Discuss your challenges with our solutions experts

A focused Lens on Permian private players

Vencer moves into US upstream as Hunt Oil pivots away

1 minute read

Benjamin Shattuck

Research Director, Americas Upstream Oil & Gas

Benjamin Shattuck

Research Director, Americas Upstream Oil & Gas

Benjamin leads our US upstream analysis and specialises in the Lower 48.

Latest articles by Benjamin

-

Opinion

A focused Lens on Permian private players

-

Editorial

Pioneer plus Parsley: What’s our Permian prognosis?

Last month, Hunt Oil Company sold its 44,000 net acre position in the Midland Basin in the US to Vencer Energy. While the transaction value hasn't been officially disclosed, reporting has alluded to a figure above US$1 billion. Considering that Vencer cited 40,000 boe/d of production, and the core location of some of the leases, they may have secured a good deal. In this article, we drill into the details.

Background to the deal: Hunt’s position

This sale is part of the storied private company’s wider pullback from US upstream. The company sold Texas enhanced oil recovery (EOR) properties last year and the family appears to be pivoting its US energy business more towards power. Its Bakken assets saw a small uptick in activity in 2018, but without the Midland the portfolio is now in decline. With Eagle Ford and Appalachian properties also sold, Hunt is now reliant on the success of projects in Peru and Iraq.

The Midland package has an interesting history. Two acquisitions from Opal and Merit in 2012 and 2013 gave Hunt scale in Glasscock and Upton counties. Some of the properties sit on University Lands. And in 2016, facing many of the same funding challenges as its peers, Hunt engaged TPG Sixth Street Partners to fund a US$400 million DrillCo for the project. The DrillCo capital was exhausted in 2019, after drilling peaked in 2018 with over 80 wells spud. One of the reasons Hunt could grow production over 400% since the DrillCo started was the existence of sliding scale royalties on some leases.

DrillCos formed during that time typically had return thresholds of 15% — in our view it’s unlikely that hurdle has been met yet for many of the wells.

Introducing Vencer

Vencer Energy is a newly formed private exploration and production company, backed by commodity trader Vitol, which had no assets before this deal. The company’s stated strategy in the Lower 48, however, was to acquire large, mature properties with proved, developed, producing reserves (PDP). With its base production of over 40,000 boe/d, the Hunt property fits the bill. We have some concerns around the decline rate, particularly considering Hunt’s rapid growth and the general decline curves of surrounding Wolfcamp wells — more on this below. Nonetheless, with a sharp pullback in drilling the asset should generate meaningful cash for the time being.

For Vitol, however, this could be more of a value chain play. Owning US production might be a strategic tie-up with its prior interest in owning key crude export infrastructure in Corpus Christi (Vitol was linked to Hilcorp receiving a permit from the Port of Corpus Christi in 2017 to scope an export facility). Export-linked pipelines like Cactus, Grey Oak, and EPIC are adjacent to Hunt’s old leases too. If the export play is real, we see some parallels to LNG players like SK and Continental who have bought into US gas assets over the past few years.

This asset isn’t the first upstream move for Vitol, but it’s a big one nonetheless.

This asset isn’t the first upstream move for Vitol, but it’s a big one nonetheless. Vitol owns conventional assets in Ghana, entering the country in 2006 by taking up an exploration position – notably in the Cape Three Points block. Eni farmed in and subsequently made discoveries leading to the development of the Sankofa field. But Vitol has relinquished other exploration blocks in Ghana due to a lack of success. And in other international projects, Vitol has funded development capex and retained access to lift crude volumes. If Vitol was looking to take equity in fields, this US deal might have been a long time coming.

Assessing the transaction: scenarios and charts

This is Vencer's first US upstream purchase and the company will need to retain key knowledge from the Hunt team. Even though Vencer seems to be built around a light capex model, more drilling will likely be needed to maintain a reasonable decline rate. As a result, there’s a lot to unpack in the valuation.

So, what’s the potential of the deal for Vencer? We’ve used our Lens Subsurface data to assess how future wells might perform. We also value PDP under several scenarios.

Modelling the deal

With little disclosure around the deal, we’ve used Wood Mackenzie Lens to model one possibility of how the entire asset may have been valued for both Hunt and Sixth Street.

Key knowns include acreage, production, and subsurface quality. Key unknowns include Hunt's working interest (per the cost carry) and the discount rate Vitol may have assumed. Another important variable is future drilling. The properties can support additional development, but on the surface that appears outside of Vencer’s business model.

Our understanding of the assets

Lens Lower 48 Valuation allows us to quickly value what we know about the package. There are 44,000 net acres spanning the Midland Basin with over 40,000 boe/d of associated production. Our base case valuation of the asset is US$2 billion, subject to the key assumption of a 90% working interest for Hunt (more on this important detail below).

