Market intelligence you need to succeed

Developer/Investor Playbook for APAC Power and Renewables Markets

Frequently asked questions

when it comes to clean energy investment and new build projects

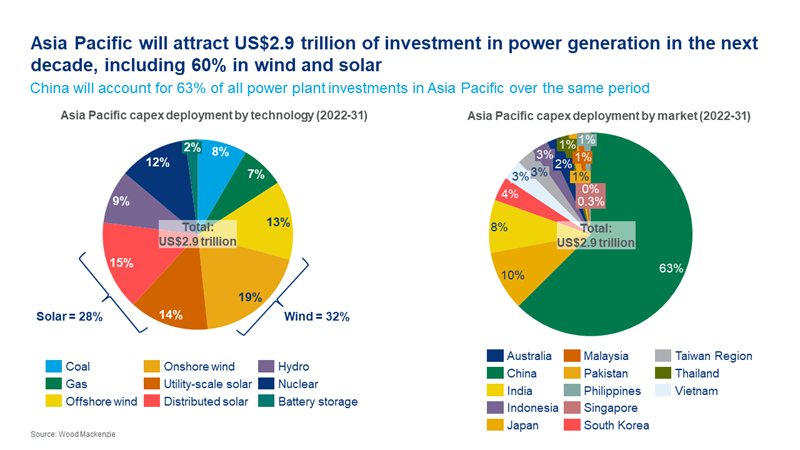

Question 1: "How big is the market for power investments and where are the markets?"

If you are oil & gas players and conglomerates moving into power investments.

Investment in Asia’s power market is expected to hit US$2.9 trillion over the next decade. This is a 28% increase from where we were just a year ago. Two key drivers of this upward revision are cost inflation and China.

With net-zero and decarbonisation targets now set across the region, this generation mix is also about to change. While our base case assumes a slower rate of growth, power demand still increases by over 90% through 2050. Renewables will play a far greater role in meeting this, with wind and solar generating half of Asia’s electricity by this time, potentially rising to two-thirds in our accelerated energy transition scenario.

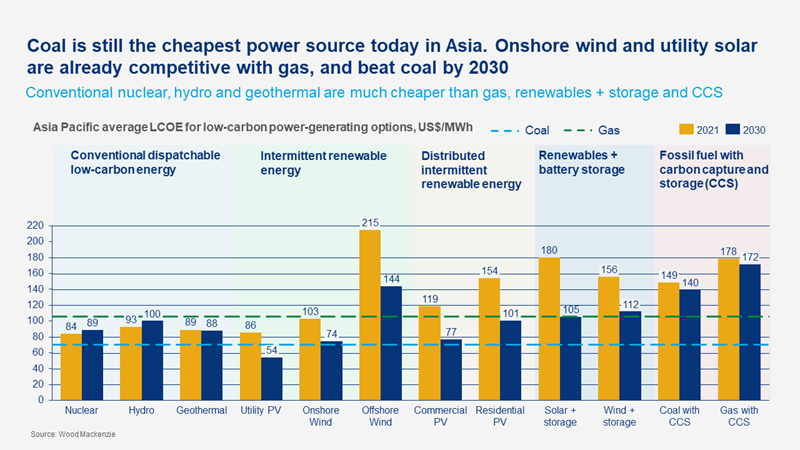

Question 2: "Which technologies offer better returns and how can I improve profitability?"

If you are cross-border investors or banks in power and renewables.

Economics is a key factor in choosing options to reduce the fossil fuel share of the Asia Pacific power system. Although wind and solar costs are falling, options for reliable and dispatchable power to support decarbonisation are still very expensive.

Currently, renewable power costs in the Asia Pacific are about 16% more expensive on average compared to fossil fuel power costs over the project lifetime. India, China, and Australia are the top three leaders with renewable power being between 12% and 29% cheaper than the lowest-cost fossil fuel, coal. Other major markets still have a significant renewables premium.

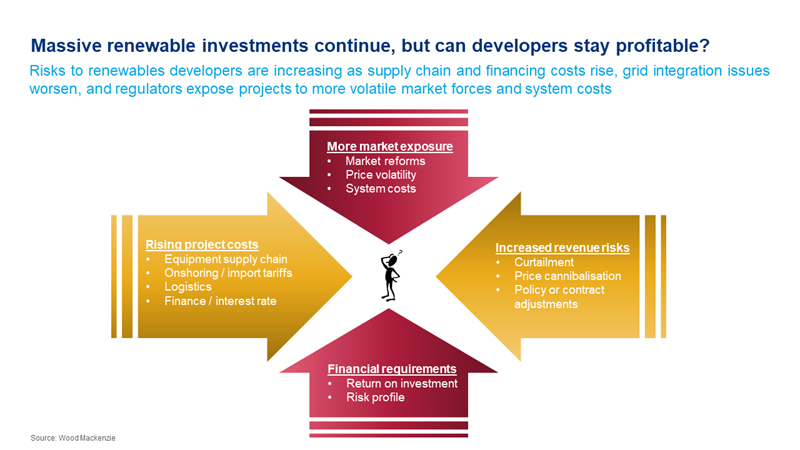

Question 3: What is the level of risk for a given technology in a given market?

If you are utilities, developers, and equipment manufacturers looking to grow scale.

Japan is a very expensive market. A fuel mix of 20% green or blue ammonia plus 80% coal as proposed, will cost around US$150/MWh even by 2030. This is more expensive than gas power while still emitting almost twice as much carbon. A combination of offshore wind and distributed solar backed up by storage and gas units would have a similar price tag.

Vietnam stops connecting wind and solar in 2022, what’s next? The nation has the highest renewables penetration in Southeast Asia with capacity hitting 47% of peak load in 2021, compared to the 18% average. But an overloaded grid and high renewables curtailment are now the main barriers to future development.

We focus on what market intelligence you need to succeed

- Strategic planning outlooks to help you identify the future business growth: power demand growth, capacity build and generation

- Country-level reports to help you evaluate your plan: market fundamentals, policies, competitive landscape and key players

- Power technology reports to help you screen the opportunities: LCOE breakdown, supply chain and technology commercialization

- World-class hourly power dispatch modelling and outlooks to help you minimize the risks: wholesale and retail prices, capture prices and retirements

- Topical analysis to help you monitor the dynamics: auctions, project pipelines, corporate PPAs and M&A activities.

-

US$2.9

trillion of investment in power generation

-

327+ GW/year

of new additions on average to 2031

-

14%

Share of coal-fired generation in 2050

-

35%

of end-user power price inflation in JKT in 2022