Four themes to watch as the Majors position for a new era

With the Majors emerging from the downturn standing strong, they're transitioning from 'survive' to 'thrive'.

1 minute read

Although capital discipline remains central to the strategic framework of these companies, they must still position their portfolios for the fundamental changes reshaping energy demand in the coming decades.

We've identified four key themes influencing this repositioning.

1. Capital discipline will drive investment decisions

The Majors are on track to generate multibillion dollar free cash flow in 2018. But strict capital discipline will still guide investment decisions. Only those projects that deliver attractive returns at US$60/bbl and are economically robust at US$40/bbl will move forward. Budgets will generally be flat or down, but those Majors with advantaged growth portfolios will enter a new investment cycle to drive long-term value growth. ExxonMobil is the standout, investing through the cycle to drive outperformance next decade.

2. Companies must continue to adapt to the new era via business development

Repositioning portfolios on the most economically attractive future sources of oil and gas supply will be the key to success in a lower-for-longer price environment. We have already seen considerable progress from the Majors in tapping into advantaged geographies. But there's more work to be done, especially by those with weaker long-term growth trajectories. The challenge will be to maintain a disciplined approach given that most players are chasing the same opportunities.

3. E&P portfolios need to move into gas to thrive over the longer-term

Investment in gas has emerged as a potential bridge in the transition to renewable energy sources. Gas-led E&P has moved up the strategic agenda for most of the Majors and is likely to be a core driver in future business development.

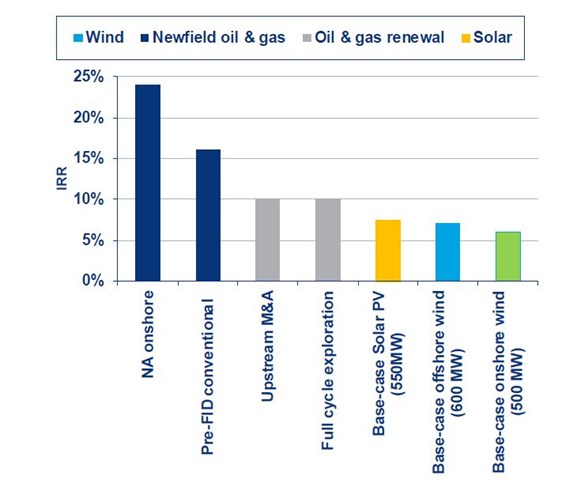

4. The transition into renewables is underway but will be a gradual process

The Majors need to start sowing the seeds of optionality in renewables, preparing for the energy transition that will play out in the coming decades. Leveraging existing portfolio synergies and strengths will drive these "greening" strategies, with different approaches taken to wind, solar and power markets. Investment in new energy will remain relatively low in the near term but will become more prominent as next decade unfolds.

Get our free report, complete with charted analysis and detailed data maps at the company level, by registering your interest today.