APAC markets driving global oil demand in 2024/25

Robust growth right across Asia Pacific region will see demand growth of 1.9 million b/d in 2024 says Wood Mackenzie

2 minute read

Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Global oil demand growth will rise by 1.9 million barrels a day (b/d) in 2024 with key markets in the Asia Pacific (APAC) region being the main driver, accounting for over 63% of the total according to Alan Gelder, Vice President of Oils Research at Wood Mackenzie.

Speaking at a Wood Mackenzie briefing as part of International Energy (IE) Week taking place in London, Gelder told attendees that APAC countries excluding China and India would account for 542,000 b/d of the increased demand with China accounting for 496,000 b/d and India 161,000 b/d. The robust growth in APAC contrasts sharply with Europe where demand is projected to decline by 44,000 b/d due to weak economic growth.

“Asia more broadly will play a vital role in the global markets in 2024,” Gelder said. “Global economic growth is still not back to historical levels and this is being played out in Europe.”

He added that the Wood Mackenzie forecast for oil growth in 2025 would be lower at 1.4 million b/d with APAC again being the major driver accounting for over 59% of the total.

Gelder also said that in terms of oil production, members of the Organisation of Petroleum Exporting Countries (OPEC) can expect to be called upon to increase volumes to balance the market in 2024 despite the OPEC+ decision in November 2023 to implement a voluntary 2.2 million b/d cut for Q1 2024.

“This production restraint will support oil prices and the Wood Mackenzie forecast for 2024 for the Brent average is $85.90 [per barrel],” Gelder said. “We forecast Saudi Arabia’s production to average 9 million b/d in Q1 2024 and 9.25 million b/d in Q2 2024 as we assume Q1 production restraint continues through Q2.”

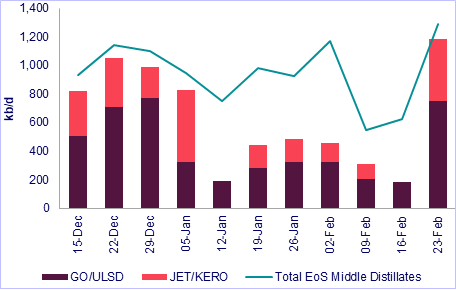

East of Suez middle distillates transiting Red Sea

Source: Wood Mackenzie European Waterborne Products Report

Gelder added that Red Sea disruption caused by the continued attacks on vessels has witnessed over middle distillate products such as diesel, gasoil and jet fuel being diverted around the Cape of Africa. This is supporting demand for bunker fuel.

“Jet cargoes have seen the biggest impact with over 60% of volumes diverting to the Cape as opposed to 45% of diesel and gasoil,” Gelder said. "This led to European jet fuel crack spreads spiking higher by over US$6/bbl. for February, just under twice the increase witnessed by diesel”