Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Global automotive industry to drive industrial textile demand

1 minute read

Airbags are a core and growing part of the industrial textile portfolio. Current global airbag yarn demand sits at 164 ktpa and is expected to reach 237 ktpa by 2025, according to a new report from Wood Mackenzie.

Commenting on findings in the 'Global Airbags Report 2019', David Hart, Wood Mackenzie Consultant, said: "The steady structural growth of the airbag business is driven by long-term increases in global car production and by rising airbag fitment rates per car. From the starting point of a single driver bag, we have seen rapid progress into passenger, side impact and curtain bags for head protection. Luxury models now add bags for knee protection and roof bags for roll-over protection.

“Sweden’s Autoliv and Germany’s ZF TRW lead the global supply of finished airbag modules. This dominance increased following the catastrophic implosion of Takata in Japan after the scandal involving faulty inflators. Autoliv and ZF TRW are both pursuing a policy of rapid globalisation, investing in bag and module plants to complement new automobile production in all relevant locations,” added Mr. Hart.

Suppliers moving towards vertical integration

The traditional structures within textile supply chains have supported profit centres at each manufacturing step – polymer, yarn, fabric, airbag and module. Enormous cost pressures in the automotive sector increasingly make these horizontal structures uncompetitive.

“Most suppliers within the airbag chain integrate at least two or three manufacturing steps within a single profit centre. This process has led to a lively trade in airbag chain businesses. For example, the Hyosung acquisition of GST, Indorama’s acquisition of PHP and Joyson’s acquisition of Takata and Highland. Wood Mackenzie believes the next two to three years could see significant acquisition and merger activity within this sector.

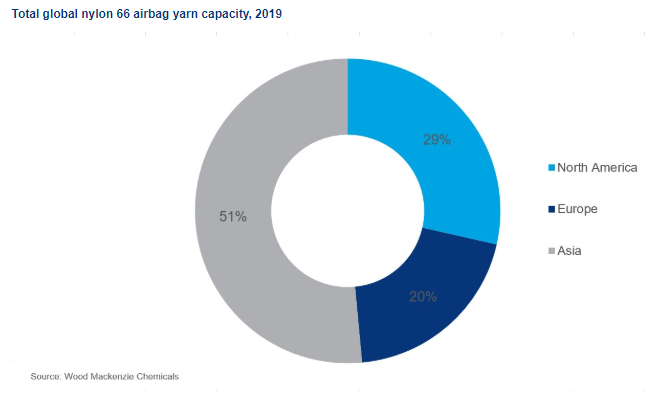

“In parallel with vertical integration is the effort to provide a fully globalised product offer at each level in the supply chain, ideally with facilities in the Americas, Europe and Asia. The major airbag module producers and automotive manufacturers are increasingly reluctant to deal with smaller single-region producers of yarns and fabrics. This has triggered a scramble to invest in locations not yet covered, e.g. Toray investing in North America, or the assembly of several regional operations to provide more rounded global coverage e.g. the Indorama Ventures linkage with Shenma of China and Toyobo of Japan - to complement its European and US operations,” said Mr. Hart.

Nylon 66 yarn base under attack from polyester yarns

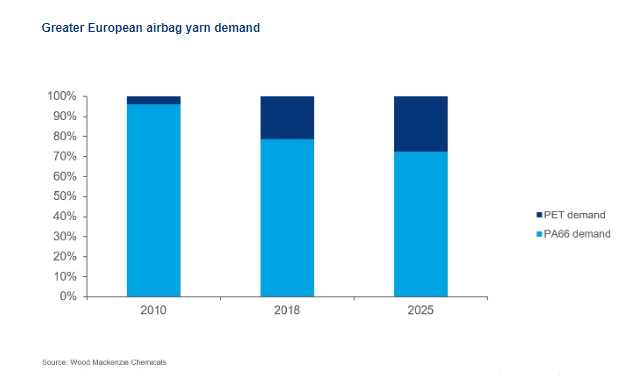

The early development of the airbag business has relied on nylon 66 (PA 66) polymer. This delivers a yarn that is strong and resilient to flexing and bending. However, polyester is typically half the cost of nylon. For many years, polyester has been seeking a route into the airbag market despite being a more rigid polymer type. Over the past decade, polyester has started to make serious progress in certain airbag categories and is likely to continue to increase its current 20% share of the global airbag business.

“Polyester prospects have been boosted over the past three years by the supply crisis in a critical PA 66 component, adiponitrile (ADN). This key product is available from just three leading manufacturers. Under pressure from strong demand, their operations have suffered a catastrophic series of forces majeures - threatening to halt PA 66 supply chains and automotive manufacturing lines.

“Nylon 66 prices have consequently escalated rapidly. An accelerated switch to polyester has been avoided since airbag modules cannot easily be changed once specified by new car models. PA 66 raw material shortages have eased slightly in recent months as global automotive demand has softened, while prices remain high. If PA 66 can defend itself until the new Invista ADN plant opens in Shanghai in 2022, it may avert a structural acceleration in the shift to polyester,” said Mr. Hart.

How will the rise of autonomous vehicles impact airbag systems?

Global airbag supply chains have long been searching for alternatives to the current yarn- and textile-based airbag systems.

“The industry is acutely aware of experiments with plastic films or nonwoven (spunbond) fabrics, both of which could radically undercut the costs of traditional textile systems. Trials over the last 10-15 years have failed to deliver a breakthrough, particularly in such a high-profile market where human lives are at risk.

“Now, a more serious challenge is emerging. Airbag and seat belt safety systems exist to protect humans from their own errors in judgement. Autonomous vehicles will have no such fallibility and therefore the automobile and its artificial intelligence will become the safety system. It is widely expected that usage of autonomous vehicles will gather momentum after 2025. However, with a mix of manual and autonomous vehicles on the roads, traditional safety systems will still be required over a transitional period. As such, airbags might only be discarded when autonomous vehicles become the primary vehicle of choice. It is difficult to see any significant move out of current traditional patterns of safety equipment until 2030,” concluded Mr. Hart.