With a flexible, modular structure unlock the workflows to navigate the transition with confidence. Explore the full range of Lens decision intelligence products.

Lens Upstream

Your gateway to global upstream industry analyses

Lens Upstream

Your gateway to global upstream industry analyses

Accelerating digital transformation in oil & gas

As the oil and gas industry re-positions to stay investible, digital technology is revolutionising the sector by increasing efficiency, reducing costs, and boosting output while lowering its environmental impact.

Lens Upstream, powered by our cloud-native platform, enables you to discover, model, value and rapidly assess strategic growth opportunities and efficiently allocate capital for resilient and sustainable portfolios.

Navigate the energy transition with certainty

Identify and capitalise on emissions reductions while ensuring portfolio sustainability to 2050 and beyond.

Actionable intelligence with immediate business insight

Finance

Finance

Analyse strategic investments, test 'what if' scenarios, or scan the market for potential buyers and sellers in a few clicks.

Exploration and Production

Exploration and Production

Simulate the economic impact of acquisitions and divestments and assess portfolio synergies in real-time.

Optimised workflows for faster decision-making

Discover, model and value assets and

companies and test hypotheses to

assess risk vs. reward

Identify strategic fit for potential targets

and compare acquisition candidates within

an intutative interface

Generate asset and multiple company valuations

using various pricing scenarios

Run 'what if' analysis for real-time M&A

ideation and assessment

Sculpt customer portfolios at speed

and on-the-fly

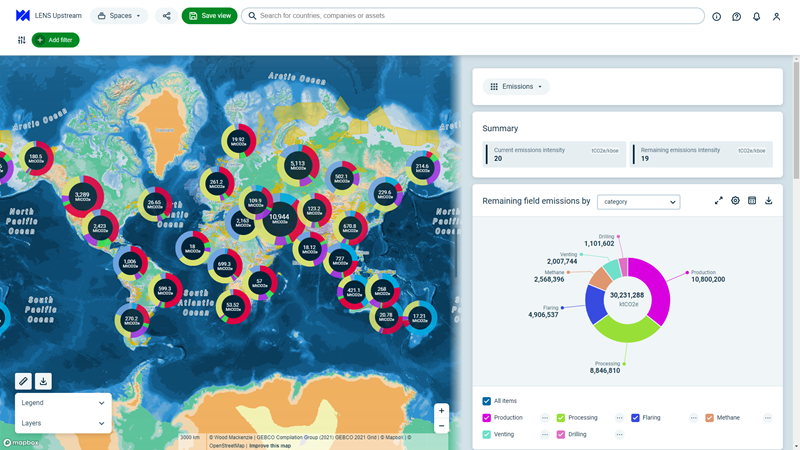

CO2 emissions screening

and benchmarking

Client Success Stories: Shell

"Data is changing so quickly…A product like Wood Mackenzie Lens allows you to visualise in real terms, a particular aspect you are interested in researching" - Richard Baker, Senor Energy Adviser, Shell.

Hear from our other clients about how our Lens Upstream has helped them get navigate the energy transition with certainty.

The single source of truth.

Agile workflow solutions fit for any upstream segment

Lens Upstream

Lens Upstream

Comprehensive upstream data coverage with modelling insights to improve capital allocation.

Lens Subsurface

Lens Subsurface

Identify advantaged barrels and support key investment decisions with an integrated view of commercial and technical data.

Lens Lower 48

Lens Lower 48

Unconventional asset valuations and operational analysis for unconventional plays with analytics-ready well, land, and subsurface data.

Decision-intelligence like never before

Lens analytics-ready data and integrated workflows include a range of sectors and focus areas across the integrated natural resources value chain. Whether you’re evaluating global upstream oil and gas assets or analysing projects in clean energy, we’ve got you covered.