US seasonal outlook webinars: hot topics for PJM and SPP in Fall 2024

Record auction prices are causing a buzz for PJM, while data centres are driving heavy demand for SPP

4 minute read

Madelyn Skinner

Market Analyst, SPP Team Lead

Madelyn Skinner

Market Analyst, SPP Team Lead

Madelyn is a market analyst on the SPP team.

Latest articles by Madelyn

-

Opinion

Power struggle: challenging grid conditions for SPP

-

Opinion

US seasonal outlook webinars: hot topics for MISO and SPP in Spring 2025

-

Opinion

US seasonal outlook webinars: hot topics for PJM and SPP in Fall 2024

US Regional Transmission Organizations (RTOs) face a tough task, balancing the ongoing provision of a safe, reliable and cost-efficient electricity supply with the need to prepare and adapt to surging demand and new sources of generation as the energy transition progresses.

Wood Mackenzie’s power and renewables short-term analysts recently presented a series of webinars reviewing the performance of US RTOs and providing outlooks for the upcoming season. Fill out the form to enjoy complimentary access to extracts from the slide decks and webinar recordings for PJM and SPP, or read on for an overview of two hot topics for these grid operators.

PJM: Multiple factors drive record capacity auction prices

On 30 July 2024, PJM announced the results of its annual capacity auction for 2025-2026. Prices for the RTO cleared at nearly US$270 per megawatt-day – a roughly tenfold increase on the previous auction. Meanwhile, at a local distribution area (LDA) level, utilities BGE and Dominion cleared at their price caps of US$466.35 and US$444.26 respectively, with transmission capacity constraints. So, what caused such high prices?

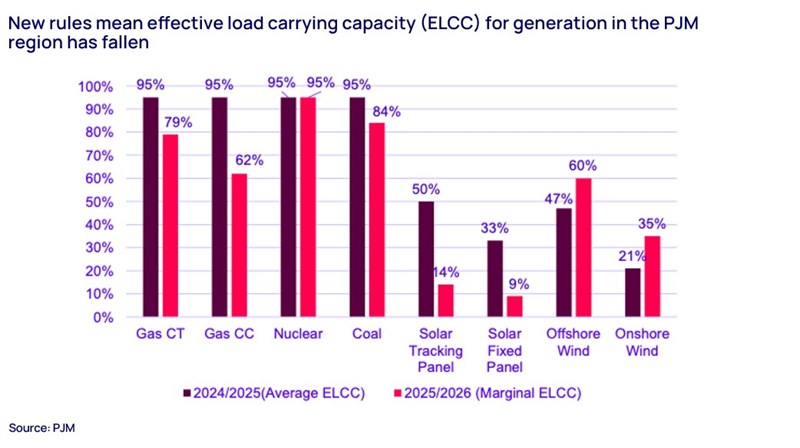

Factor 1: Capacity market reform

PJM’s capacity used to be calculated based on average effective load carrying capacity (ELCC). However, in order to reflect generating resources’ real capabilities to contribute to grid stability in severe circumstances, marginal ELCC was adopted for accreditation for the 2025-2026 auction. For most resources this resulted in a noticeable downgrading of capacity (see chart below). The shrinkage in supply as a consequence was reflected in bidding behaviour in the auction.

Factor 2: Rising demand

A second issue is the rapid rise in demand, particularly in specific areas. A clear example is Dominion, which rejoined the capacity market as an LDA for the 2025-2026 auction. Dominion faces the most significant pressure from increased demand of any LDA within PJM’s remit, mainly due to the sustained growth of data centres in the area it covers. Fifteen new data facilities are due to be connected in Virginia over the course of 2024, adding roughly half a gigawatt (GW) of load to the system. Aside from a limited generating stack, Dominion’s ability to meet demand is impacted by a tight capacity emergency transfer limit (CETL – the amount of power an LDA is allowed to import from elsewhere in the network).

