Discuss your challenges with our solutions experts

Texas freeze: the real-time impact on gas storage

How power outages hit storage, supply and the local market

1 minute read

Ben Chu, Head of Trading Analytics and Proprietary Data – Natural Gas, Short-term Analytics

Frank Lin, Senior Analyst, Midstream and Utilities

Amir Rejvani, Analyst, LNG and Proprietary Storage

For the uninitiated observer, it may seem ironic that recent winter storms left millions without power and heat in the US in a region ostensibly awash with energy. But behind the headlines more complex factors were at play. At Wood Mackenzie, our unique access to both gas and power monitoring and data gave us an integrated, real-time view of an unprecedented event and the issues it created.

Find out more about how our short-term analytics can help you be ready for the next market-moving event, or read on to learn how we gained real-time insight as the Texas storm hit.

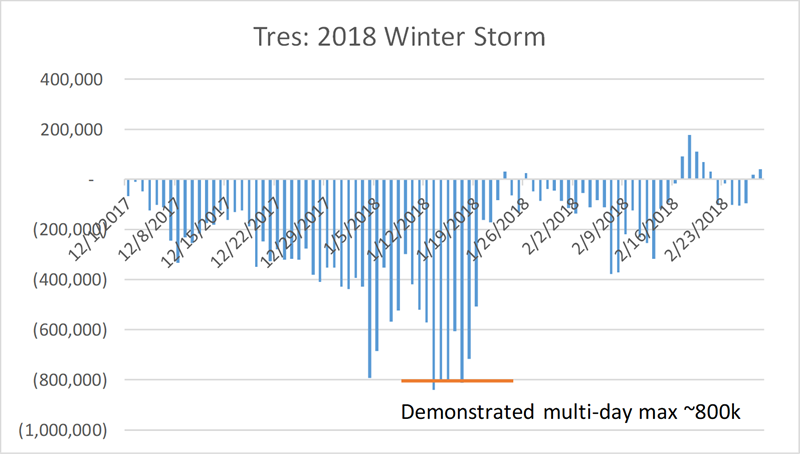

Power outages hit gas withdrawals

At the peak of the storm, a power outage affecting large areas of Matagorda and Wharton counties in Texas meant the Tres Palacios Gas Storage Facility experienced a loss of commercial power. This reduced the facility’s ability to withdraw gas from storage by a third: from 736,000 mmbtu/d on 14 February, prior to the force majeure (FM) event, withdrawal rates dropped to an average of less than 490,000 mmbtu/d between the 15 and 19 February as the peak of the storm hit.

Shortage of supply hits prices

Tres Palacios has a multi-day max draw capability of around 800,000 mmbtu/d, as was demonstrated in the winter storm of January 2018: that means approximately 300,000 mmbtu/d of gas molecules were stuck underground just when they were needed most. The lack of these needed molecules helped sharpen the spike in local Texas prices: for Houston Ship Channel gas delivered between 17 and 19 February prices averaged well over $300/mmbtu, over 100 times higher than for the first 10 days of February.

Tres Palacios Gas Storage Facility: withdrawals during 2018 winter storm

Source: Wood Mackenzie

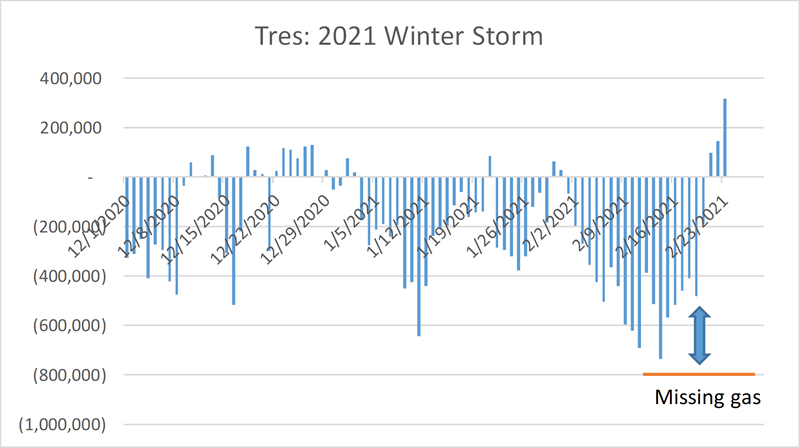

Tres Palacios Gas Storage Facility: withdrawals during 2021 winter storm

Source: Wood Mackenzie

Early warning signs

Given past experience, cold weather forecasts in early February may not have caused traders undue concern, but were there other indications that the market outcome this time would be different?

