Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Extending Energy Profits Levy surprising choice for government

Wood Mackenzie report says move will not generate any income for four years

1 minute read

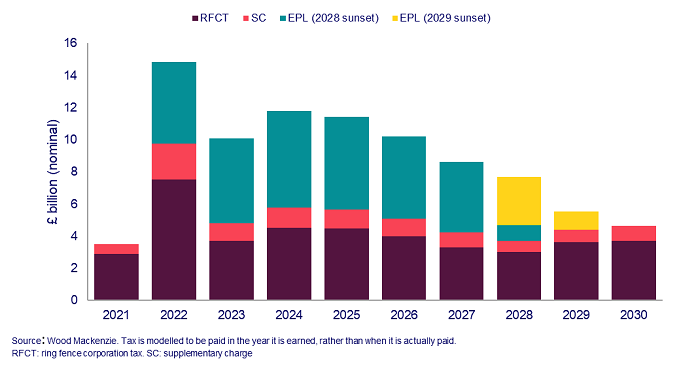

The Spring Budget statement from the UK Chancellor of the Exchequer, Jeremy Hunt, that announced that the Energy Profits Levy (EPL) would continue until 31 March 2029 could result in a transfer of £4.1 billion (US$5.2 billion) from energy companies to government according to a report by Wood Mackenzie.

The report ‘UK extends energy profits levy (EPL) by one year’ states that the £4.1 billion of future (undiscounted) cash flow from the companies to government is based on Wood Mackenzie’s current Brent price forecast (c. US$80 a barrel).

“The extension of the EPL is a surprising choice by the government as it will not generate any income for the government for at least four years,” says Graham Kellas, SVP, Global Fiscal Research at Wood Mackenzie. “And a tax that is now expected to have a seven-year lifespan under stable prices does not abide by most definitions of a ‘windfall’ tax.”

UK tax estimates 2021-2030

ellas adds that by retaining the current allowances and rates, the government clearly assumes that the extension will not change companies’ investment plans.

Wood Mackenzie’s Lens database includes £28 billion of future capital expenditure in the UK, associated with incremental spend on onstream assets and the potential development of 1.8 billion barrels of oil equivalent (boe) of additional oil and gas resources. The industry has warned that all this investment could be at risk, because of the ongoing turbulence in the fiscal terms.

“Taken on its own - the extension of the EPL is unlikely to impact investment decisions,” Kellas says. “However, the cumulative fiscal instability has really unsettled North Sea investors. And, in an election year, the opposition Labour party’s tax plan has added significantly to the fiscal uncertainty”.