Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Australia leads global market for battery energy storage systems

Capacity buildout to accelerate with battery system pricing expected to decrease by 18% over 10-year period

3 minute read

Australia leads the global market for battery energy storage systems (BESS), with the total pipeline of announced projects now exceeding 40 gigawatts (GW), according to latest Wood Mackenzie analysis launched at the Australian Clean Energy Summit in Sydney.

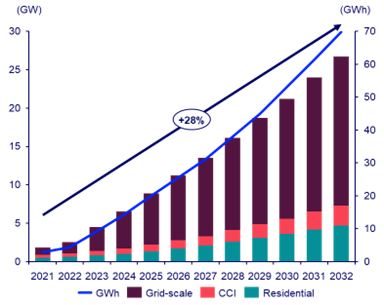

“The recent surge in renewable energy and competitive market design has made Australia one of the most attractive markets for grid-scale energy storage globally. Helped by the presence of competitive wholesale and frequency control markets offering diverse revenue streams for battery storage, and significant funding from the Australian government providing revenue certainty to storage projects. Because of this, we expect a 28% increase in the country’s battery storage capacity from now until 2032,” said Kashish Shah, senior research analyst at Wood Mackenzie.

Source: Wood Mackenzie

A price drop for system and battery modules expected in Asia Pacific

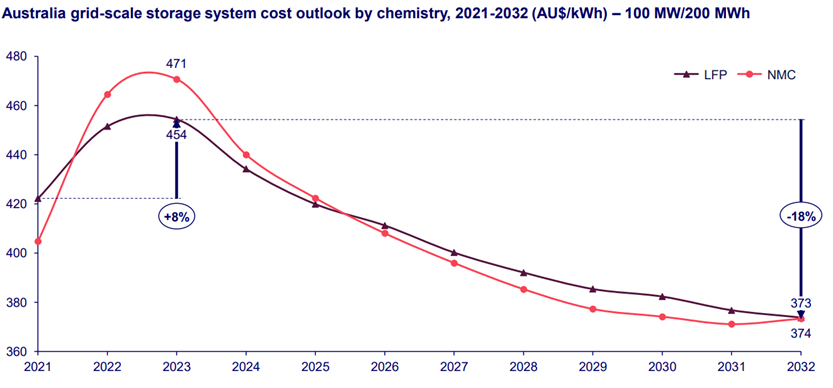

Two-hour grid-scale batteries are currently the most prevalent technology in Australia as project owners mainly target the high-value frequency control and ancillary services (FCAS) market. Battery module pricing is expected to decline by more than 40% in Australia and South Korea by 2032 for both LFP and NMC chemistries. This in turn will drive overall system costs down by 18% to 21% on a US$ per kilowatt hour (KWh) basis over the next ten years – becoming the largest cost reduction driver of CAPEX.

Source: Wood Mackenzie

Current pricing conditions are due to softening electric vehicle (EV) demand growth and downturn in lithium prices, which has seen nearly a 46% decrease since November 2022. Further systemic price declines from additional refining and production capacity are expected by 2025. Wood Mackenzie expects the commodity price declines and technology improvements to also reduce battery module prices in the coming years.

By comparison, battery system costs for grid-scale storage in Australia are 30-40% higher than China – China is the cheapest region, with prices expected to drop 50% by 2032. A prolific domestic module manufacturing and an intense competition amongst the market participants will mean that cost in China will fall faster than anywhere else in the world.

“China’s system costs benefit from a booming domestic supply chain whereas import dependence in Australia and South Korea will continue to be a bottleneck. In addition, Australia’s high labour wage rates will mean EPC cost inflations which dilute cost reduction gains in modules,” Shah added.

LCOE for standalone energy storage in Australia

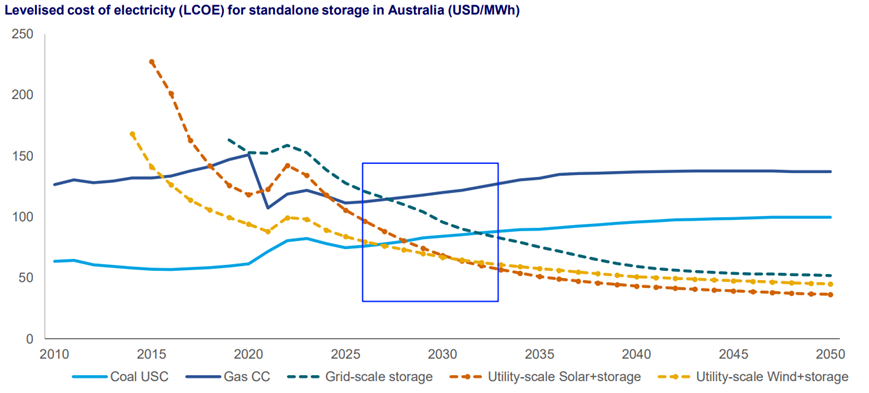

Currently, the levelised cost of energy (LCOE) of standalone grid-scale energy storage is still expensive compared to other dispatchable generators but will undercut gas-fired power generation in 2032 according to Wood Mackenzie findings.

Going forward, Wood Mackenzie expects renewables plus storage to undercut coal and gas in 2028, which is when the capacity buildout of battery storage will accelerate in the Australian market.

Source: Wood Mackenzie

“However, there are some barriers to Australia’s uptake in energy storage. Such as getting a grid connection in time and at a desired network point is a big challenge. It can be costly too. The cost of building a substation is about 12-13% of the total CAPEX. But overall, high battery costs are going to be an ongoing challenge for Australia compared to rest of the APAC region,” Shah concluded.

ENDS

The Australian Clean Energy Summit (ACES):

- The Wood Mackenzie team will be attending the Australian Clean Energy Summit on 17-18 July in Sydney, Australia. If you’re attending and would like to speak to an analyst, please contact Vivien and Mon to arrange an interview.

Methodology:

- Some analysis listed in this news release are from Wood Mackenzie’s Asia Pacific (APAC) Energy Storage Pricing Report.

- Wood Mackenzie categorises the system level costs into battery module costs, balance of plant costs, power conversion system, power controls and EPC costs.

- CAPEX outlook: Wood Mackenzie’s $/KWh outlook for system level CAPEX for grid-scale storage in Australia looks at two of the most prominent lithium-ion technologies – LFP and NMC.

Acronyms:

- LFP: Lithium Iron Phosphate

- NMC: Nickel Manganese Cobalt