Wood Mackenzie LIVE at OTC 2019

Our top upstream research analysts are presenting exclusive insights at our booth #762 at the 50th Offshore Technology Conference in Houston. Check back here for live updates or follow #WOODMACLIVE to get realtime insights.

10 May, 8:45am CDT:

Thank you all for stopping by our booth and meeting us during OTC this week. We're wrapping up our blog today. See you next year!

VIDEO: OTC Coming to Americas panel

Watch snippets from the OTC panel Coming to America from Hart Energy, featuring research director Julie Wilson.

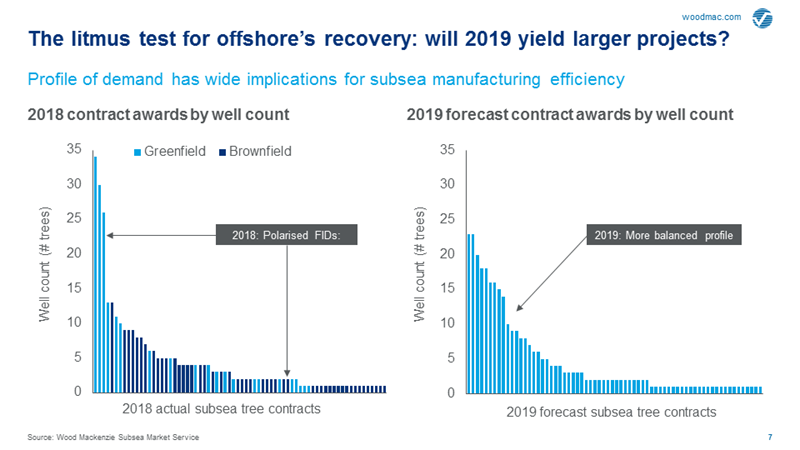

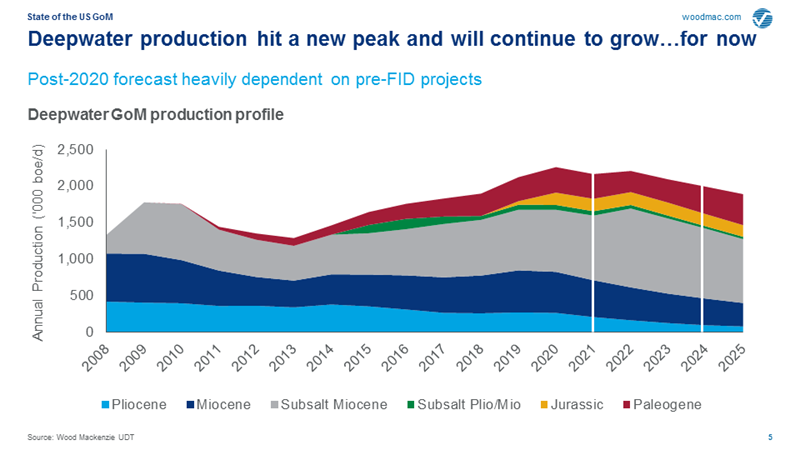

Oil price remains one of the most important, and difficult to forecast, factors in monetizing offshore projects. In the US GoM, we forecast Subsalt Miocene projects with expected FID dates in 2019/2020 to have development breakevens in the low to mid $40s (PV15, Brent). However, GoM Lower Tertiary projects expected to be sanctioned in the next few years have development breakevens ranging from the upper $40s to low $60s (PV15, Brent). Further sanctioning of these large offshore projects will require the industry to continue to innovate-with big data, supplier led solutions, and subsea technologies.

9 May, 12:30pm CDT:

![]()

I'm picking up rising interest around performance-based commercial models. BHGE presented their approach to what they call 'Pay for Performance' agreement. The project example they presented was Equinor’s Johan Sverdrup development in the North Sea. The concept involves early engagement and buy-in among the key stakeholders (operator-OEM- rig contractor) regarding performance metrics. Requires that all parties be completely transparent... hence a lot of trust.

Leslie Cook comments on #OTC50 trends

8 May, 12:30pm CDT:

![]()

