Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Changes to North Sea profits levy could sound death knell for industry

Amendments by UK’s new government could paralyse investment for next five years

1 minute read

The UK government’s announcement of further changes to the Energy Profits Levy (EPL), a windfall tax aimed at oil and gas companies operating in the North Sea, could paralyse upstream investment for the duration of this parliament if implemented in the October budget according to new research by Wood Mackenzie.

The research states that the government suggests the changes to the EPL could bring in annual average revenue of £1.2 billion, or £6 billion over the next parliament.

This would be achieved by increasing the EPL from 35% to 38%, extending the sunset clause (the time when the levy will be abolished) by 12 months to 31 March 2030, abolishing the 29% investment allowance and reducing the capital allowances. Just how these critical allowances would be changed was left hanging.

“After less than a month in power, the Labour government has continued in the same vein as the previous Tory government by making further temporary changes to the upstream tax system without addressing the uncertainty over the critical capital allowances,” says Graham Kellas Senior Vice President of Global Fiscal Research at Wood Mackenzie. “The short-term gains of tweaking the EPL could result in the premature slowdown of investment across the upstream sector which could lead to accelerated cessation of production.”

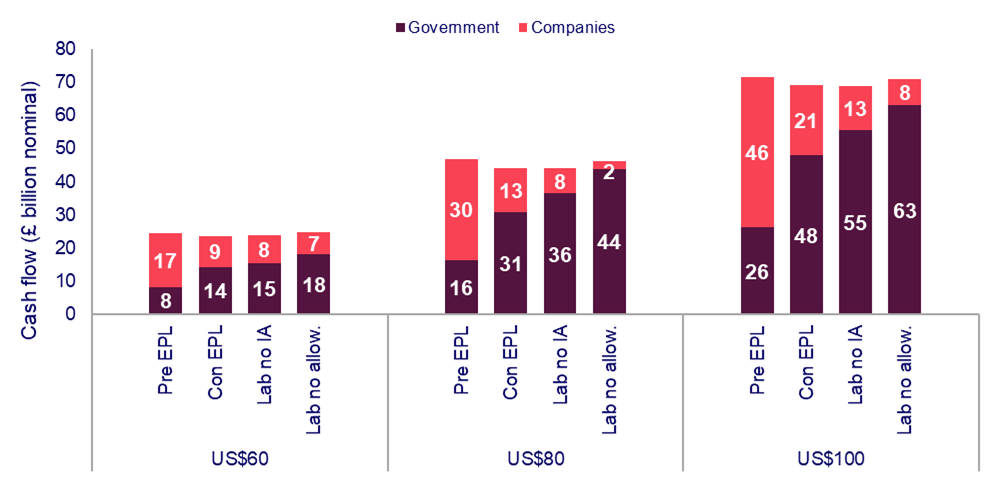

Government and company cash flows (2025-2029)

Source: Wood Mackenzie

The research adds that the extension of the sunset clause to 2030 was surprising because Labour had previously stated it would keep its version of the EPL for the duration of the parliament which will end in 2029. To therefore extend the sunset clause to 2030 makes little sense and retains one of the EPL’s critical flaws: the misalignment of fiscal terms between the investment phase and the producing phase.

“The sunset date has extended so often investors will now pragmatically assume that the EPL is a permanent feature of the system, rather than assuming terms become more favourable in the future” says James Reid, Senior Research Analyst at Wood Mackenzie.