1 minute read

How will the changes affect refining and shipping?

We know that the IMO’s regulations represent the biggest step change the shipping industry has ever seen and the implications will be felt throughout the value chain.

But there are still a number of things we don’t know.

Various options are available to shippers in order to comply and the marine fuels mix is set to change significantly. Switching to marine gasoil is easy, but it’s also the most expensive option. What alternative fuels do we expect will be the most popular as HSFO is phased out? In this webinar, Sushant Gupta, Research director, Asia Pacific refining and oils market, shares how shippers’ fuel choices will affect crude price differentials and what the implications are for refining economics.

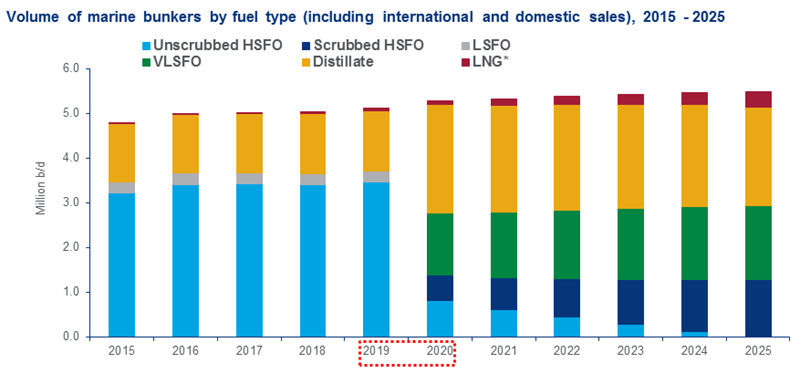

Impact of IMO on marine fuels demand

Source: Wood Mackenzie Product Market Service - more detailed data is available through the subscription of this product

Which upstream oil producing countries face the biggest impact?

We expect heavier sour crudes to fall in value relative to lighter sweeter grades. At first glance, it looks as though large upstream producers of sour crudes – like Saudi Arabia, Russia and Iraq – could take the biggest hit. But it’s not a simple as that.

So which region do we think stands to lose the most? Hear from Angus Rodger, Director of Upstream Research, on our 30-minute webinar. Simply fill in the form on this page.

What about LNG?

LNG bunkering is scaling up. We are seeing bigger players, bigger ships and bigger commitments emerging. LNG fuelled ship development is also accelerating. In 2018 there were nearly four times as many vessels equipped to use LNG, in comparison to 2013.

Expect price increases for bulk commodity shipping

Shipping costs for bulk commodities will increase, but the impact will vary. Listen to the webinar to hear how we expect ocean freight rates for thermal coal, iron ore and other commodities to rise.

Complete the form on this page to access the full 30-minute discussion. You can also download the list of questions from the participants and our response to them.

Your IMO 2020 Insights hub

How will IMO 2020 affect the crude market and fuel prices? Who will be affected and what does this mean for your business?

The IMO 2020 Insights hub provides you with latest and thought-provoking insights to understand how IMO standards will affect fuel markets and evaluate potential new opportunities. Our trusted market intelligence across sectors, proprietary tools and expert analysis helps you plan and strategise for a post-IMO 2020 reality.

Get the latest news and analysis here.

-

1 January 2020

When IMO 2020 comes into force

-

80%

The total required reduction of sulphur

-

3.5 wt%

Current maximum fuel oil sulphur limit

-

0.5 wt%

New maximum fuel oil sulphur limit