1 minute read

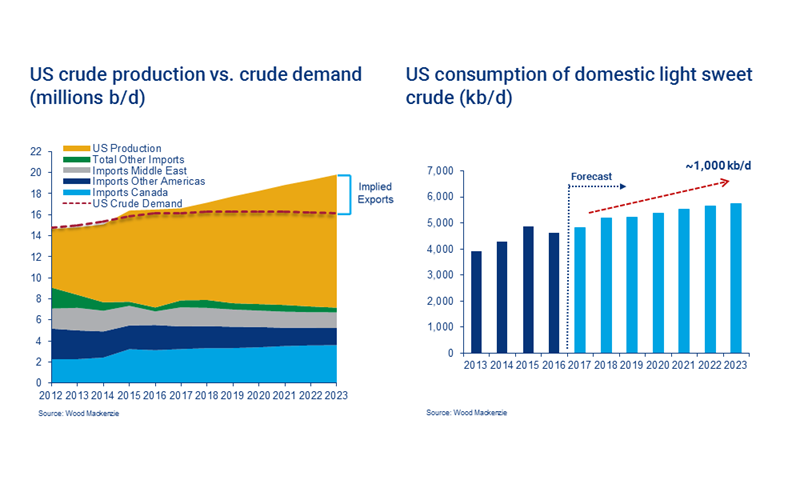

The global crude export landscape continues to shift as the US Lower 48 pumps more light sweet crude into the market.

With little forecast incremental demand for these volumes domestically, US producers will look first to Europe and then Asia to absorb this excess production.

Since its crude export ban was lifted in 2015, the US – for the first time in a century – is becoming a major player in global crude markets. The shift to shipping crude out of the US, rather than only bringing it in, has global implications, especially as onshore production surges.

Domestic US refineries: overflowing with US crude

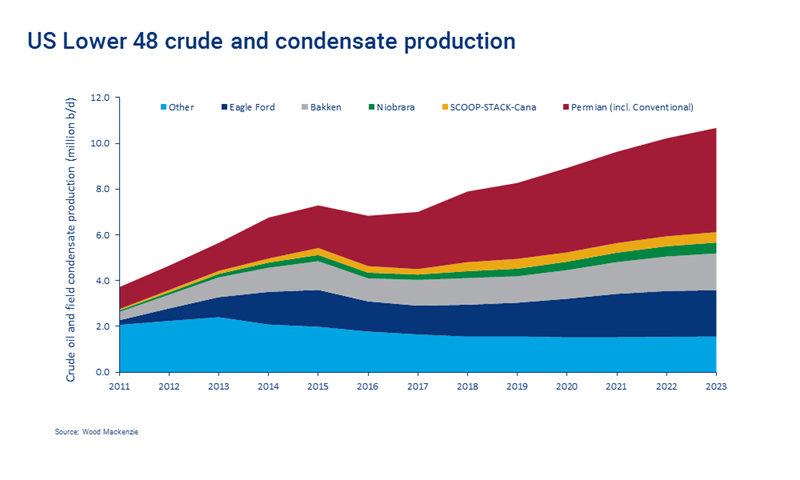

Over the next five years, we expect to see an additional 4 million barrels per day (b/d) of US crude enter the market – potentially positioning the US as the world's largest crude producer. But the majority of this production will be light sweet and ultra light crudes, as well as condensates. US refiners tend to prefer medium and heavy crudes and have a minimal capacity to modify their configurations, and this means only modest consumption of these lighter crudes domestically. We estimate that only about 900 kb/d will be absorbed into the domestic market, leaving the rest for export.

Could the US become the world's largest crude exporter?

Chief Economist Ed Rawle discusses the implications of the surge in US crude on global markets.

So where will all this crude go? And at what price?

In the near term, the US will look to Europe to absorb most of its crude volumes. Refining values are higher in Europe and transport costs are lower. But US crude grades will be fighting African Bonny Light for European market share, so US crudes will need to be discounted to stay competitive. The marginal barrel will then shift to Asian markets in 2022, once European demand is sated. Higher transport costs to Asia will require even further discounts to capture market share.

Contrary to a widely shared view that condensates will comprise the majority of US exports in the next five years, we expect them to account for just 25% of exported volumes by 2023. Questions about specific crude streams will arise for US producers and midstream operators looking to understand which are most likely to be exported.

I scream, you scream, we all scream for crude streams

The Permian Basin – the jewel in the US Lower 48’s crown – is forecast to account for half of all US onshore oil production by 2023, or approximately 5 million b/d. We expect a strong appetite for its light crude in Europe and Asia, where it may receive a premium of ~$0.50/bbl relative to WTI Cushing blend and Eagle Ford crude.

Which export hub will see the most volume growth over the next five years?

Which export hub will see the most volume growth over the next five years? With additional Permian takeaway pipes under construction and the potential for massive port infrastructure enhancements to accommodate larger crude vessels, the Texas port of Corpus Christi is best positioned to see significant volume increases. Corpus Christi is forecast to surpass 1 million b/d of exports by 2020, doubling to 2 million b/d by 2023.