Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Global hydrogen pipeline plummets in Q4, with only 1Mtpa of new projects announced

Counterbalanced by record electrolyser manufacturing announcements totaling 45GWe

1 minute read

The total global announced capacity for hydrogen projects reached 71.4 million tonnes per annum (Mtpa), but 2022 falls short of becoming a record year according to latest analysis from Wood Mackenzie.

Despite a record 12 Mtpa of project capacity announcements in the first quarter of 2022, the global hydrogen pipeline slowed through the year with only 1Mtpa of new projects announced in Q4 – falling short of total capacity announcements in 2021 by 3 Mtpa.

“2022 was marked by the energy crisis and a slew of policy announcements from the EU, US and UK supporting hydrogen production. Despite this, announcements slowed through the year as developers shifted their focus to de-risking the existing project pipeline” said Flor Lucia De la Cruz, senior research analyst, Hydrogen and Emerging Technologies at Wood Mackenzie.

Source: Wood Mackenzie Lens Hydrogen

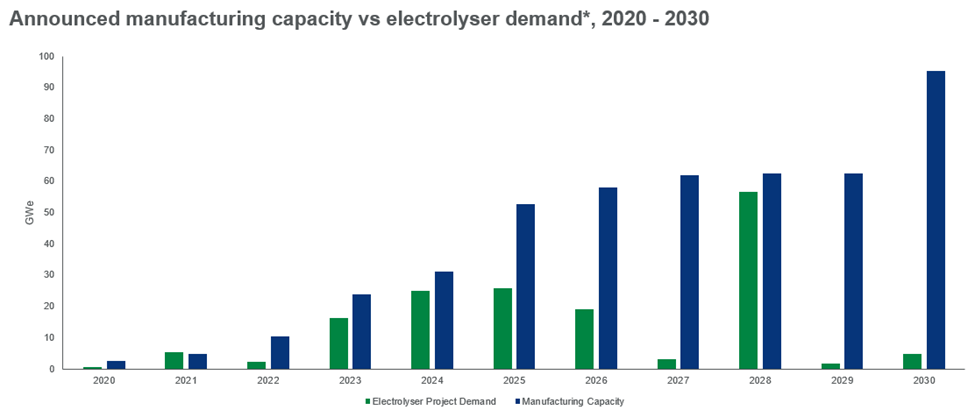

The slow-down in project announcements was counterbalanced by record electrolyser manufacturing announcements. A record 45 gigawatt of renewable hydrogen electrolysers (GWe) was announced in Q4 2022, taking the total announced nameplate electrolyser manufacturing capacity to 106GWe.

Original equipment manufacturers (OEMs) chased the 360GWe pipeline with a record 83GWe in manufacturing announcements through 2022, according to Wood Mackenzie findings. With 45GWe of that electrolyser manufacturing capacity announced in Q4, up 72% from the previous quarter. 41GWe of the Q4 announcements were from gigafactories based in Africa.

De la Cruz said: “A year ago, electrolyser manufacturing capacity looked like a bottleneck. OEMs have responded so swiftly that there is a risk of significant manufacturing overcapacity by 2025, particularly if production projects fail to progress.”

“However, OEMs are ramping up manufacturing output slower than nameplate capacity given the additional time required to develop labour and skills as well as securing machinery and materials” De la Cruz added.

Source: Wood Mackenzie Lens Hydrogen

There was a lack of mega projects announced in Q4 2022, but existing projects saw major progress. For instance, Shell’s 200MWe ‘Holland Hydrogen I’ began construction in July.

BP also made headlines in May after announcing its purchase of a majority stake in the $70bn Asian Renewable Energy Hub (AREH). In the US, the first mega-projects were announced including GHI’s ‘Hydrogen City’, which will add 3 Mtpa to the pipeline, and SoCalGas’ ‘Angeles Link’, adding a further 20 GWe.