Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Labour Party’s North Sea tax plans risk long-term pain for short-term gain

Wood Mackenzie report says proposals could affect future projects on the UK Continental Shelf

4 minute read

The UK Labour Party’s proposed plan to generate an additional £10.8 billion in revenue from the North Sea could have a major impact on cash flows of energy companies which in turn could stall new investment including energy transition projects according to a Wood Mackenzie report.

The report ‘UK Labour's tax plan risks wiping out North Sea investment’ uses Wood Mackenzie’s unique data and models to examine Labour’s proposals. like: The impact of the different components of Labour’s plan on company values has been modelled – including sensitivities where further clarity is needed. This is compared with the impact of the current EPL system and the system that applied before the introduction of the EPL in 2022.

Labour’s proposals have been met with widely reported resistance by industry bodies and companies operating on the UK Continental Shelf (UKCS).

Labour’s plan

The proposals by Labour to raise an extra £10.8 billion include:

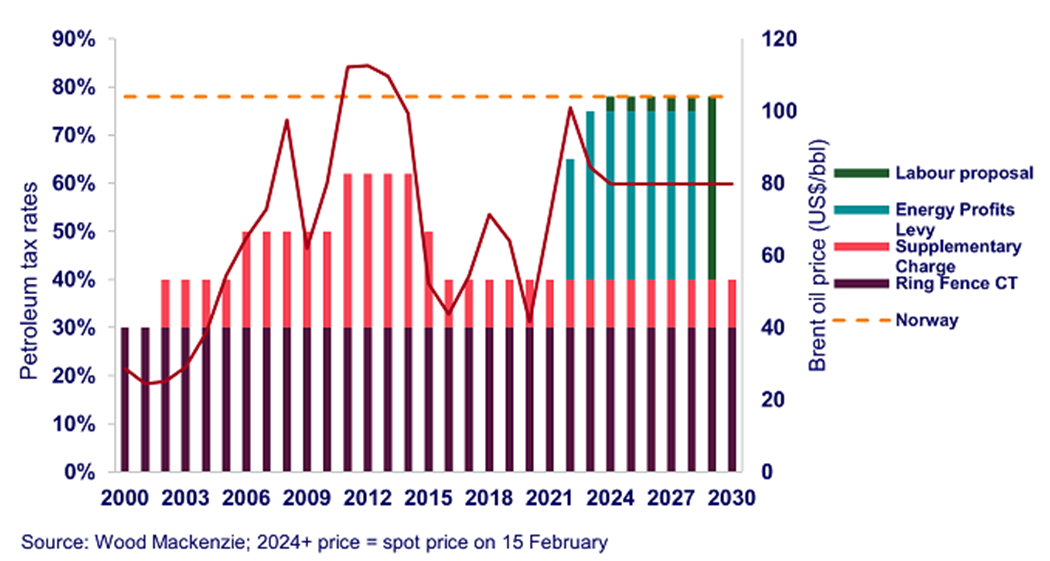

- Increasing the Energy Profits Levy (EPL) rate by 3%, (to an effective 78%, the same rate as Norway)

- Extending the EPL to the end of the next parliament (expected to be late 2029) instead of 31 March 2028

- Removing EPL “loopholes” – Wood Mackenzie understood this to refer to the current investment (or uplift) allowance, but the lack of clarity around the plans means Labour could also remove the capital allowance.

Wood Mackenzie’s analysis concludes that if the proposals are enacted, an unintended consequence could be that many North Sea producers freeze investment until – at least – the EPL sunset, most likely in late 2029. That may have further consequences, such as the premature cessation of production on old fields, accelerated decommissioning, removing infrastructure necessary for the development of satellite discoveries, and reducing investment in CCUS and offshore wind projects.

Labour’s recent comments - including a briefing note for its ‘Prosperity Plan Policy’ on February 8 - stated the party would “end the loopholes in the [current EPL] that funnel billions back to the oil and gas giants”. The ‘loopholes’ are not defined but further statements suggest this refers to one, or possibly all, of the EPL’s current allowances for capital expenditure.

Wood Mackenzie says that removal of these investment allowances would then result in the EPL becoming a 38% quasi-royalty, levied on a company’s net revenue, not profits.

“Labour’s EPL proposals could satisfy a short-term need for some extra tax from an unpopular sector,” says Graham Kellas, Senior Vice President for fiscal research, “But if its plan does include removal of the capital allowances, investment in the UK North Sea could be greatly reduced, with serious long-term implications.”

UK vs Norway

Kellas adds: “Labour’s plan to raise the effective tax rate to 78% is designed to mirror Norway’s marginal tax rate on oil and gas profits. However, Norway’s system has been in place for three decades and allows all capital costs to be deducted. If this creates a loss in any year, the government will refund companies for 71.8% of the loss.”

With no mention in the Labour proposal of matching Norway’s tax refund system, the report adds that the removal of capital allowances could deter companies from investing in the North Sea on a massive scale.

“The UK’s marginal tax rate has been consistently lower than Norway’s but is subject to frequent changes, by both Conservative and Labour governments and this has created an unstable investment climate,” says Kellas. “For a global industry that always stresses the importance of fiscal stability for long-term investment decisions, in recent years the UK has become the fiscal wild west.”

Changes in UK oil & gas marginal tax rates since 2000

Editor’s note – Further information about Wood Mackenzie report

Wood Mackenzie’s report, titled ‘UK Labour's tax plan risks wiping out North Sea investment’ is a fiscal analysis based on the following assumptions:

- Labour’s tax plan will apply to all upstream operators on the UKCS.

- Our assumptions for the Brent oil and National Balancing Point (NBP) gas prices mean the price levels required to trigger the early cancellation of the energy profits levy (EPL) will not be reached.

Wood Macenzie evaluated each element of Labour’s proposed tax plan for the whole UKCS and compared the impact on the remaining value of North Sea assets with existing terms, as follows:

- No EPL: the fiscal system before June 2022

- Conservative EPL: the current fiscal system

- Labour EPL – 3% rate increase

- Labour EPL – 2029 extension: as (3) plus an additional 21 months of EPL (31 March 2028 – 31 December 2029)

- Labour EPL – no investment allowance: as (4) plus removal of the EPL investment allowance

- Labour EPL – no capital allowance: as (5) plus removal of the EPL capital allowance

Labour was contacted with requests for further clarification of the methodology used to calculate its figures but has not responded to date.

Labour's tax plan risks wiping out North Sea investment

A look at the potential impact Labour's proposed fiscal plan could have on future of the UK Continental Shelf

Buy report here