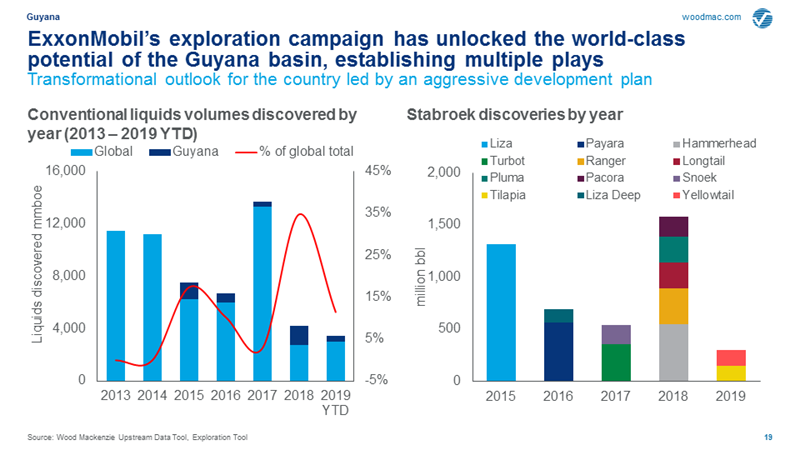

How do you build out a robust local supply chain in a new deepwater region, such as Guyana, without imposing high local content rules? There’s a lot to learn from the Brazil case study. Enhancing local capabilities is a first step. For example, Guyana is retraining old sugar field workers to be deck hands, developing supply bases onshore. Longer term though you need to develop skilled labor - scholarships for STEM. Everyone loses if Guyana moves towards higher LC for political purposes.

Maria Cortez comments on #OTC50 trends

8 May, 12:20pm CDT:

Julie Wilson and the entire Coming to Americas panel came to the consensus that deepwater, and specifically the Americas, is and will remain a core growth area. Great rocks, great people and technology centers and great opportunities through partners and governments. This is the sentiment across the panel, Equinor, Chevron, Talos, Ecopetrol, BP and ExxonMobil.

The multi-phase pump installed by the Subsea Integration Alliance on the Murphy-operated Dalmatian field is a great example of how subsea boosting can give new life to GoM fields in a cost sensitive investment environment. The multi-phased pump increased production in the field by 250% in the first month, and we estimate it increased the life of the field by 5 years. For further analysis on how subsea pumping could impact the economics of other GoM fields, stay tuned for our GoM OTC insight, to be released soon.

7 May, 5:05pm CDT:

![]()

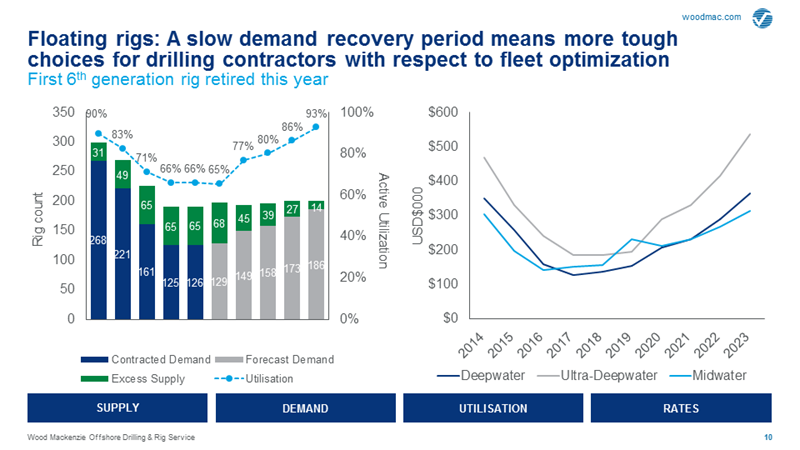

Transocean CEO Jeremy Thigpen spoke about innovation in the deepwater rig market. Over the past few years, drillers have made substantial strides in reducing drilling costs through efficiency and performance. Breakevens on projects have gone from $64/bbl down to $34/bbl and FIDs have increased by more than 60%. Transocean will continue to optimize their processes and introduce new technologies. Some of the most exciting work being done through their R&D program includes: enhanced well control tool, advanced shearing tool aShear, automated drilling equipment for harsh environments, and human machine engineering called HaloGuard. Hybrid micro- grid power system that stores unused energy, remote monitoring prognostics, the first ever 8th generation 20k drillship for U.S. Gulf of Mexico.

Leslie Cook comments on #OTC50 trends

Shell highlighted that the quick turnaround subsea tie-back (SSTB) game is not just for smaller players, majors can play that game too. The phased development of Kaikias brought the SSTB field from exploration to first oil in around four years. By converting its exploration well into a producer, and side tracking a producer from an appraisal well borehole, the field came online a year ahead of Wood Mackenzie’s estimates. Further phased developments could help large operators move forward with projects at a quicker clip, and allow field development flexibility in a more volatile oil price environment.

7 May, 3:10pm CDT:

![]()

Shell is using AI-assisted seismic interpretation in Malaysia to pick faults and identify top and bottom of salt. Interpretation time has been reduced by 80%. The advantages of automated seismic interpretation are two-fold: it shortens the cycle time to production, thereby adding value, AND it improves the quality of the interpreter’s work because he or she has time to think about the important elements of the interpretation. Automation allows for multiple scenarios and multiple iterations.

