Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Incentives uncertainty clouds Pathways Alliance economic feasibility

World’s largest CCUS project up for FID in 2025, but long-term incentives in question

3 minute read

As the $12 billion phase one of Canada’s Pathways Alliance nears FID, the world’s largest carbon capture and storage (CCUS) proposal faces uncertainty surrounding the long-term availability of economic incentives, according to a new report from Wood Mackenzie.

According to the Wood Mackenzie report “Black gold to green future?”, Canada’s aspiration of cutting its greenhouse gas emissions by 40 to 45 percent by 2030 from a 2005 baseline looks unrealistic given emissions have only decreased by close to 5 percent, hovering still around 700 million tonnes per annum (Mtpa). A boom in oil sands bitumen production, from 1 to 3.3 million barrels per day over that time, has mostly negated other emissions reduction efforts, which have been small in magnitude.

To move forward on its reduction goals, the Pathways Alliance, which aims to be the largest upstream emissions reduction cluster in the world, will play a major role as it targets a net reduction near 80 Mtpa by 2050. The CCUS economics of Phase I aims to reduce 10 to 12 Mtpa of CO2 or more and carries a capital spend estimated at $12 billion with a final investment decision (FID) in 2025.

‘While the federal government and much of the public expect producers to reduce their Scope 1 and 2 emissions, especially when profits are high, there are challenges that exist,” said Peter Findlay, director CCUS Economics for Wood Mackenzie. “The overarching question is who between government and industry is willing to underwrite the political risk of that price over a project that will take three to five years to build after sanctioning and need to operate for 20 to 30 years?”

Continued, Findlay “Another question has focused on the strength of the CCUS incentives to help fund the project, with most oil producers and industry associations advocating for incentive levels matched to the IRA 45Q in the US.”

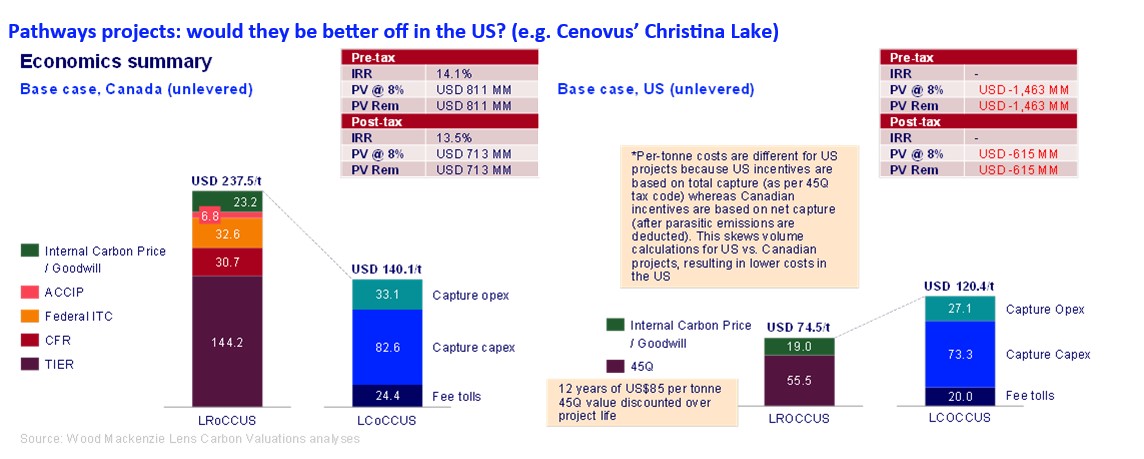

According to Wood Mackenzie, CCUS incentives in Canada are already much higher than in the US. In a hypothetical scenario where Cenovus’s proposed Christina Lake project is built in the US (and its economics juxtaposed with the Canadian project below), Wood Mackenzie’s analysis demonstrates that it would be much less economically attractive in its base case.

“Very few post-combustion projects are moving forward in the US because the 12-year IRA-enhanced 45Q is simply insufficient to incentivize long-term capture,” said Findlay. “However, what the US IRA 45Q has going for it, is certainty. It is highly unlikely that the legislated support built into the US tax code would or could be rescinded without strong support of both chambers of Congress and the President, unlikely given that CCUS has broad support from both Republican and Democratic legislators.

“The real challenge for Canadian CCUS then is not insufficient incentives — they are some of the most attractive in the world— but the uncertainty of their existence throughout project life. The value of most of these incentives could be changed by political whim at any point during the project life — even going to zero.”

The report concludes that if federal and provincial governments cannot collaborate to underpin this uncertainty, few CCUS projects will move forward and most, if not all of Pathways, will be delayed and potentially scuppered, as the industry has threatened.

“This should not all fall on the government,” said Findlay. “Both the government and oil sands producers will have to constructively work together and solve this uncertainty. It is in all their best interest to do so. As Canadians wait for that to occur, sizeable economic value is lost, and millions of tonnes of CO2 are unnecessarily emitted.”