Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Long-term pause in new US LNG investment could transform market

Industry must adapt to demonstrate its place as a low-emissions provider in the energy transition

3 minute read

Addressing President Joe Biden’s Executive Order to temporarily pause the approval of new US LNG export projects right to export to countries that the US does not have a Free Trade Agreement (FTA) with (non-FTA), Giles Farrer, head of gas and LNG asset research at Wood Mackenzie said, “the decision will not affect our forecast for US LNG exports out to 2028, but after that it could affect the trajectory and pace of the sector’s growth and have potential to tighten the market in the long run.”

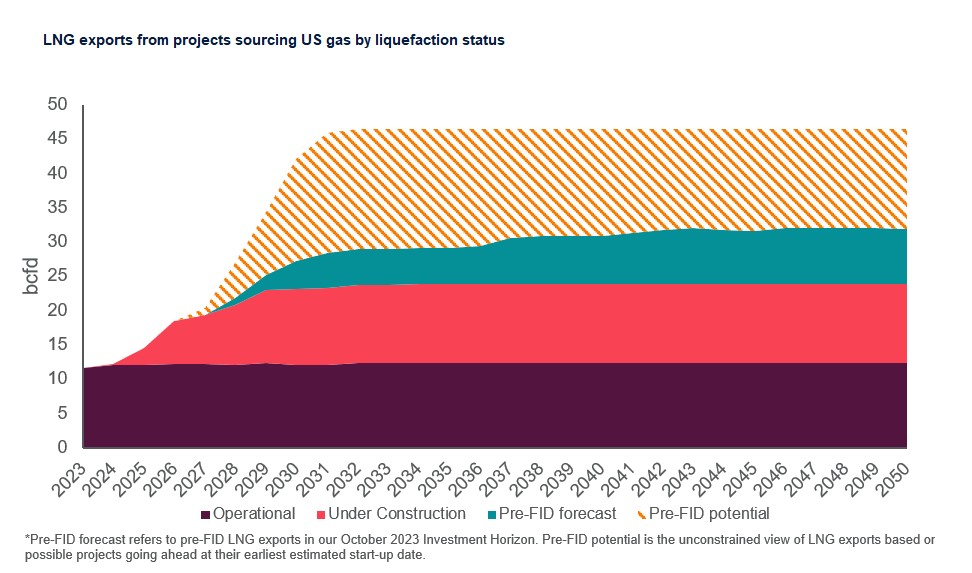

In 2023, the US became the world’s largest LNG exporter, overtaking Qatar, and Australia. To meet growing global demand, Wood Mackenzie forecasts that US LNG and Mexican LNG project export capacity would reach 238 million metric tonnes per annum (mmtpa) of LNG by 2050, accounting for 30% of global LNG supply.

However, despite gas producing around 50% lower emissions than coal when combusted, climate scientists have raised questions about how much methane is leaked along the LNG value chain and what this means for the emissions footprint of LNG around the world. This was one of several factors triggering the administration’s move to pause future export projects.

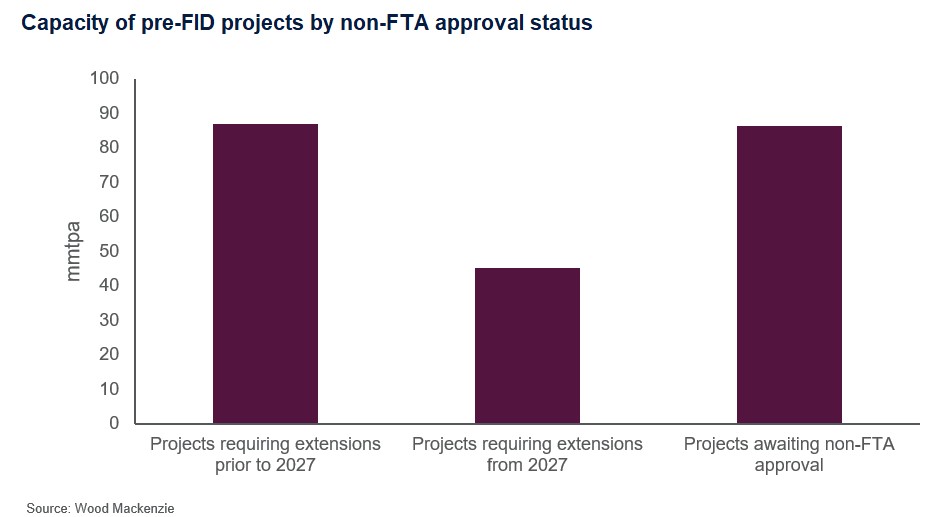

According to Wood Mackenzie, it is still not clear the extent to which all pre-FID projects in the US are affected. The pause could also impact Mexican LNG projects because they plan to use US feedgas. The pause will clearly impact the 10 projects awaiting non-FTA approval, but it may also impact many of the projects which under their current DOE approval require first exports prior to 2027. There are almost 90 mmtpa of projects awaiting non-FTA approval. Without non-FTA approval, these projects will struggle to gain sufficient backing to proceed. New LNG projects typically take between three and five years to build.

“With 200 mmtpa of LNG currently under construction around the world, which will add nearly 50% growth to the market, we have long held a view that there will be a slowdown in new investments decisions from 2024 because the global LNG market looks well supplied in the second half of the decade,” said Farrer. “If the pause is temporary and simply delays FID to 2025 and 2026, the impact on the global market would not be material and perhaps only limited to the 2028-2029 period.”

However, Farrer noted that a long-term pause on all new US LNG projects would have lasting implications on the global LNG market and could affect how buyers perceive US LNG.

“While we expect existing LNG buyers to wait in the short term, these and other potential new buyers could start to look at competing projects outside of the US, such as those in Canada, Australia and particularly Qatar, as alternative supply sources,” said Farrer. “Both a short- and long-term pause may result in higher prices for the broader LNG market. It could also have long-term implications for the role that gas and LNG play in the energy transition, with Asian governments potentially scaling back strategies to use gas as a transitional fuel to replace more polluting coal, as they simultaneously ramp up investments in renewables, if possible.”

Continued Farrer, “It is unclear how long this pause will last and what ultimate effects it will have. Regardless of ongoing and future events, the US LNG industry needs to accept the burden of clearly demonstrating that it is a responsible and dependable provider of a much-needed and less emissions-intensive energy source, which is an essential part of the solution to a smooth energy transition. It must assume a leadership role in the broader global LNG industry in this regard. Continued articulation of its efforts and accomplishments, along with strong partnership and deep engagement with all stakeholders, is imperative.”