Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

7 Btpa of carbon capture needed to meet net zero by 2050

Capacity for planned CCUS projects at 1,400 Mtpa; US leads in activity

2 minute read

Speaking at Wood Mackenzie’s Carbon Capture, Utilization and Storage Conference in Houston, Mhairidh Evans, head of CCUS research for Wood Mackenzie, said that urgency is needed to meet the seven billion tonnes carbon capture (Btpa) required to meet net zero goals in 2050.

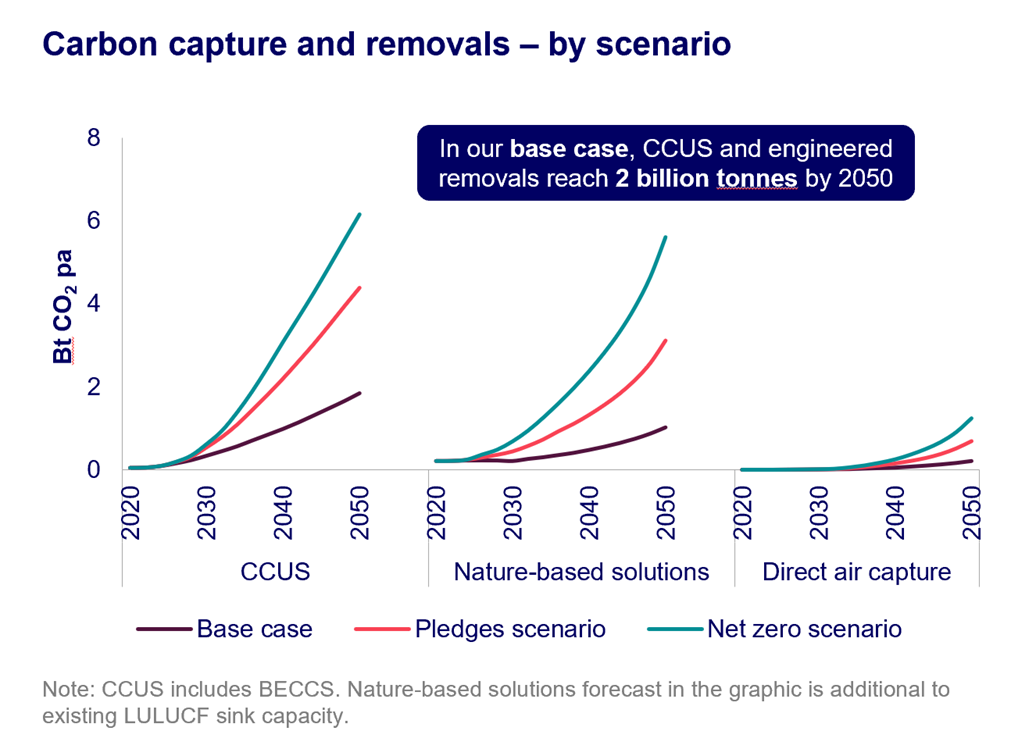

“Energy efficiencies, renewables and alternative fuels will not be enough to meet net zero by 2050,” said Evans. “We need a huge amount of carbon to be captured out of our industries and the power sector to decarbonise the last miles that can’t be easily reached by green electrification or alternatives. Right now, we are on track to meet our base case scenario, which forecasts 2 Btpa of CO2 capture and removal by 2050 – though this corresponds to a 2.5 degree global warming scenario. For net zero by 2050 and a 1.5 degree compliant scenario we would need 7 Btpa. To come close, we need to get shovels in the ground quickly.”

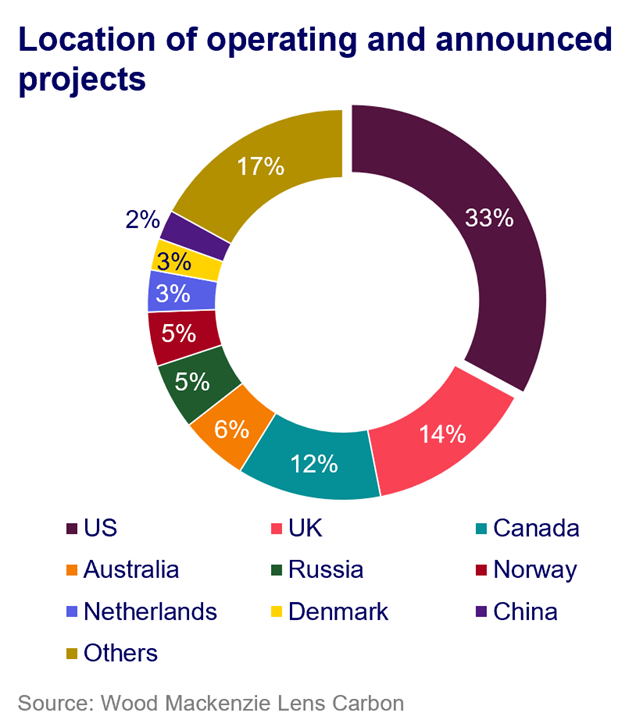

Currently, Wood Mackenzie is tracking globally planned CCUS capacity at 1,400 Mt CO2 Pa, across all types of projects – capture, transport and storage. The US leads in this activity with 33% of all projects.

“We do see an exciting project pipeline and some markets are well-positioned for strong growth, particularly the US,” said Evans. “While no country has the perfect approach, the US market stands out as the global leader in many ways. There is substantial support for emitters to decarbonise with the Inflation Reduction Act 45Q tax credit, and for companies to build out the infrastructure value chain of CO2 transport and storage with the Infrastructure Investment and Jobs Act. The US also has vast geological carbon storage resources that can be developed by companies with upstream oil and gas know-how. It is really the most attractive market in the world to start a CCUS business right now.”

Despite opportunities for growth, governments and developers do face several challenges and hurdles to scaling up the industry, added Evans.

“It’s clear we need investment, but the industry is still somewhat hesitant as developers are facing high costs, evolving technologies, unclear business models, and nascent policy and regulation,” said Evans. “We also need more emitters to come on board with carbon capture. There are companies proposing new CO2 storage hubs every month at the moment, but there is a limited pool of ready customers.

Evans continued, “Costs are an issue as well, as the 45Q tax credit isn’t quite enough to cover the cost of carbon capture for every project, though it should cover many. We expect costs to fall, potentially up to 30% this decade. However, with the 45Q tax credit being open to projects starting construction as far away as 2033, companies could decide to wait for costs to fall before committing. This would mean a delayed impact of projects, and climate change is not waiting.”