Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

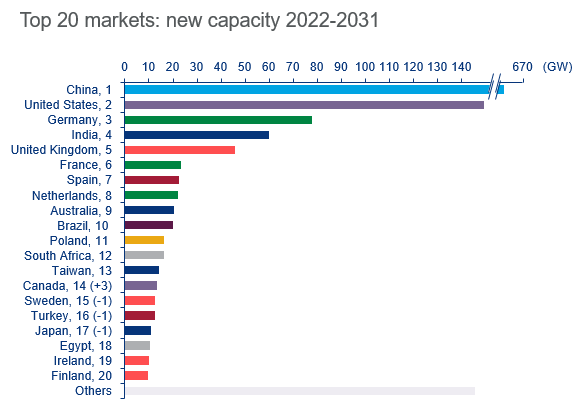

Climate policies trigger 1.9% upgrade QoQ in global wind power

25.6 GW capacity to be added between 2022 and 2031 – driven by IRA and EU policies

1 minute read

Global wind power is expected to see an 1.9% increase of installed capacity Quarter on Quarter (QoQ), an equivalent of 25.6 gigawatts (GW), between 2022 and 2031 according to Wood Mackenzie, a Verisk business (Nasdaq: VRSK).

New climate policies and aggressive strategies across the Americas and Europe resulted in a net upgrade QoQ of 21 GW (of the total 25.6 GW).

Luke Lewandowski, Wood Mackenzie research director, said: “The Inflation Reduction Act (IRA) establishes long-term investment stability in the US, with more than 5 GW of the 6.8 GW upgrade QoQ expected from 2028-2031. Procurement activity in Quebec and a robust pipeline in Alberta will trigger a 2.5 GW upgrade in Canada, strengthening its position as a top 20 global market.”

A 9.3 GW upgrade in North America QoQ represents the largest uplift for a sub-region globally this quarter.

For Europe, Wood Mackenzie forecasts an 9.7% increase QoQ in the region, the equivalent of more than 10.2 GW, which reflects the European Union’s ongoing campaign to achieve greater energy security.

“New and strengthened policies in Germany, France, and Greece, and project concessions and awards in Finland, Denmark, and the UK yielded QoQ upgrades in each sub-region. This was not the case in Eastern Europe, where Russia’s invasion of Ukraine has negatively impacted its domestic market,” Lewandowski said.

Asia Pacific, excluding China, represents the only sub-region globally to receive a significant downgrade this quarter, which saw a 1.9 GW reduction.

“This is primarily due to the state utility in Vietnam not recognising new wind power over grid stability concerns, but also due to slow market development in Japan and project adjustments in South Korea,” Lewandowski said.

“Offshore project disruption in China caused by typhoons, supply chain challenges and Covid-19 outbreaks has put even greater pressure on completing projects before 2026 as the 14th Five Year Plan ends in 2025,” Lewandowski added.

A net 4.8 GW upgrade QoQ consolidates much of the boost into 2025 in China, resulting in a new annual high for the market of 72 GW that same year, which will not be surpassed until 2031.