Discuss your challenges with our solutions experts

The impact of Tesla’s California virtual power plant

We answer three questions about what this announcement means for residential VPPs in the United States

On 22 July 2021, Tesla Powerwall customers in California became eligible to enroll their batteries into a virtual power plant (VPP).¹ Tesla claims that it may be able to aggregate up to 50,000 batteries. If all these systems were enrolled — an unlikely scenario — it would be the equivalent of installing the second-largest utility-scale battery in California at 350 MW/675 MWh.²

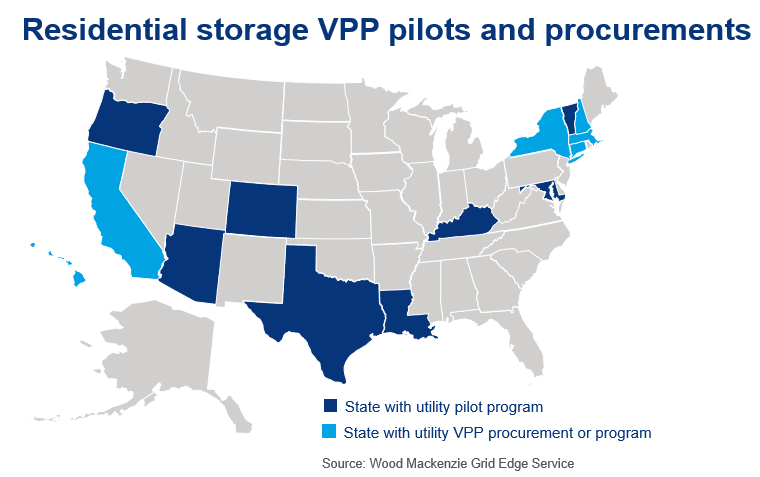

Aggregating behind-the-meter residential storage into VPPs has been tested by US utilities since 2015. Since 2018, we have tracked an increasing number and scale of announcements, with the largest VPP exceeding 80 MW.

In a newly released insight, The impact of Tesla’s California virtual power plant: What it means for residential VPPs in the United States, we dig into the impact of this announcement by Tesla. A summary of the findings is below:

What does this mean for the broader market of residential storage VPPs?

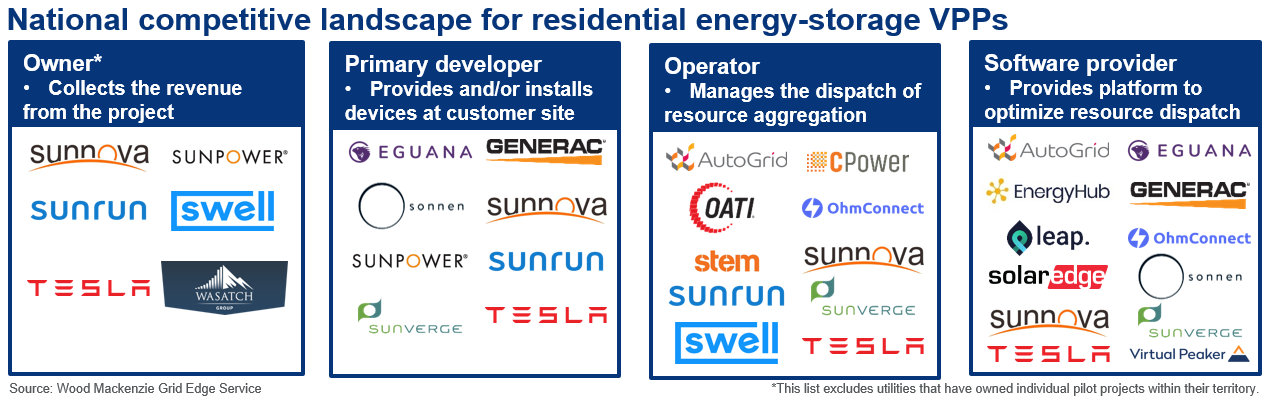

Tesla is expanding its customer relationship. This could impact other aggregators’ strategies to expand or maintain their relationship with Tesla customers. This will have the most impact on companies that have aggregated Tesla systems into their own VPPs. We see the potential for other hardware providers to follow Tesla’s lead and explore similar offerings for their customers and expand their relationship while boxing out others.

This announcement will have little impact on VPP owners’ approach to monetizing VPPs. Tesla’s approach in this beta pilot is described as a “public good program” without compensation for Tesla or customers. If this pilot is successful, we assume Tesla will look to monetize the aggregation in the future. This approach is nearly opposite to the strategy of other VPP aggregators, who have focused on securing a revenue stream first and then worked to build out the asset through customer acquisition. We foresee aggregators sticking with this revenue-first model as it enables them to craft the customer value proposition based on known project economics.

How does this impact California’s grid operations?

We expect Tesla’s VPP will grow to less than 17 MW in the first year. While this VPP has a potentially large upside, there is no financial incentive for customers, no announced revenue stream from California’s energy market and a short window to enroll batteries for possible summer heatwaves. For all these reasons, we see limited interest outside of brand loyalty and climate awareness. We forecast less than 5% of the 50,000 possible Powerwall customers will join in the first year.

While there is currently no announced revenue stream, we are optimistic Tesla could use these batteries to participate in the recently established Emergency Load Reduction Program. This program by the California Public Utilities Commission offers compensation of US$1/kWh delivered during emergency events.

At the forecasted scale, the pilot will not have a meaningful impact on grid operations in California. In context, the California Independent System Operator was able to receive 4,000 MW of behavioral demand response from a series of flex alerts on 18 August 2020 following the rolling blackouts in the state.

How should utilities think about residential VPPs in the US?

Looking across the country, we have tracked over 30 operational and planned residential VPPs across 15 states. These have been announced with cooperative, municipal and investor-owned utilities.

While most are still in the pilot stage, we see two effective strategies utilities use to procure aggregations of residential storage. Some are developing BYOD programs to include batteries. Others are enabling aggregators to participate in bilateral resource adequacy procurements. We forecast both to continue and expand with decreasing costs of residential storage and increasing concerns of resilience.

To learn more about how utilities are responding to distributed energy resources from microgrids to VPPs to EV charging infrastructure, the Grid Edge Service is your one-stop-shop for understanding market sizing, revenue streams and policy dynamics. Contact power@woodmac.com to learn more.

¹ Wood Mackenzie defines a VPP as a set of distributed energy resources (DERs) that are:

- not co-located

- able to provide distribution, generation, or transmission services

- able to be aggregated as a single entity using a software platform

Additionally, VPPs can be an aggregation of a single type of DER or multiple types.

² Tesla claims that up to 50,000 Powerwalls could be aggregated. If all these systems are Powerwall 2 batteries (7 kw/13.5 kwh) and participate in all events, this would amount to 350 MW of capacity.