Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

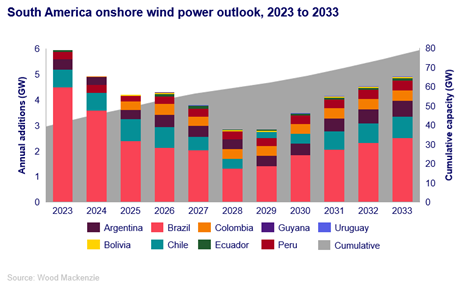

South America to see onshore wind capacity double in the next 10 years

Brazil, Chile and Argentina to drive 81% of regional growth, mainly boosted by free market opportunities

1 minute read

South America’s cumulative onshore wind capacity will double to 79 gigawatts (GW) in the next 10 years as developers install 40 GW of new capacity by 2033, according to Wood Mackenzie’s latest South America onshore wind power outlook.

2023 was a record year with 5.9 GW of onshore wind additions in South America, helped by a rush in Brazil to secure expiring wheeling fee subsidies, stated the report.

Despite limited power demand visibility, Brazil maintains its lead as largest market in the region. The country alone will contribute 54% of the total regional growth, adding 21.5 GW by 2033. Followed by Chile (6.2 GW) and Argentina (4.5 GW), with all three countries expected to leverage Commercial and Industrial (C&I) PPAs to underpin wind development.

“As the recent policy-driven renewables overbuild slows in the top two markets, Brazil and Chile, South America will face limited growth in the medium term,” Kárys Prado, Senior Research Analyst, Power & Renewables at Wood Mackenzie, said.

Prado added: “Going forward, market recovery will rely on grid upgrades that help overcome solar competition, as well as power demand boosts, such as green hydrogen opportunities.”

According to the report, limited transmission infrastructure will remain a challenge for onshore wind in the region, facing fierce competition with cheap solar PV which benefits from dispersed locations to overcome essential grid upgrades still pending completion.

“One of the critical drivers for the region is the free market. Large offtakers pursuing decarbonisation goals and negotiable contracting conditions will remain essential for onshore wind expansion as markets mature in Argentina, Brazil, Chile and Peru,” Prado said.

Prado added: “Colombia and Ecuador will still depend on the regulated market and its centralised auctions to underpin development. With state utilities in Bolivia, Guyana and Uruguay also expected to continue playing a crucial role in promoting onshore wind projects.”

“Overall, a clear supply and demand policy is essential to unlocking the upside in South America, from power mix diversification to green hydrogen,” Prado concluded.