Factor 3: Reduced supply

The third and final issue is that the retirement of key generating assets means supply to PJM’s grid is constrained. The BGE area has long been subject to capacity constraints, and with two important generators due to be retired, the issue has become even more acute. Together, Brandon Shores and Wagner Unit 3&4 supply over 2 GW of power, and power flow analysis conducted by PJM indicates their retirement will significantly impact grid stability. To address the problem, PJM are working on reliability-must-run (RMR) service contracts with Talon Energy, the operator of the two assets. However, this means Brandon Shores and Wagner Unit 3&4 will be absent from the day-ahead market from June 2025. Without the capability to respond to competitive market pricing signals, they will ramp up less frequently.

SPP: Future demand growth to be driven by data centres and bitcoin mines

Like many RTOs, SPP has seen substantial growth in electricity demand from data centres and bitcoin mines in recent years. It has already expressed concerns regarding future grid stability, citing the growing load from data centres as a factor. With data centre capacity across the region projected to grow by 130% by 2027, the increased load from these power-hungry facilities will only increase pressure on the network.

North Dakota: Already feeling the strain

North Dakota in particular has already proven an attractive location for data centres, thanks to plentiful low-cost wind generation, relatively low taxation, less government regulation than other states, and a cool climate that helps prevent machines overheating. Existing large facilities account for nearly 900 megawatts (MW) of load, with a further 500 MW planned. Additional demands on North Dakota’s energy resources have sparked plans to build a new gas-fired plant with up to 1.4 GW of capacity, which would make it the largest fossil-fuelled power plant in the state.

Kansas City and Oklahoma: Poised for growth

Currently, the only really large data centre in the southern part of SPP’s footprint is Google’s facility in Pryor, Oklahoma. However, Oklahoma and Kansas City are both poised for substantial growth in the coming years, thanks to abundant, cheap land, low energy prices, plentiful renewable generation and supportive tax regimes. Planned facilities in the Kansas City area will add around 1.5 GW of load, with other projects mooted. Meanwhile, two new projects in Pryor and Muskogee, Oklahoma will add 650 MW. A further facility, dubbed Project Anthem, is planned for Tulsa, and finally, a development being considered in the city of Stillwater could bring as many as six facilities to the area.

Can the grid stand the strain?

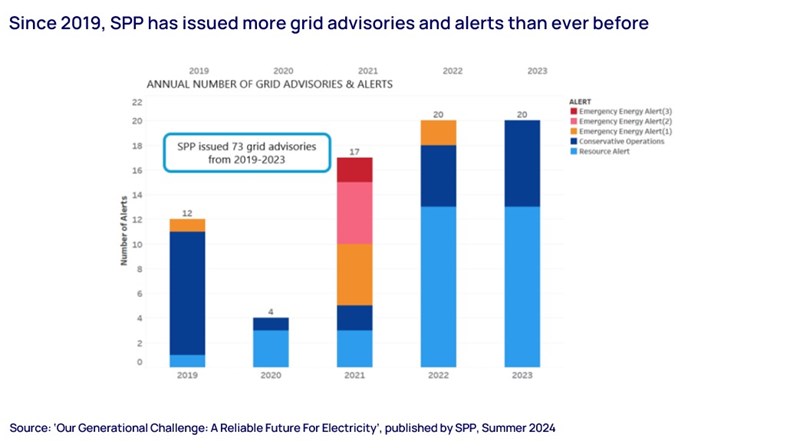

Prior to 2019, grid reliability issues were rare for SPP. However, over the last five years the rise in load has led to the issuance of as many as 20 grid advisories and alerts per year (see chart below).

New wind generation will add to SPP’s theoretical capacity, but wind energy is of course not always available. At the same time, available dispatchable energy is being lost as thermal plants are retired. With demand growing from electric vehicles as well as from data centres, and extreme weather events becoming more common, SPP has expressed concerns regarding grid stability in the coming years.

Learn more

Remember to fill in the form at the top of the page for complimentary access to extracts from the slide decks and recordings of our PJM and SPP webinars, which feature more detailed discussion of the topics covered here.