High interest rates impede the US residential solar market boom

Next year, US residential solar will experience its first annual contraction since 2017

4 minute read

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë's areas of focus include residential solar policy and project finance

Latest articles by Zoë

-

Opinion

The US solar industry faces a perfect storm of Federal policy and trade challenges

-

Opinion

Insights from Wood Mackenzie’s Solar & Energy Storage Summit 2025

-

Opinion

US residential solar turbulence persisted through 2024

-

Opinion

Solar surge: the US solar industry shatters records in 2024

-

Opinion

US residential solar market turmoil reached new heights this year

-

Opinion

RE+ 2024: Our 7 biggest takeaways

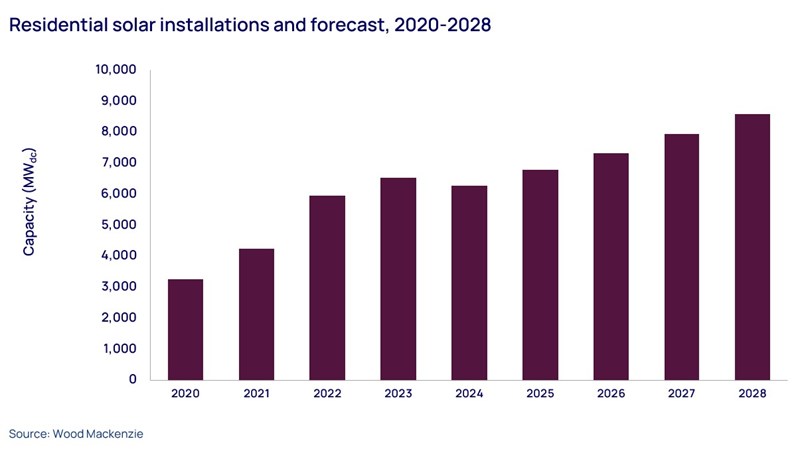

After five consecutive years of growth from 2017 – 2022, the residential solar market will slow this year and contract in 2024. Low financing costs helped the loan market grow tremendously over the past few years, which contributed to the overall residential solar industry boom. But as the Federal Reserve raises interest rates and a potential recession looms, consumer demand continues to soften.

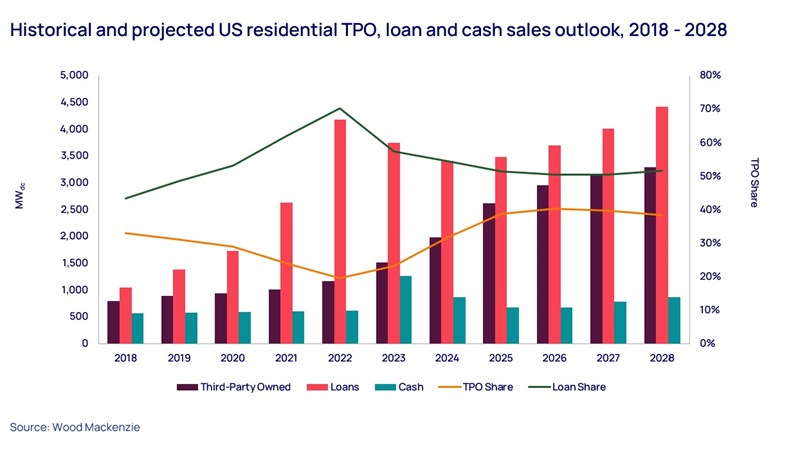

Continued high interest rates will also shake up the residential solar financing landscape starting this year. Although this challenging environment impacts both the loan and third-party ownership (TPO) segments, loans are more sensitive to interest rates increases. Plus, there is renewed enthusiasm for the TPO segment because of the availability of the ITC adders for TPO projects. These factors will lead to the loan segment’s decline in 2023 and 2024 and a boost to the TPO segment’s market share over the next five years.

Wood Mackenzie’s US residential solar finance update H2 2023 delves into the state of residential solar consumer finance in the US. The report highlights the key players, trends, and forecasts of the third-party ownership (leases and power purchase agreements) and customer ownership (cash and loan purchases) markets. Fill in the form to access a complimentary extract from the H2 2023 report and read on for some key highlights.

The residential solar market will slow down significantly in 2023 and contract in 2024

While residential solar installations in the first half of 2023 increased by 31% year-over-year, growth has not been as strong in traditionally larger markets with lower retail rates like Arizona and Texas, where high interest rates create headwinds. Many installers and financiers continue to report a slowdown in demand and sales, which will lead to a reduction in installed volumes. After growing 31% in 2021 and 40% in 2022, the market will only increase by 9% in 2023 as economic headwinds and softened consumer demand persist.

Further, the California net billing transition will cause a 38% statewide market contraction in 2024. Coupled with continued high interest rates, this will lead to a 4% reduction in national installation volumes next year, and the residential solar segment’s first annual contraction since 2017.

The loan market will contract in 2023 and 2024 as loan providers adjust to selling higher APR products

Over the past year, loan providers had to adjust to very different conditions from the low financing rate era that helped the loan industry flourish. Loan providers made significant pricing and product adjustments over the past year, which impacts the customer value proposition in some states. According to the EnergySage platform, the average quoted solar loan APR more than doubled from 2.5% in Q3 2022 to 6.1% in Q3 2023.

As loan providers focus more on securing funding and long-term financial health than short-term aggressive growth, the loan segment will contract by 10% in 2023 and 9% in 2024. However, the segment will slowly recover in 2025 and 2026, eventually growing faster than the overall residential market in 2027 and 2028.

Over the next five years, the ITC adder advantage will boost the TPO market share to 40%, but it will still not surpass loans

As loans became less attractive in some states and TPO projects became eligible for the ITC adders, more installers started offering a TPO product or initiated partnerships with TPO providers. This year, some TPO providers have seen less momentum than expected due to the pace and nuances of the Treasury guidance and a higher cost of capital. However, many still expect to see growth this year.

With its highest quarterly volume recorded in Q2 since 2016, the TPO segment will grow 30% this year and win market share from loans. TPO volumes will grow at an average annual rate of 17% between 2024 and 2028 as financiers qualify more projects for the ITC adders, with the segment ultimately reaching 40% market share in 2027 and 2028.

High interest rates shake up the competitive landscape, as all loan providers lost overall financier market share in H1 2023

The high interest environment also led to a shift in the residential solar financing competitive landscape. GoodLeap continues to lead the financier and loan provider rankings but lost market share compared to H1 2022. Dividend was the only loan provider to see growth during this time, as the company surpassed Mosaic in the financier and loan market rankings for the first time. In contrast, the three largest third-party ownership (TPO) providers, Sunrun, Sunnova, and SunPower, each increased funded volumes and market share in H1 2023 as the segment gains momentum.

In spite of the challenging environment, multiple new players entered the market over the past year with optimism. Owned by Qcells, EnFin offers a unique solar loan value proposition through its manufacturer backing. Skylight Lending, also a loan provider, has leveraged its previous installer competitive landscape knowledge and other companies’ past mistakes to navigate current market headwinds. Lastly, Palmetto launched a TPO offering under its financing arm, LightReach, with a focus on installer experience and input that could help them grow market share.

Learn more

For a closer look at our US residential solar finance update, fill in the form at the top of the page to download your complimentary extract of the report.