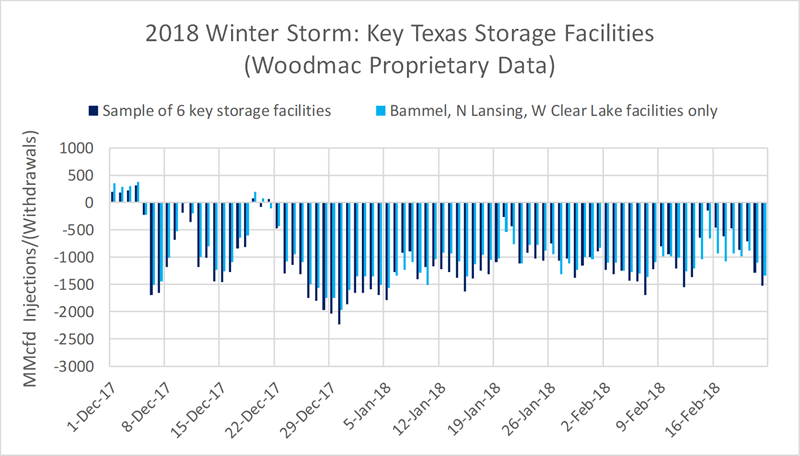

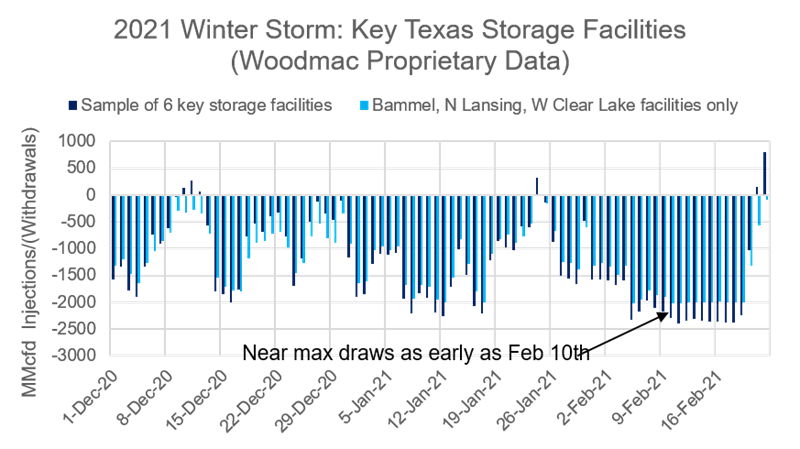

One important signal came from our proprietary Texas storage data, gathered from sensors and cameras placed strategically around the US energy infrastructure. Our monitoring of Bammel, N Lansing, West Clear Lake, Boling, Markham and Spindletop began to show near max draws at these key Texas storage facilities as early as February 10, indicating well ahead of other issues – production freeze-off supply losses, peak-of-cold demand and the unexpected Tres Palacios FM – that the market was already needing every molecule.

The behaviour of these key Texas storage facilities ahead of the storm was an early indicator of market tightness prior to the massive price rally; the subsequent loss of supply to freeze-off and growth of demand at the peak of the freeze only further exacerbated this need for molecules for human use.

Key Texas gas storage facilities: withdrawals during 2018 winter storm

Source: Wood Mackenzie

Key Texas gas storage facilities: withdrawals during 2021 winter storm

Source: Wood Mackenzie

From too much to too little

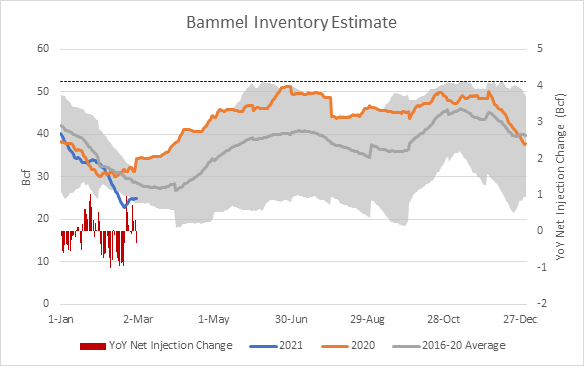

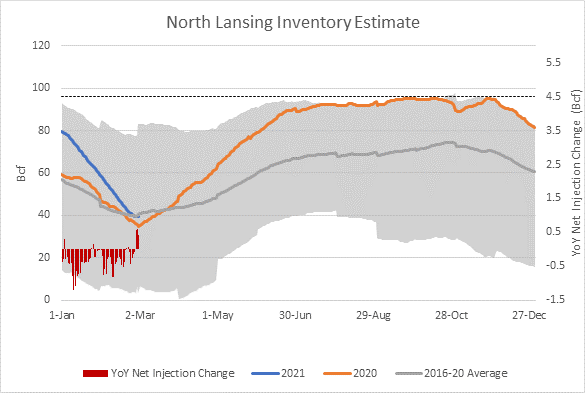

This situation was a significant change from just six months ago. In normal circumstances, Texas storage helps absorb excess gas in the US when needed. But in the summer of 2020, HPL’s Bammel facility and NGPL’s North Lansing facility were nearly full well ahead of seasonal norms.

