Unconventional operators can unlock US$10 billion in cash from DUC wells

By reinvesting that unlocked cash, unconventional operators could deliver up to US$65 billion in revenue

1 minute read

Following the oil price crash, operators undertook multiple initiatives to reduce costs and become more efficient. Lower equipment costs, improvements in productivity and reduced headcounts are just some of the measures that helped drive 2018 breakevens down to under US$50/bbl from US$76/bbl in 2014.

Nevertheless, there is still room for improvement. Inconsistent well performance has plagued operators, who have struggled with costs and development times that vary considerably. Operators’ inventories also have a large number of drilled but uncompleted (DUC) wells, which we estimate represents US$26 billion in trapped cash from the 8,000+ DUC wells currently spread across the US.

Of that total, up to 40%, or US$10 billion, could rapidly be made available for re-investment or returned to shareholders, and the opportunity cost of not reinvesting that US$10 billion of cash represents US$40 to US$65 billion of lost revenue (pre-royalty). With up to US$10 billion of cash and US$65 billion in lost revenue on the table, operators have much at stake.

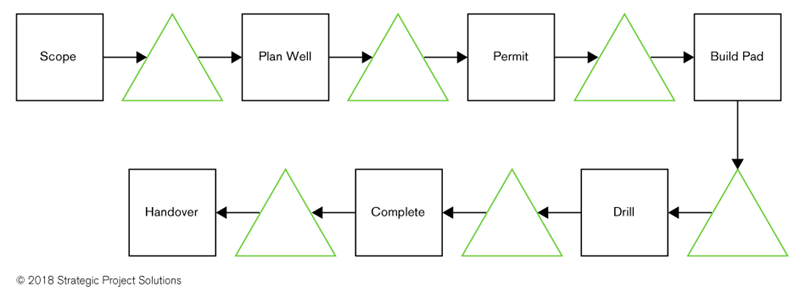

If they hope to capitalize on this opportunity, operators must address the larger problem that is associated with a high prevalence of DUC wells: an inefficient well factory. Moving beyond the current approach of locally optimizing the isolated performance of each operation — drilling, completion, flowback — and instead implementing a system that focuses on optimizing performance across the entire well production system will be critical.

In a recent project, we identified a US$300 to US$500 million reduction in the cash necessary to deliver 200 wells over one year simply by optimizing the factory system. However, the dynamics at play in these situations can be counter-intuitive for many in the oil and gas industry, and understanding them is critical for effective decision-making in a well production system.

Focusing on optimized well production systems will be — or should be — the new reality for many operators. Instead of optimizing discrete components, operators will need to take a more holistic view of the entire well production system if they hope to unlock cash and achieve greater efficiency.

Get the full report

Fill in the form on this page to get your complimentary copy of our new report "$10 Billion of cash — and even more in value — laying on the factory floor".