Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Geopolitical tensions, a record year for elections and economic uncertainty will define the backdrop to the upstream industry in 2024.

Wood Mackenzie recently released its What to Look for in 2024 upstream series. Key themes to watch in global and corporate upstream include continued consolidation, increased activity from NOCs, reversing decarbonisation gains, shifts in strategic playbooks and an upstream investment plateau.

Another banner year for M&A will focus on scale, performance improvement and diversification

Sector consolidation will continue to be a key trend in 2024. There’s no unifying theme across all these potential big deals. But the industry is maturing, and size matters. Higher market valuation multiples, easier access to finance for larger companies, lower costs and better execution are some of the incentives.

“For deals to work, they need to demonstrate improved operational, financial and, for some deals, emissions performance,” said Fraser McKay, Head of Upstream Analysis for Wood Mackenzie. “Some buyers may follow ExxonMobil’s playbook with Pioneer and look to bring unique data, technology, and processes to a basin. Others will be marriages of convenience. But not all deals will work, and it will remain hard for smaller international Independents to prove tangible synergies between disparate portfolios than their larger more diversified brethren.”

NOCs step up activity

COP 28 has placed greater emphasis on sustainability plans. The effect for some NOCs – a peer group that produces half of the world's oil and gas – will be bigger ambitions in low carbon and emissions abatement, particularly for those signed up to the Oil and Gas Decarbonisation Charter (OGDC). However, upstream growth will still be on the agenda for most NOCs in 2024.

“Most NOCs are still in the business of growing upstream capacity,” said Neivan Boroujerdi, Director, Corporate Research and NOC lead for Wood Mackenzie. “It is a strategy that has been emboldened by the energy security concerns of the last 24 months.”

According to Wood Mackenzie analysis, the Middle East champions will lead much of the growth, with ADNOC, Aramco and KPC increasing spend to meet domestic capacity targets. The Chinese NOCs could also step up, albeit from a low base: upstream equity, LNG offtake and strategic partnerships in the Middle East, Africa and Latin America are possibilities.

Mergers and acquisitions will increase as well.

“The NOCs have reset financial strength and will target M&As to plug strategic gaps in gas, LNG, short-cycle oil and international exploration,” said Boroujerdi. “With this amount of growth and activity, there is a risk that transition strategies could slow, but most will continue to accelerate international transition themes.”

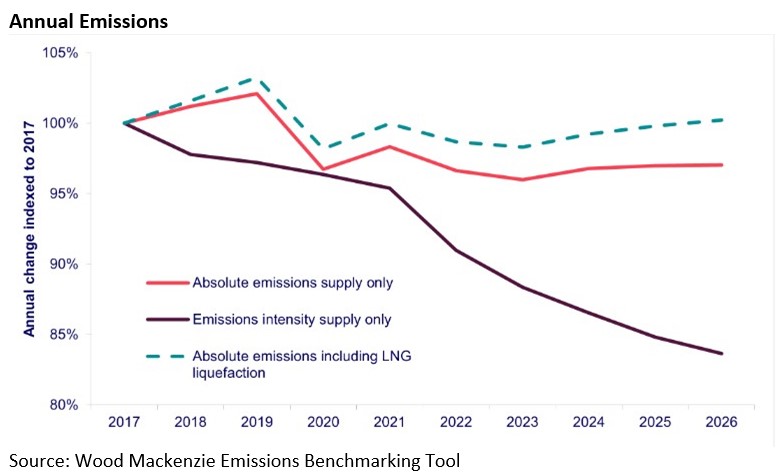

Some decarbonisation gains will reverse in 2024Production will rise by 3% in 2024 and decarbonisation won’t keep up. Upstream scope 1 and 2 emissions will increase by 12 million tonnes of CO2e year-on-year.

“Emissions intensity will keep falling through flaring reductions, more electrification, CCUS and greenfield projects, which will all help to reduce emissions per barrel, by at least 2%,” said Adam Pollard, Principal Analyst of Upstream Emissions Research. “But the biggest driver is rising volumes of advantaged low-intensity oil and gas from the Middle East and US. Incremental intensity improvements are good, but more work is required to reduce absolute emissions. Tougher new regulations are on the way, many of which will face political delays. But oil and gas remain low hanging fruit for some governments’ decarbonisation efforts. The sector will get more ambitious with new initiatives announced and major projects sanctioned, but it will take several years to see the impact on global emissions reductions.”

Shifts in the strategic playbook for oil and gas players

Sustainability concerns, stakeholder pressures and low valuation multiples will drive companies to adjust their strategic playbook.

“Investors want a reliable, growing base dividend as a reward for rising energy transition risks,” said Tom Ellacott, Senior Vice President of Corporate Research for Wood Mackenzie. “But companies will have to grow cash flow if they want to grow dividends, re-balancing capital allocation towards investment to maintain sustainable cash-generating businesses.”

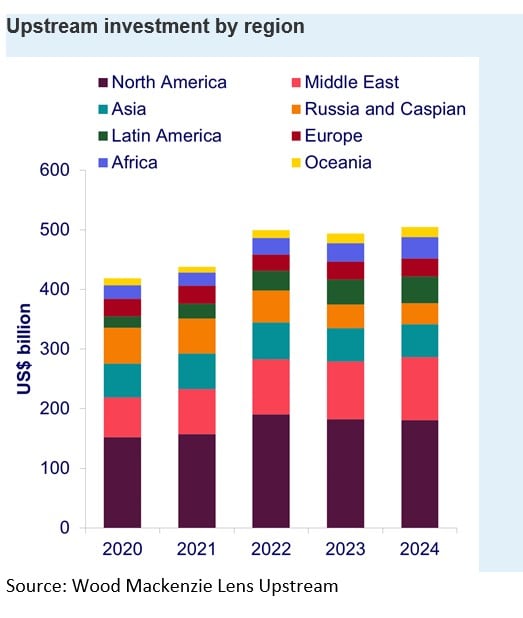

Upstream investment will plateau

Upstream operators will remain focused on resilience, sustainability, and efficiency. Most will exercise caution in the face of inflation, bottlenecks, and price uncertainty, with confidence undermined by widening OPEC+ production cuts.

Global spend in 2024 will reach just over US$500 billion in 2024, up just 2% from 2023 after a rise of 18% over the last three years (all in real terms). But the incremental rise belies important underlying shifts.

“Investment will rise in the Middle East, but fall in the US Lower 48,” said Ian Thom, Director of Upstream Research. “The new project pipeline remains healthy, with 45 projects vying to take final investment decision (FID) – a potential investment commitment of US$170 billion to develop 25.5 billion boe. Around 30 will proceed in 2024. Many of these will be deepwater discoveries, with the 10 biggest deepwater oil projects requiring US$52 billion of investment for recoverable resources of 5 billion barrels of oil.”

Global economic weakness or a loss of unity in OPEC+ are key investment wildcards. A steep price downturn would precipitate the third investment collapse in a decade “operators can and will slash budgets quickly if they need to”, said Thom.