Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Global wind power outlook falls by 29 GW Q-o-Q

Wood Mackenzie report says growing pains in the US and sluggish project development in China are to blame, but fall only amounts to a 2% decline

2 minute read

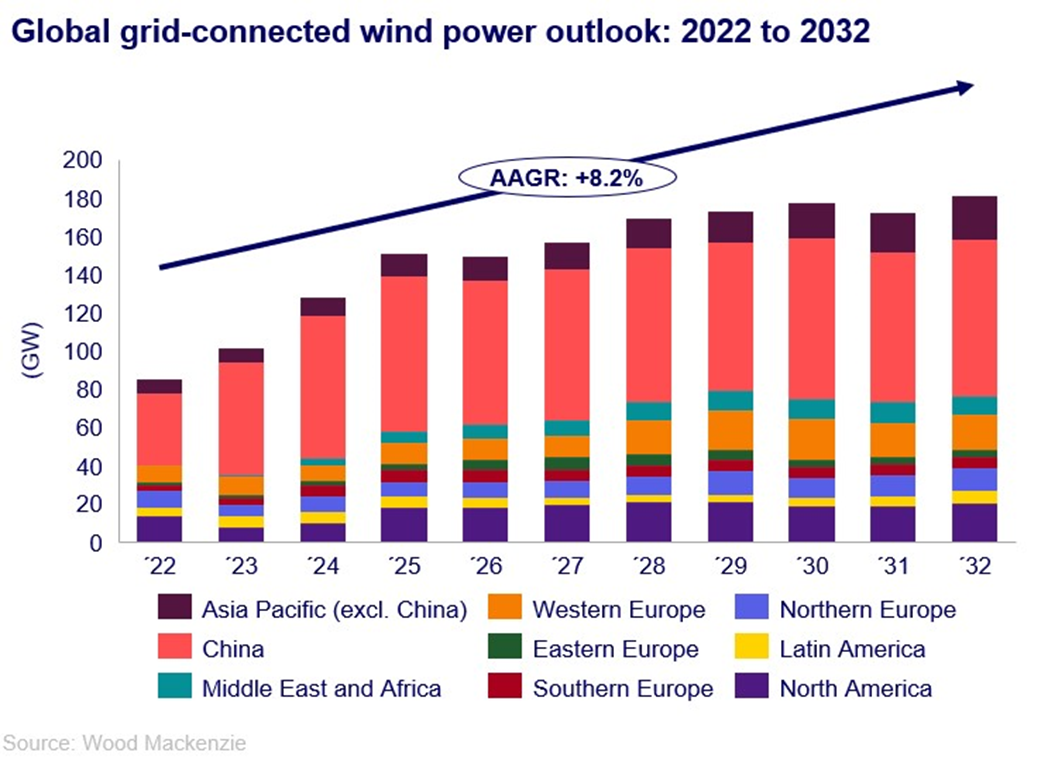

The outlook for the global wind power sector has fallen by 29 gigawatts (GW) in the fourth quarter of 2023 (Q4 2023), with the downgrade signifying a drop in cumulative installed capacity to 2.35 terawatts (TW) by the end of 2032 according to Wood Mackenzie.

The figures are cited in Wood Mackenzie’s ‘Global wind power market outlook update: Q4 2023’ which states that the Q4 downgrade amounts to less than a 2% change in expected capacity quarter-on-quarter (Q-o-Q) and reflects developments in key markets such as the US and China.

“Long-term market fundamentals remain strong globally despite near-term challenges in project execution in China and offshore market maturation in the US,” says Luke Lewandowski, Vice President, Global Renewables Research at Wood Mackenzie. “Markets will evolve and the findings from the report reflect some of those nuances.”

The report states that 82% of the global downgrade Q-o-Q come from the combined cuts in the Chinese and US markets.

US market showing some growing pains

A number of cancelled power purchase agreements (PPA’s) in the US has contributed to a 10.9 GW downgrade in the global offshore outlook Q-o-Q from 2023 to 2032.

The report adds that beyond Ørsted’s announcement to cease development of its Ocean Winds 1&2 projects, supply chain bottlenecks and permitting delays will push nearly 8 GW of offshore wind projects in the US beyond the 2032 outlook. This means that cumulative offshore capacity in the US by 2030 will reach roughly half the government’s 30 GW target as a result.

A continued ‘wait and see’ approach in the US caused by economic and policy uncertainty, results in a 2 GW cut in the near term to the 10-year outlook for the US market.

“Continued economic and policy uncertainty, including pending guidance from the US Treasury, caused onshore and repowering development timelines to shift, prolonging the 2023 slowdown through 2024,” Lewandowski says.

Headwinds from a sluggish Chinese project market in the near-term

A tightening of the permitting requirements in China has a 12 GW cut to the forecast Q-o-Q the report states. This increased stringency in permitting is partnered by the cancellation of several projects that have been classified as idle and slow project execution rates to result in a 12 GW downgrade, a 1.5% decrease Q-o-Q according to the report.

“The near-term outlook [for China] is expected to be sluggish and this is reflected in the outlook,” Lewandowski says. “However, China’s onshore wind outlook from 2026 to 2032 remains unchanged Q-o-Q.”

The report adds that the comparatively fast solar installation process allows state-owned asset owners to manage wind project construction delays as new solar capacity helps to make progress towards the annual renewable targets.

UAE accelerates ahead of COP28

The Middle East market got a minimal upgrade of 103 MW, up 0.5% Q-o-Q over the 10-year outlook. The report states that the UAE’s Masdar rushed to inaugurate its 103 megawatt (MW) Wind Program cluster before the COP 28 conference, boosting the near-term outlook by 206% and accounting for nearly a sixth of total expected capacity in the country by 2032.

“There is some serious growth potential in the Middle East and other emerging nations across Asia and Africa and hopefully COP28 will help unlock some of that potential,” Lewandowski says.