Supercharging the US grid: utility investments and initiatives

Investment in US grid modernization is accelerating – but is it going in the right direction?

3 minute read

The energy transition is set to put pressure on the grid in the coming years. Dynamics of both load and generation are changing as electricity is becoming the go-to for transportation and heating and there is an increased reliance on alternative energy resources. In the transition era, customers are more engaged with their electric utilities and are demanding options.

On the other hand, we have an aging grid infrastructure that needs to withstand severe weather events more than ever.

As the ultimate owner and operator of the grid, utilities have embarked on a grid modernization journey over the past decade. While policymakers are setting ambitious decarbonization targets, regulators are becoming more receptive or even requiring utility-proposed grid modernization plans, also allowing alternative forms of cost recovery mechanisms. Now the question is, how much is the US spending on grid modernization? And is it metamorphosing the grid into the right shape?

Drawing on insight from our Grid Edge Service, our report Utility investment in grid modernization includes critical data on utility strategies, initiatives, investments, deployed technologies and cost-recovery mechanisms. Fill in the form to access an extract from the full report, and read on for an introduction.

Grid modernization: a promising picture

Between 2018 and 2023, 25 major investor-owned utilities (IOUs) filed for US$36.4 billion to modernize their distribution grid through rate cases, grid modernization plans or targeted applications based on specific needs. This represents a 35% compound annual growth rate. The rate of investment is rapidly accelerating, with 71% year-on-year growth from 2022 to 2023.

We expect 2024 to see the highest level of investment by these 25 IOUs so far, at US$5.9 billion.

No one-size-fits-all solution to modernize the grid

While there is no industry-wide standard definition, grid modernization generally refers to a wide range of initiatives. This includes everything from improvements to the physical infrastructure and the automation of its operation, to communication networks, and the strategic deployment and management of DERs.

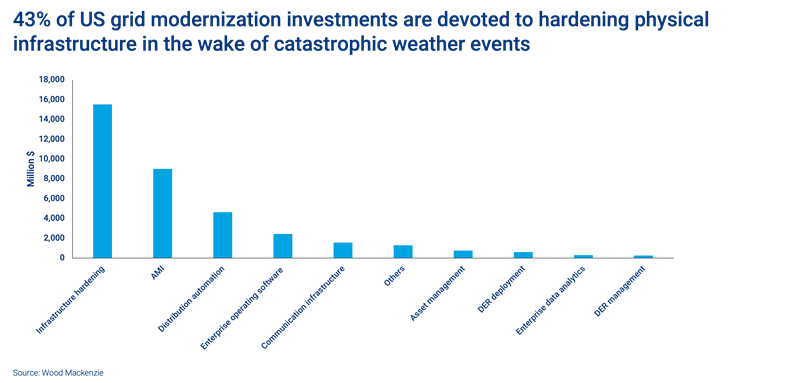

Our report shows that based on regulatory requirements, the current condition of the grid, geographical constraints and the changing preferences of customers, utilities develop their own unique grid modernization strategies. We have identified 330 unique initiatives undertaken by the 25 IOUs, further categorized under 10 grid modernization categories, including physical infrastructure hardening, advanced metering infrastructure (AMI), distribution automation and enterprise operating software.

The investment balance

While GM investment is strong, the spending is uneven. 43% of GM investments are concerned with hardening physical infrastructure in the wake of catastrophic weather events. Investment directed to DER integration and market readiness on the other hand is minuscule.

While more than US$1.3 billion of investments in enterprise operating software, physical infrastructure hardening, distribution automation, and communication infrastructure are DER-driven, DER management solutions see a US$255 million investment. This suggests that utilities are currently focused on preparing the grid to withstand DERs, rather than orchestrating them.

Regional variation is significant, too. While the Southeast is hardening its physical infrastructure to withstand hurricanes, the Northeast is busy implementing AMIs to shape prosumer behaviors. California, as the top electrification market, is making the highest level of investment in DER deployment and management.

Technology opportunities and challenges

Only 1.49% of utility GM expenditure, or US$542 million, is invested in innovation. Meanwhile, venture capital poured US$2.5 billion into grid R&D in 2022 alone. As utilities will eventually be responsible for integrating the emerging technologies developed by corporates, this significant mismatch in R&D expenditure could risk an innovation bottleneck.

AMI deployments are at various stages, from the earliest stages of rollout to network expansion. Recent rollouts tend to utilize AMI 2.0 advanced functionalities to enhance both grid operation and customer value.

Most utilities are pursuing distribution automation (DA), driven by its increased reliability, grid operation efficiencies and energy conservation features, without impacting customer energy choices. While DA has the highest number of initiatives, it is clear utilities are at various stages of automating their grid, deploying pieces of DA in an incremental fashion.

Our data shows that despite regulators’ directives to consider non-wires alternatives (NWAs) before making significant infrastructure investments, NWAs have not yet become mainstream as utilities report lower cost-effectiveness, timeliness and inadequate capacity.

Want to explore investment in US grid modernization in more detail?

The full report explores this topic in detail. Fill in the form at the top of the page to access a complimentary extract.