Of our base case US$2 billion valuation, we value PDP (10% discount rate) at US$1.2 billion and proven, undeveloped reserves (PUDs) (20% discount rate) at US$800 million. Despite being a PDP-heavy deal, PUDs account for more than one-third of our valuation. Vencer has no experience as an operator. However, following the acquisitions of Parsley Energy and DoublePoint Energy we imagine there are capable operation teams looking for work. Securing Hunt's experienced team could be first priority, though.

PDP analysis

Lens Lower 48 Valuation auto-populates Hunt’s well set and fits a decline to each producing well. Below we see the operated wells contributing to the company’s existing production.

While only 25% of the wells Hunt has drilled in the basin are horizontal, they account for over 90% of its production base. This means decline rates for this asset will be steeper than most conventional projects. On a flowing boe basis, our valuation is US$30,000 boe/d. This is in line with some of the notable tight oil deals in recent memory.

PDP and new drill

The Midland Basin is one of the most active areas in the Lower 48, making a PDP-driven deal somewhat surprising. However, value and upside exist in the form of PUDs. Our Lens Direct database, populated with production and subsurface data, allows us to evaluate Hunt’s acreage position. The image below plots Hunt’s acreage versus our acreage ranking.

While the asset doesn’t have heavy exposure to the core parts of the basin, it has five zones that can be economically drilled at US$50/bbl. We model over 400 remaining locations and assume 40 gross wells are drilled per year. See our PUD buildup:

Because the assets do not sit in the core of the Midland Basin, much of the potential inventory breaks even at higher prices. While an operator would prefer lower breakeven assets, meaningful upside still remains.

At US$85/bbl, the remaining undrilled inventory doubles to more than 900 locations.

A big unknown – has the drill carry reverted?

It’s important to note that Hunt’s DrillCo with TPG Sixth Street Partners ran through 2019. Given low prices for much of 2020, it's possible that the wells drilled have not generated enough return to have reverted to typical working interest. This makes net working interest a key unknown in our Hunt model. We have used Lens Lower 48 Valuations to run sensitivity analysis across the assets. The average remaining working interest will play an enormous role in the deal price.

Impact of varying discount rates

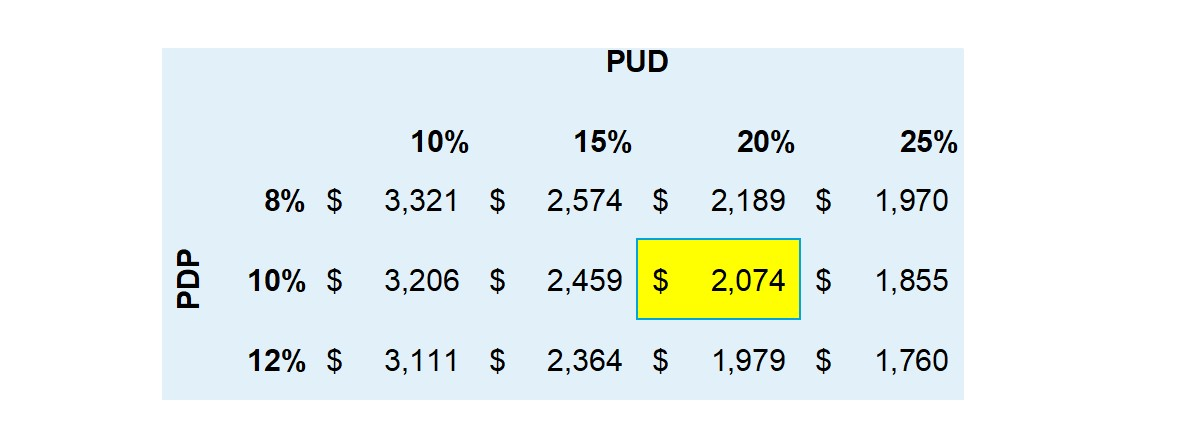

Recent price strength and an accelerating M&A space mean that key variables in valuation models could be shifting. In recent years, investors have better understood the operational and commodity price risks associated with tight oil. This means that discount rates in valuation models have trended upwards. While our base case assumes a 10% discount rate for PDP and 20% for PUDs, Vencer could differ from these based on its cost of capital and potentially integrated operations.

In the table below we’ve flexed discount rate in Lens Lower 48 Valuation. As you can see, the change from the most aggressive scenario to the least is drastic.

Valuation at varying discount rates

What's next?

For Hunt, the pivot away from onshore US is nearly complete. The Bakken is its only remaining asset and does not fit strategically. With M&A in the Williston Basin picking up momentum, it could be only a matter of time until Hunt finds the right buyer.

For Vencer, there is clearly PUD potential on the acreage. A decision not to drill would be to forgo value. While the operational learning curve is steep to climb, there are talented crews and people looking for work in the basin.