Rising to the challenge: decarbonising European power and prospects for flexible resources

As Europe pushes towards a decarbonised future, flexibility is becoming the cornerstone of sustainable power systems - but while batteries and other flexible assets will play a vital role, how can the power markets make room for them?

5 minute read

Mark Pyman

Research Analyst, Europe Power & Renewable

Mark Pyman

Research Analyst, Europe Power & Renewable

Mark monitors power market trends across Europe.

Latest articles by Mark

-

Opinion

Rising to the challenge: decarbonising European power and prospects for flexible resources

-

Opinion

How effective were EU emergency power demand reduction measures?

In the race to decarbonise, Europe’s power markets are undergoing a seismic transformation. Renewable energy sources like wind and solar are growing rapidly, but their variable nature poses significant challenges to maintaining the balance between supply and demand. To address this, the integration of flexible resources such as Battery Energy Storage Systems (BESS) has become crucial.

In the latest enhancement to our European Power Service, we’ve expanded our modelling scope to include forecasting of frequency response ancillary services. This provides insights into the revenue potential for BESS and other flexible assets—resources that will be instrumental in supporting Europe's evolving energy mix.

For those seeking a deeper dive, fill out the form to download an extract from our recent report; Rising to the Challenge: Decarbonising European Power and Prospects for Flexible Resources is available. Or, read on for an exploration of a couple of the report’s key points:

The growing need for flexibility in power markets

2024 has underscored the urgent need for flexibility within Europe’s power markets. As the transition to renewable energy accelerates, the volume of variable output power sources such as wind and solar has soared. In the first three quarters of the year, wind and solar power generation increased by 10% year-on-year across Europe’s largest markets, while coal and gas generation plummeted by 19% over the same period. This shift marks significant progress towards decarbonisation, but it has also exposed the inefficiency of Europe's existing power systems, with inflexibility manifesting in unexpected ways.

For instance, Europe has already surpassed last year’s total count of negative price events—a clear sign of the need for flexibility. In 2024, negative wholesale prices have occurred over 8,400 times compared to 6,555 times in all of 2023. This trend illustrates the increasing strain on system operators who are left scrambling to maintain system stability. The answer? More flexible assets and better market mechanisms to manage imbalances and minimize costs.

A mixed picture of battery deployment across Europe

The rising volatility in European power markets signals both a challenge and an opportunity. Whilst historically opportunities for BESS have been driven by access to ancillary markets, volatility in wholesale and intraday markets will become a more important driver of revenues going forward – particularly as batteries saturate ancillary markets and become marginal price-setters, with bids benchmarked against alternative revenue opportunities.

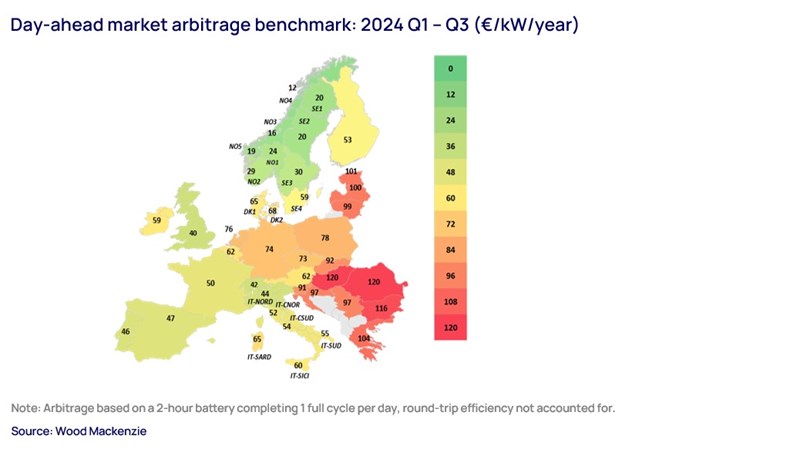

Increased within-day price fluctuations point to growing arbitrage opportunities for BESS, but the situation varies significantly across different regions. For example, indicative revenues from wholesale market arbitrage are up in Germany (+6% to €74/kW/year) and Poland (+59% to €78/kW/year) for the first three quarters of 2024. In contrast, markets like Great Britain (GB) and Spain have seen declines in arbitrage revenues.

Why the disparity? In GB, the rapid deployment of BESS, combined with increased power imports from France (due to low French power demand and strong nuclear generation), has limited the available arbitrage opportunities. Moreover, solar energy—known for causing more within-day market volatility than wind—is less prominent in GB.

In Spain, the story is different. While solar penetration has led to wider within day price spreads at times, these have been suppressed somewhat by strong hydroelectric generation. High hydro availability – particularly in the springtime ‘shoulder-months’ when high wind and solar generation also coincide - have resulted in prolonged periods of low prices and fewer peak price events, reducing the volatility that would typically favour battery arbitrage.

The variation in revenue opportunity and market access for assets across countries is reflected in the uneven pipeline of BESS projects.

Making the business case for batteries

Despite the clear need for more flexibility, bringing batteries to market remains a challenge. In Europe, battery projects are predominantly reliant on merchant revenue, which means forecasting the revenue stack—ranging from energy trading to ancillary services—is complex, yet essential. Unlike other asset classes, where revenues are often more predictable, batteries must navigate a broader range of income streams. This complexity highlights the importance of reliable forecasts that consider market-specific factors and bidding strategies.

Our new modelling capabilities for ancillary services help fill this gap. By providing detailed, hourly forecasts of ancillary service volumes and prices across multiple European markets, we can offer critical insights into the revenue opportunities for BESS. This includes markets for both primary frequency control reserves (FCR) and automatic frequency restoration reserves (aFRR), which are fast-acting services ideal for BESS and other renewable technologies.

Ancillary markets: a key revenue stream for batteries

Ancillary services, particularly those designed to maintain system frequency, are becoming increasingly important in Europe’s energy landscape. Frequency restoration provide a vital source of income for batteries, as they enable system operators to manage discrepancies between supply and demand. Payments are made based on the capacity to ensure potential to provide energy and, in some cases, for actual energy activation.

However, as more flexible assets like batteries enter these markets, concerns about price saturation are growing. Our forecasts indicate that while some saturation is likely, the rising demand for these services—driven by the increasing reliance on variable renewable energy sources—means they will continue to offer revenue opportunities for flexible assets.

A holistic view of the revenue stack

While ancillary services will play a key role, batteries will need more than just these revenues to deliver a healthy return on investment. Our research shows that energy trading—through wholesale market arbitrage and intraday market participation—will account for the lion's share of a battery’s revenue stack. Additionally, capacity market contracts and subsidies (where available) will be critical to making the business case for new projects.

Europe’s power markets are in dire need of increased flexibility, but the deployment of flexible assets like batteries is contingent on a strong, market-specific business case. Understanding how these markets will evolve and how different revenue streams will perform is vital for anyone looking to invest in or operate flexible energy assets.

Learn more

To gain access to more detailed forecasts and insights, download an extract from our recent report - Rising to the Challenge: Decarbonising European Power and Prospects for Flexible Resources - by filling out the form at the top of the page.