As a result, there was no remaining room to absorb gas when the weather got mild in early autumn and caused cash prices to dip down into the $1 range. Fast-forward six months and the situation was reversed: from having too much gas above ground with limited room in storage to absorb it, then there were suddenly not enough molecules above ground in Texas. These key facilities were already drawing max days ahead of the peak cold.

HPL Bammel Gas Storage Facility: comparative inventory estimates 2016-2021

Source: Wood Mackenzie

NGPL North Lansing Gas Storage Facility: comparative inventory estimates 2016-2021

Source: Wood Mackenzie

Impact on midstream and production operations

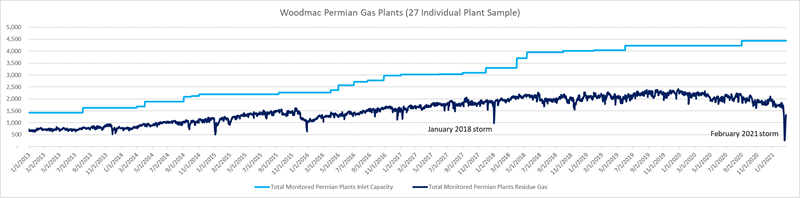

With more southerly operators less prepared for winter conditions than those in the Rockies and Northeast, the cold front also severely impacted production and midstream operations.

Among our total sample of 27 gas processing plants in the Permian Basin, throughput dropped by 85% in the peak of cold on 16 and 17 February. Our models show that Cimarex Permian production plunged by two-thirds during that week, from 1.2 bcfd to 450 mmcfd, before recovering to normal levels by 21 February. Matador and EOG production from the Delaware basin also dropped significantly, with gas flows at Matador’s Black River processing plant down 65% from early February highs.

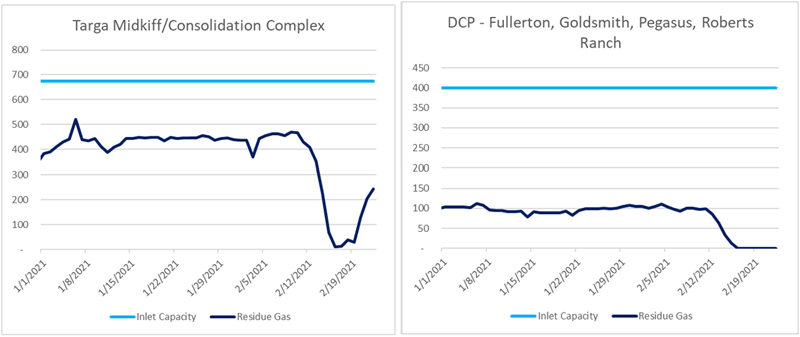

Some gas plants in the region shut down entirely. Our sample of four monitored DCP plants in the Permian basin – Fullerton, Goldsmith, Pegasus and Roberts Ranch – all shut down to zero gas flows between the 15 and 16 February, and have remained shut down days after the storm, after power had returned. Energy Transfer paused operations at Red Bluff, Halley and Keystone as residual flows at these plants dropped to zero flows in the same time frame. Other large gas plants in our Permian data set showing significant flow drops include Targa’s Midkiff/Consolidation complex and Western Gas’s Ramsey plant. While total Texas production fell by around 32% at peak freeze-offs, the gas processing plants in Texas were much more sharply affected.

In the Mid-Con things were slightly better from an upstream perspective. Our OVV Newfield Legacy model shows production dropping by nearly half on 14 and 15 February. DVN’s production in STACK play was also down a third during the same period. More recent data shows both players resorted majority of shutdowns with 10 days. As the largest gas producer in Oklahoma, Continental mentioned they have 50% gas production offline during the peak of the blast, due to a combination of wellhead freeze and power outage.

Moving up north, operators in the Rockies seem better prepared with winterize packages at their facilities. Our model shows processing volume barely changed in the Rockies during the Arctic snap, which was later confirmed by OKE during their Q4 call that Bakken facilities were “very rarely offline” - “Our processing plants ran extremely well too, even in the mid-continent. Really the only disruptions we had was when power – when we lost power, which was really, there was – that we could do about that”.

Source: Wood Mackenzie

Keeping a sharp eye on supply

Analysts and prognosticators will certainly look back and reflect on the ‘great Texas gas price spike’ for some time. At Wood Mackenzie, we’ll continue to monitor the behaviour of key storage facilities and processing plants to stay one step ahead of the market.

How prepared are you for the next market-moving event? Our short-term analytics services could help you keep ahead of demand and supply issues – fill in the form to request a demo.