Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Floating rig utilization rebounds to pre-COVID levels

Rig demand expected to increase 20% from 2024-2025, rates up 40% past year

1 minute read

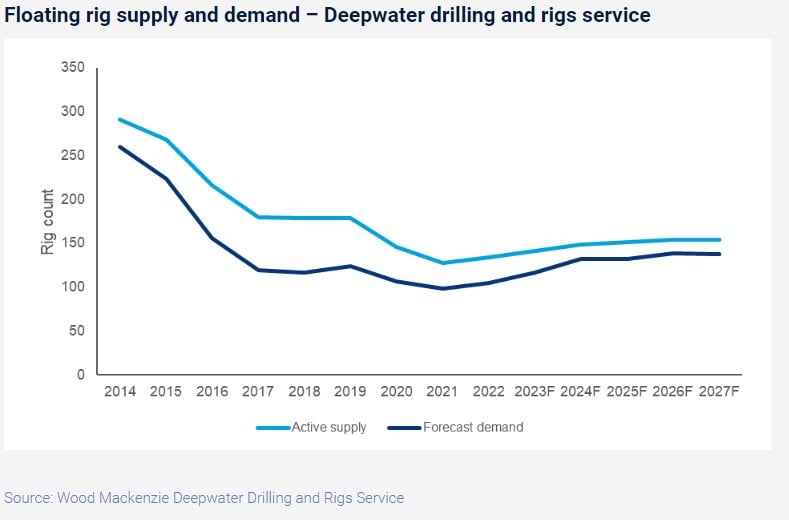

Rig utilization has returned to pre-COVID levels, driving rates up 40 percent in the past year as demand is forecast to increase another 20 percent from 2024-2025, according to a recent report from Wood Mackenzie.

According to the report “Are we at the tipping point of the deepwater rig market?” active floater utilisation has rebounded from a low of 65% in 2018 to over 85% in 2023, the number of contracted ultra-deepwater (UDW) benign rigs has returned to pre-COVID levels and day rates for best-in-class floaters have doubled in the past two years.

“Higher oil prices, the focus on energy security and deepwater’s emissions advantages have supported deepwater development and, to some extent, boosted exploration,” said Leslie Cook, principal analyst for Wood Mackenzie. “Active supply is now more in line with demand and rig cash flows are positive. We expect demand to continue to rise.”

Much of this expected growth will come from the “Golden Triangle” of Latin America, North America and Africa, as well as parts of the Mediterranean. Wood Mackenzie projects that these areas will account for 75% of global floating rig demand through 2027.

Rates on the rise

Recent activity has pushed rates up 40% in the past year and Wood Mackenzie anticipates a further 18% escalation for floater day rates. Before the end of the year, rates of US$500,000/day or above may return for highly-prized, advantaged ultra-deepwater rigs. Benign ultra-deepwater rigs have averaged US$420,000/day in the first half of 2023, with utilization at 90%.

“With increasing demand and rates, we are approaching the tipping point for new builds and reactivations,” said Cook. “We haven’t reached it yet, but for new builds, it’s not a question of if, but when. The need for decarbonisation, technological advancement, more efficiency and, ultimately, fleet replacement will drive a new cycle. If rig economics remain robust and rig companies see contractual risks abate, this could be sooner rather than later.”