ahead with the development of the largest nickel sulphate facility in Western Australia. Do you think this will be the first of many projects like this?

Many would-be producers are jumping on the nickel sulphate and battery material market bandwagon in order to bolster their profile and encourage investors. BHP are ideally situated to enter the nickel sulphate market, as they produce high-purity nickel powder and sulphuric acid. In a nutshell, all ones needs to produce nickel sulphate is dissolve the powder in the sulphuric acid and then crystallise out the nickel sulphate.

So if the demand is there from battery manufacturers, and the price is right, then there is no question we will see more nickel sulphate production either from existing nickel producers, like BHP, or from new projects and secondary recycling.

Q. What’s been the major takeaway from nickel’s performance in 2017?

Probably that the price has actually gone up! Average nickel prices declined 45% from 2014 to 2016 and are expected to rise this year, on average, by just over 8%.

Market sentiment has swung as a consequence of Chinese demand appearing poor at the start of the year and then picking up; the potential for Filipino mine closures and what could have resulted in a significant reduction in ore supply to China but ultimately hasn’t; Indonesia relaxing its ore export ban; and now, the excitement over EVs and their potential impact on nickel demand.

While EVs will undoubtedly come, the rate at which the uptake occurs, the type of battery that will be used, etc., lead to wide-ranging estimates on future nickel demand in the sector. It's not going to impact demand significantly in 2018, but the perception in the market of the demand growth may well be positive for the nickel price.

Complete the form to download our report, A demanding supply problem for nickel, and get a deeper understanding the increased demand for electric vehicles will have on the nickel market.

Find out more in the news