Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

ADNOC’s gas self-sufficiency could cost over $40 billion

Complex nature of Abu Dhabi’s gas reserves offers technical and costs challenges

2 minute read

The Abu Dhabi National Oil Company (ADNOC) will need to invest more than $40 billion in order for the United Arab Emirates (UAE) to attain gas self-sufficiency due to the complex nature of the country’s gas resources according to a Wood Mackenzie report.

The report, the third and final part of a comprehensive look at ADNOC’s gas operations titles the ‘ADNOC Trilogy’, looks at the key projects ADNOC is looking to execute as part of its gas expansion plan. These include sour and unconventional gas fields that were previously thought too complex technically and expensive to develop.

“The commitment to self-sufficiency is driving ADNOC to examine all options in its push for more gas,” says Alexandre Araman, Principal Analyst, Middle East Upstream at Wood Mackenzie. “Its growth strategy, approved by the Supreme Petroleum Council in 2018, relies on the development of ultra-sour gas, unconventional and gas cap resources. Associated gas expansion is also expected to contribute as well as exploration and new discoveries.”

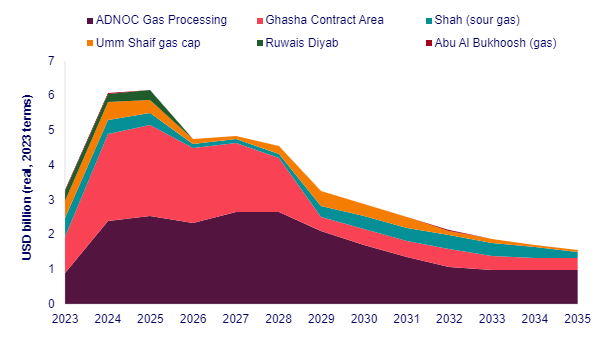

ADNOC Gas Investment Outlook

Source: Wood Mackenzie

Ghasha contract area

The report cites the Ghasha development as a critical piece of the self-sufficiency puzzle, with a target to produce 1 billion cubic feet a day (bcfd) of sales gas before 2030. The concession contains nine offshore fields.

“The high costs associated with an offshore ultra-sour gas development, the sulphur handling requirements and the typically low domestic gas prices result in challenging economics with cost estimates of at least US$20 billion.” Araman says.

Shah expansion

The report cites the Shah Gas Development expansion as another key project and plans are underway to boost the total capacity to 1.85 bcfd from the current level of 1.45 bcfd. If this is approved, sales gas should increase from 0.74 bcfd to 0.94 bcfd.

The report adds that due to the ultra-sour nature of the gas at Shah, any development is always extremely challenging from both a technical and budget perspectives.

Other projects in the pipeline include large untapped unconventional gas resources at Ruwais Diyab as well as plans for developing gas caps and additional conventional gas resources, but the report states that technical issues and escalating costs could see the timelines stretched for many of the projects being planned.

“ADNOC is moving swiftly to advance on all fronts via mega development projects, ambitious production targets and IOC partnerships,” Araman says. “But the complex and expensive nature of these resources has derailed progress with escalating costs and final investment decision delays.”