Julie Wilson comments on #OTC50 trends

7 May, 2:30pm CDT:

![]()

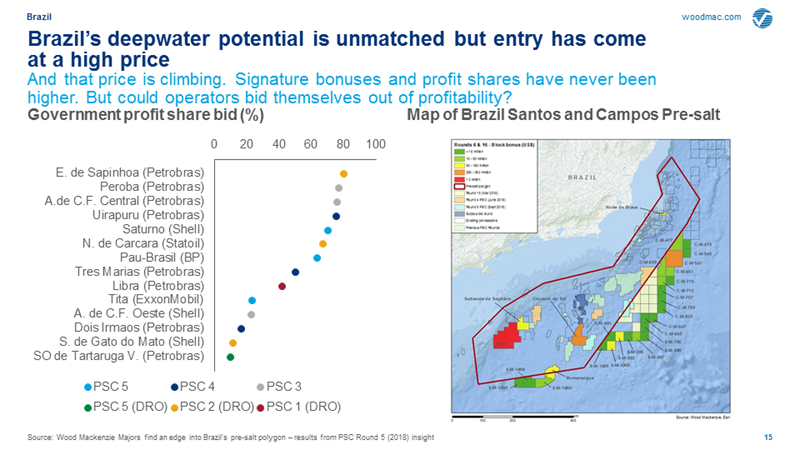

Shell does not see deepwater going anywhere anytime soon. They’re committed to opportunities in the US GoM, Mexico and Brazil with growth driven by positive change happening, particularly in Latin America. They expect to kick off their pre-salt drilling in Q3 with up to five wells over the next two years. Mexico drilling is expected to start in December with two wells in Campeche deepwater. Shell will take on up to three additional wells after that around Perdido, but seismic is still ongoing and well permit cycle time is very long. Improvements to seismic acquisition, processing and interpretation, and mindful industry collaboration are among key drivers to opening up opportunities to reduce deepwater cycle time.

Caitlin Shaw comments on #OTC50 trends

7 May, 12:45pm CDT:

![]()

BP emphasized its “capital-light” collaborative approach to midstream in Mexico. Fieldwood lauded the open negotiations they had with Pemex for the use of offshore facilities for Phase 1 of the Ichalkil-Pokoch development. And Murphy shared their plans to appraise the Cholula deepwater discovery and drill two more exploration wells in 2020. They have a lot of prospects in different play types to go after in their block, including subsalt.

7 May, 12:00pm CDT:

William Turner comments in S&P Global Platts' piece on BP's Gulf of Mexico expansion plans in its Thunder Horse field:

"Over the past few years, deepwater has gotten into shape, offering faster return on investment, earlier cash flow and shorter cycle times," William Turner, Gulf of Mexico analyst for Wood Mackenzie, said in a presentation to the Offshore Technology Conference.

"We're seeing some indication that the investment pendulum is starting to swing back to deepwater," Turner said. "It's long and slow but we're headed that way."

There's a growing emphasis on partnering with suppliers in order to commercialize projects at a faster clip. The majors know that they are on a journey, and even though they have come a long way, they still need to get faster and cheaper in the deepwater to compete. With a comfort range of development capex per BOE of $15-$20, this will be especially critical for new Lower Tertiary projects, which are on the higher end of that range.

6 May, 3:45pm CDT:

![]()

Halliburton Chief Technology Officer Greg Powers changed roles after 8 years in January to Vice President of Global Innovation, a new position for Halliburton. When he was the CTO, the products they developed simply “had to work.” The risk tolerance was very low. Now he and his team have to get their heads around a new model that does tolerate some risks. They have to embrace the “fail fast” mentality. Fail, don’t punish those involved, learn from it and try again. This is a new approach for Halliburton and the wider industry as a whole. I expect this will harvest some very fresh innovation.

William Turner comments on #OTC50 trends

6 May, 11:45am CDT:

![]()

Managed Pressure Drilling (MPD) is hot. More operators are seeing the advantage of drilling with MPD. Weatherford just launched their new intelligent MPD called Victus. A highly revolutionized tool that will transform drilling performance, decrease NPT, and enhance safety in drilling operations. Based on Wood Mackenzie research, MPD for offshore operations is expected to double in the next decade.

Leslie Cook comments on #OTC50 trends

3 May, 9:00am CDT:

We're gearing up for OTC next week. Our own Julie Wilson is moderating the panel Coming to Americas. Read her executive summary now before the show.

Find out more

As the global natural resources industry evolves, so do the needs of our clients.

Make informed, data-driven decisions with Wood Mackenzie's suite of commercial and subsurface data and analysis tools.

Stephen Perry, Senior Business Development Manager