3 key takeaways from the Energy & Sustainability Forum North America

A look at the key themes from the conference, including sustainable aviation fuels, investment economics, and routes to carbon reduction

3 minute read

Austin Lin

Principal Analyst, Refining and Oil Products

Austin Lin

Principal Analyst, Refining and Oil Products

Austin leads Wood Mackenzie's refined products research in the Americas.

Latest articles by Austin

-

Opinion

7 questions about Trump tariffs and their impact on the North American oil market answered

-

Opinion

3 key takeaways from the Energy & Sustainability Forum North America

Refineries will remain a key part of energy infrastructure as the transition to a more sustainable economy progresses. While gasoline demand is expected to peak by 2028, the market for a range of refined products including petrochemical feedstocks, ethane and LPG, naphtha, jet kerosene and biofuels will continue for decades to come. But how will the downstream sector adapt to meet the considerable challenges decarbonisation presents?

Wood Mackenzie recently provided the market keynote at the Energy & Sustainability Forum North America in New Orleans, an event dedicated to the decarbonisation of the downstream sector. Fill out the form at the top of the page to download a free copy of our presentation from the event or read on for our three key takeaways from the conference.

Sustainable aviation fuel is flying high

Aviation promises to be amongst the most challenging sectors to decarbonise. With the electrification of commercial flights still on the drawing board, a range of alternative solutions will be needed to meet climate targets. As a result, sustainable aviation fuel (SAF) continues to enjoy an incredible amount of attention across the industry.

A ‘drop-in’ fuel capable of being blended with traditional kerosene-based jet fuels, SAF is a highly attractive proposition for the airline industry. As well as being 100% renewable, it is also less polluting than conventional jet fuel in terms of its carbon footprint.

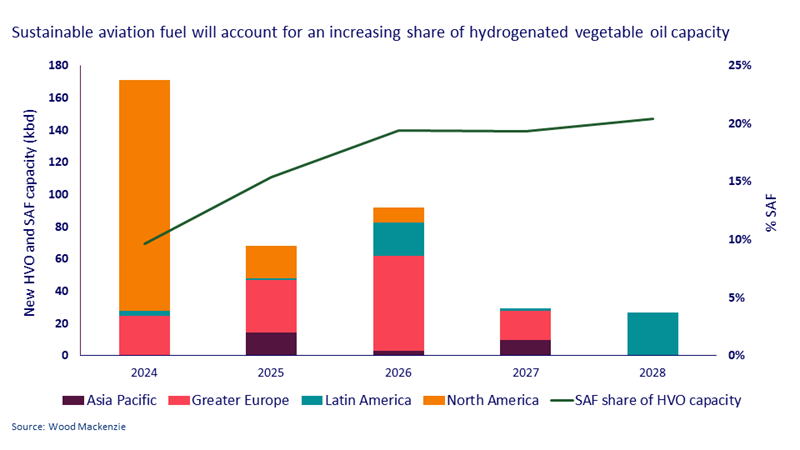

SAF is an upgraded form of hydrotreated or hydrogenated vegetable oil (HVO), a fully renewable diesel that can be produced from a range of crops and waste products. We expect 300,000 barrels per day (b/d) of new HVO capacity to be added globally by 2028. North America is leading the way, contributing over three-quarters of new capacity in 2024, with Europe contributing the biggest share of new additions between 2025 and 2027 (see chart below). The rapid addition of capacity means utilisation rates are lagging, but utilisation will ramp up once the current surge in capacity stabilises.

With concerns mounting over the food versus fuel debate, however, it may not be an entirely smooth flight path for SAF. To determine just how large the pool of plant-based feedstocks can be, industry and governments will need to align on more accurate models for carbon intensity in agriculture.

Effective policy support is needed to incentivise investment

The interface between government policy and regulation on the one hand and corporate investment on the other will be decisive in enabling the downstream sector to contribute effectively to the energy transition. With this in mind, we moderated a session digging into the relative benefits of a carrot versus stick approach and looked back at the Inflation Reduction Act nearly two years after it was signed into law.

Investment economics were highlighted several times, with participants insisting that projects must make financial sense. The development of clear, consistent policy incentives is essential to create a fertile environment for project development and execution. Critically, firms are looking to governments to put in place technology-agnostic policies that allow emergent processes to compete fairly.

A lower-carbon downstream sector will require an ‘all of the above’ approach

We looked at the current state of refining in the energy transition and refiners’ best options to reduce emissions in a recent article. The consensus among delegates at the conference was that no silver bullet exists for achieving reductions in carbon intensity downstream. Instead decarbonising the sector will necessitate an ‘all of the above’ approach.

With this in mind, projects in the pipeline are exploring a range of mitigation strategies. These include improving energy efficiency in the refining process itself, the use of cleaner energy inputs from renewables or nuclear power from small modular reactors (SMRs), and the utilisation of carbon capture and storage (CCS) technology to reduce emissions.