In the past two years, we have seen the oil price decline from a 2014 peak of US$110/bbl (Brent) to the trough of US$25/bbl in 2016. However, unlike the last oil shock in 2008, driven by a global financial crisis, internal industry dynamics are largely responsible for today's lower oil price environment. The decline in oil prices since 2014 has been precipitated by growing North American tight oil production, Chinese demand uncertainties, and OPEC's desire to maintain market share.

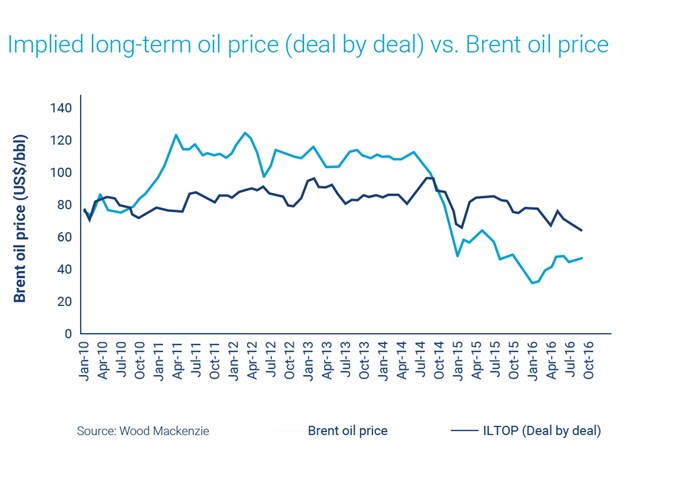

The oil price decline has been so significant that for over a year-and-a-half, Brent oil (and the forward curve) has been trading below the implied long-term oil price (ILTOP) of consummated deals, indicating a misalignment between buyers and sellers price expectations, and hence low transaction numbers.

Our M&A service estimates that over US$300 billion of potential assets earmarked for disposal remain in the global upstream deal pipeline. Where transactions have occurred, buyers have been willing to transact at an ILTOP significantly higher than current oil prices. Conversely, the number of deals where the sellers have been forced to transact due to balance sheet distress has been low — both sides are playing the waiting game.

Seeking the highest returns in an unprecedented oil price market requires deep understanding of target assets and their commercial characteristics. For funds new to a geography or sub-sector, we can identify and help you better understand the assets, businesses and companies that meet investment criteria. Our seasoned consultants specialise in pinpointing where potential investments become economic — even in a lower-for-longer market — as well as unique factors relevant to your decision.

There are a number of approaches looked at in our report:

- What is the 'price gap' in the M&A market?

- Who were the traditional market participants?

- What are the potential recovery scenarios?

- What would be the resulting implications on the transaction market?

- Could there be regional discrepancies as the market returns

To continue reading this complimentary report by our M&A consulting team, please fill in your details in the form above and submit.