Would a hard Brexit mean hard times for the UK offshore wind industry?

Our team of offshore wind analysts assess the impact of no-deal on supply chains, project delivery and the adoption of wind power

1 minute read

In the recently published report, "Potential impact of hard Brexit on the UK's offshore wind industry", I collaborated with our team of offshore wind analysts to assess the impact of a hard Brexit on the UK's offshore wind industry. Get the key points below and then fill in the form on this page to receive your complimentary copy.

How likely is a no-deal Brexit and what would it mean for the UK offshore wind power industry?

A recent consensus forecast from Verisk Maplecroft indicates that the likelihood of a hard, no-deal Brexit remains low. Nevertheless, Brexit uncertainty has slowed investment in and expansion of the UK supply chain.

Any trading barriers with Europe will pose challenges to offshore wind suppliers, project execution and the transition to renewable energy.

What's the current state of play for UK offshore wind power industry?

The UK is the largest offshore wind power market in Europe. It is expected to remain so until 2028. By the end of 2018, 8.2GW of capacity had been installed, with another 19GW of capacity expected to come online in the next ten years.

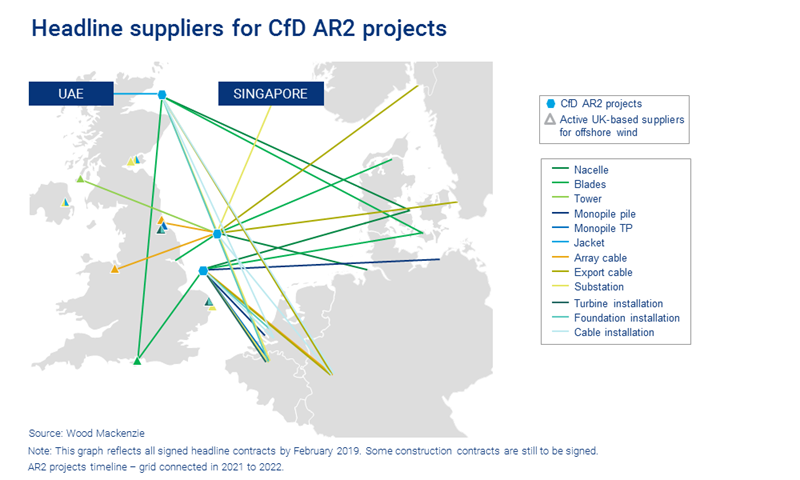

The UK market has attracted large foreign suppliers; 32% of the big suppliers are now based in the UK. And the continental Europe and UK supply chains are deeply interconnected. Approximately 68% of the offshore wind supply chain is sourced from non-UK based firms.

Our analysis of all signed headline contracts shows the depth of these connections. (See chart below.)

What if...?

February 2019 forecasts put the likelihood of hard Brexit as low. But what if...?

Hard Brexit would have a less severe impact on the offshore wind power industry than other industry sectors. Even so, any trade barriers would have a detrimental effect on industry growth. For example, non-UK based supply chain players would face an average WTO tariff of 2.7% plus a significant degree of uncertainty over labour, finances and the law until a new trading agreement was reached with the EU.

In the short term, the risk of import tariff and other various uncertainties may result in a drop in the capacity awarded in the upcoming CfD auction round 3. It is expected to see a higher degree of clarity on hard Brexit by the commencement of the next CfD allocation round.

In the long term, the impact of a hard Brexit would be limited. Wind power growth is more closely linked to the global energy transition, which will continue to accelerate and drive up demand.