Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

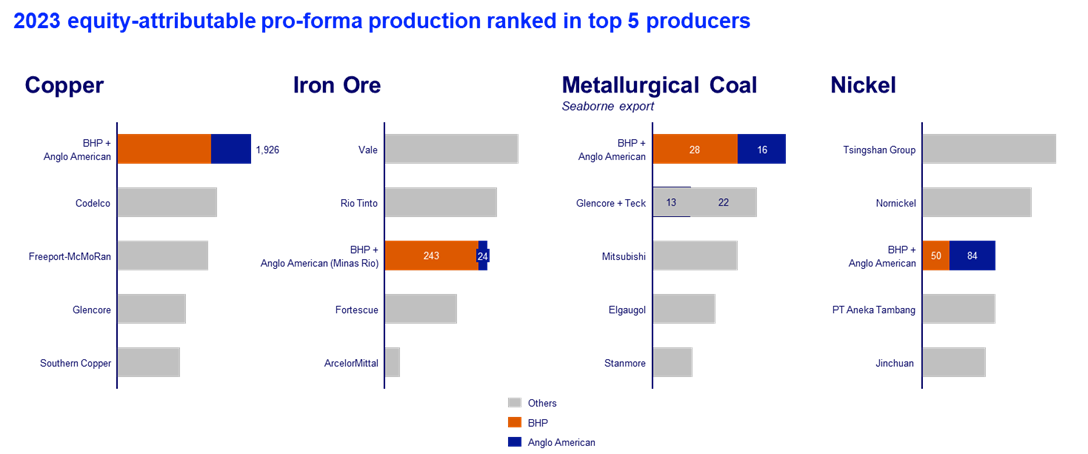

BHP’s proposed offer for Anglo American would see it reclaim position as world’s leading mining company

Deal would create copper, iron ore and met coal mining superpower says Wood Mackenzie LON

1 minute read

The $38.8 billion bid by Australia’s BHP Group, which comprises an all-share offer for the Anglo American, would create the world’s largest copper miner, but may not be high enough to satisfy shareholders of the UK company according to analysis by Wood Mackenzie.

“The deal would represent the biggest shakeup of the global mining industry in more than a decade,” says James Whiteside, Metals and Mining Corporate Research Director at Wood Mackenzie. “But Anglo American shareholders may consider fair value closer to the share price in 2023 before operational issues emerged and other suitors may be compelled to act at this price”

Under UK takeover rules, BHP has until 22 May to make a formal offer. If the deal is successful, it would be the biggest in BHP’s history and one of the year's biggest merger and acquisition deals across any sector.

“BHP has spent the last 10 years simplifying their asset base only to buy one of the most complex portfolios in the industry,” Whiteside says. “However, this deal is all about copper and when greenfield options look limited and expensive it makes sense for [BHP] to look for more workable solutions.”

The deal would also reinforce BHP’s leading position in iron ore and metallurgical coal.

“The notable pivot here is the move away from a myopic focus on future facing commodities with premium quality metallurgical coal regaining priority status in the company’s portfolio,” Whiteside says.