Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Keir Starmer softens stance on UK oil and gas

Decision to halt new exploration licences would have minimal impact

2 minute read

The recent announcement by Keir Starmer, the leader of the UK’s Labour Party, that he will ban new oil and gas exploration licences if he gains power at the next election will be viewed as a largely symbolic gesture according to analysts Wood Mackenzie, the leading provider of decision intelligence for the world’s natural resources sector.

Principal Analyst Upstream Greg Roddick said that because all activity on existing licences will be allowed to continue, Mr. Starmer’s announcement could even be interpreted as a softening of Labour’s previous position.

“Labour has said changes would only impact the offer of new licences,” Mr. Roddick says. “Opportunities in existing licences are more material and, in recent years, exploration drilling has already dropped to historic lows .”

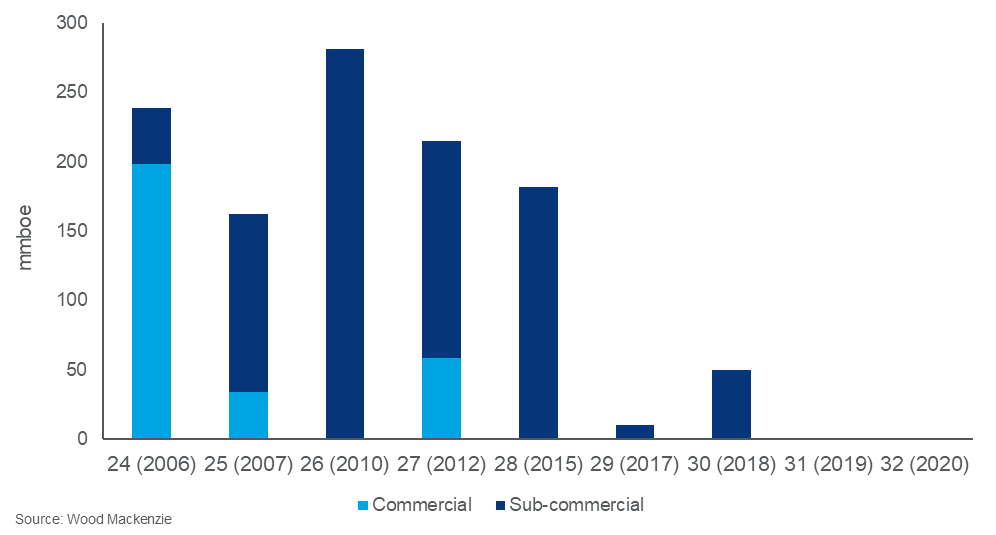

Wood Mackenzie estimates that the UK has yet-to-find prospective resources of just over 1 billion barrels of oil equivalent. This is overwhelmingly located on existing exploration licences and the last new acreage to see a commercial discovery was awarded in 2012. The previous two licencing rounds failed to deliver any drilling commitments and the first exploration well from the last round in (2020) is only expected to be drilled this year.

“In short, the industry has long had the opportunity to secure the most prospective UK acreage and has largely already done so,” Roddick says. "There is no guarantee that new, commercial discoveries will be found. Those that are will likely be small and are unlikely to reverse the trend given the maturity of the UK Continental Shelf.”

“Given the challenging environment in the UK, open acreage would be considered much higher-risk and is unlikely to attract the attention of the industry’s leading explorers,” Roddick adds.

Discovered oil and gas by license round

Source: Wood Mackenzie Lens. Year in bracket denotes year license awarded

Speaking at the company’s offices in London, North Sea Oil & Gas Analyst Jessica Brewer said that Labour’s decision to stop new exploration licences would not impact future investment decisions as much as other factors.

“The introduction of a windfall tax (the Energy Profits Levy) and the uncertainty around the Labour Party’s fiscal proposals will be the biggest hurdles facing investment in new oil and gas projects in the UK ” Ms. Brewer added.

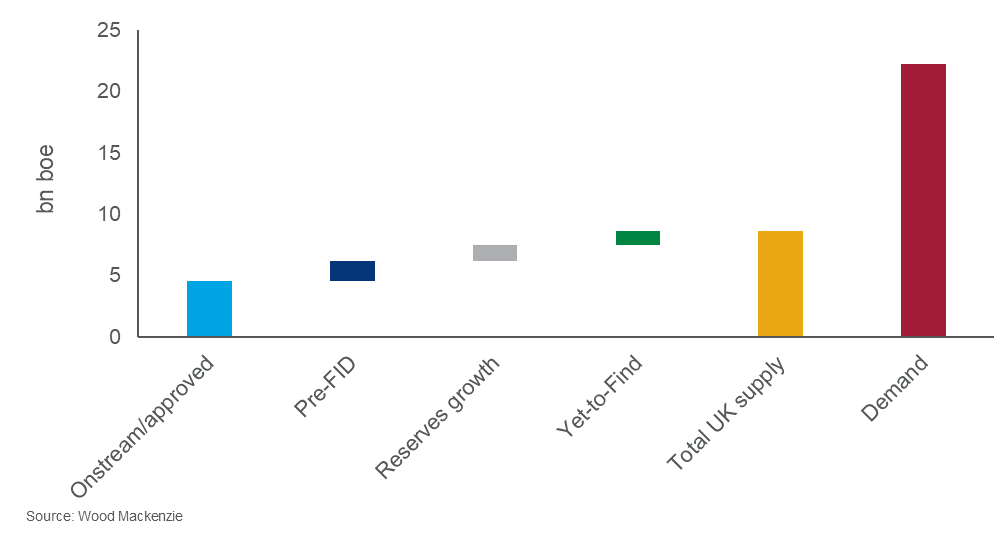

What is there left to play for in the UK?

Wood Mackenzie estimates that there almost five billion boe are set to be produced from onstream and approved UK oil and gas fields. The potential from pre-final investment decision (FID) projects, reserve growth and existing discoveries adds up to a further three billion boe.

“Pre-FID greenfield projects [which add up to nearly 2 billion boe] are the most obvious development candidates, given many are ‘sanction ready’,” Ms. Brewer said “Labour has indicated new developments on existing licences will be respected. The outcome of fiscal policy will have a greater bearing on projects in the longer-term.”

Oil and gas supply and demand (2023-2050)