Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Cumulative US community solar capacity expected to break 6 GW in 2023, despite interconnection and siting headwinds

Short-term growth is driven by positive policy reform in existing state markets and capacity from new state markets

3 minute read

US community solar installations declined by 6% year-over-year in 2022 and 13% in Q1 of 2023. This was primarily driven by the supply chain uncertainty of the past year as well as interconnection and siting issues hindering growth in key state markets such as Massachusetts and Maine, according to the latest report released by Wood Mackenzie in collaboration with the Coalition for Community Solar Access (CCSA).

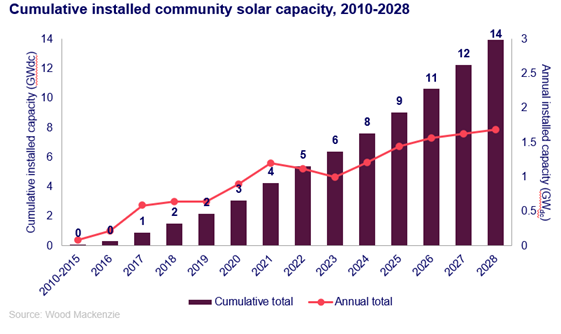

But community solar growth is expected to return starting in 2024 and continue through the next five years. Going forward, Wood Mackenzie has forecasted existing markets will grow by an annual average of 8% with nearly 14 gigawatts (GW) of cumulative capacity expected by 2028. This forecast does not include the potential of new programs which could result in a significant uplift.

“Near-term growth is driven by the continued success of programs in New York and Illinois as well as positive policy updates in Maryland, Minnesota, and New Jersey. In addition, California’s newly proposed program has the potential to represent 20% of Wood Mackenzie’s national outlook between 2024 and 2028,” Caitlin Connelly, research analyst at Wood Mackenzie, said.

For the Inflation Reduction Act (IRA), recent guidance from the US Internal Revenue Service regarding investment tax credit (ITC) bonus adders has shown that qualifying for more than one adder will be difficult. Community solar developers can qualify for any of the three ITC bonus adders but are most likely to seek the low-income communities (LMI) adder first, according to report findings.

The $27 billion Greenhouse Gas Reduction Fund (GGRF) also provides new opportunities for community solar. The US Environmental Protection Agency ‘Solar for All’ fund within the GGRF will be particularly beneficial for community solar, granting up to $7 billion in funds to support the creation and expansion of community solar programs with an emphasis on supporting low-income communities.

“Community solar’s growth continues on a healthy long-term trajectory with capacity projected to more than double over the next five years in existing state markets alone,” said Matt Hargarten, VP of Campaigns at CCSA. “These projections don’t factor in new states passing community solar laws and the billions of dollars of federal grants that we expect will go to states to expand access to community solar. Needless to say, we’re just scratching the surface on how many people in America can get the benefits of community solar access by the end of the decade if regulators and legislators keep their foot on the gas.”

Wood Mackenzie and CSSA’s reporting now includes alternative forecasts for community solar, resulting in either an uplift or downgrade to Wood Mackenzie’s business-as-usual base case. The bull and bear-case alternative forecasts highlight the impact of key market uncertainties such as supply chain dynamics, retail rate changes, and state and federal policy updates. In Wood Mackenzie’s bull case scenario, the national five-year forecast increases by 13%, while the national outlook decreases by 24% in the bear case scenario.

The report also shows that subscriber management companies Arcadia, Perch Energy, and Ampion now manage more than 50% of the total community solar market.

“Developers continue to rely on third-parties to outsource subscription acquisition and management services especially as state-level subscriber requirements continue to become stricter and more burdensome. Successful subscriber management companies have been seen to utilize software tools which lowers subscriber acquisition costs and have business models oriented toward successfully targeting low-income populations,” Connelly concluded.

ENDS

Notes to Editors:

Community solar refers to local solar facilities shared by multiple community subscribers that receive credits on their electricity bills for their share of the energy produced. In most cases, customers subscribe to community solar projects and receive a bill credit from the utility. The size of the bill credit is determined by the program. Programs can provide a full retail-rate bill credit or some alternative rate.

Community solar has a diverse customer base. Homeowners, renters, and apartment tenants unable to install rooftop solar are typical subscribers to community solar systems. Additionally, non-residential entities like commercial and industrial companies, non-profits, or municipal and government entities often serve as “anchor tenants.” An anchor tenant signs a longer-term contract for offtake from the project and tends to use a significant amount of the electricity supplied by the project.